- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

October Surprises – New Clinton Email Probe and Worsening Chinese Bank Bad Debts

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Just when the U.S. election drama looked like it would end and bring certainty to the markets one way or the other, a new FBI investigation into front runner Hillary Clinton has upended that foregone conclusion. China's bad debt bank problem which had seemed to be improving demonstrated that they have still not reached the peak state of non-performing loans. Britain's economic growth rate confounded Brexit doom sayers. Troubled German Deutsche Bank toyed with redesigning the bonus program in an effort to save money on skyrocketing legal and fine costs which are dragging the bank near the brink of insolvency. As economic uncertainty and political surprises are constantly rocking the newswires, you should add to your gold retirement and investment holdings whenever you can.

Black Swan Hillary Clinton Email Surprise Brings Potential Impeachment Uncertainty

On Friday the FBI made an unanticipated October surprise revelation. They will review additional emails of Hillary Clinton's connected with their investigation of her private email server. The law agency has already obtained warrants for the new emails. This stunning political arena announcement has been called a Black Swan event that could change the course of the U.S. Presidential election in the eleventh hour, per Citi's Tina Fordham, Chief Global Political Analyst at the bank. “In our view, these developments do constitute an ‘October surprise' that could have a meaningful impact on the race,” their new research note published today stated.

Fordham and her team have constantly sounded the alarms regarding the incredibly high black swan event risk occurring in this intense and ugly campaign. Between the continuing possibilities of “information warfare” leaks and scandals, they have consistently refused to call a Clinton victory inevitable. This latest revelation could hand the election to Republican candidate Donald Trump at the last minute. Several different election predicting systems with accuracy dating back 20 years are suggesting a narrow Trump win.

Potentially more important for world markets, the uncertainty surrounding the election results may simply continue after the ballots are counted. Citi research concluded with the reminder that Trump may refuse to accept the results as one danger. Another more likely one is that ongoing investigations into Clinton's possibly criminal emails may put her at considerable risk of a future date impeachment if she is elected and then found guilty of criminal conduct this time. The markets hate uncertainty while gold thrives on it, and it may only be beginning.

$40 Billion Write off at 5 Chinese Banks Exposes China's Bad Debt Problem

The big five banks of China have just revealed that the bad debt problem in the Chinese banking system is actually not improving. They are again losing money having to write off bad debts at faster rates than they can raise capital or realize profits this year. On top of this, the ratio of non performing loans is still rising. The average NPL ratio from the big five national Chinese banks has risen up to 1.72 percent from the last seen 1.69 percent revealed at the conclusion of June by the China Banking Regulatory Commission. The Agricultural Bank of China has seen the worst write downs this quarter. Largest Chinese bank by assets ICBC bank saw its NPL ratio rise to 1.62 percent from June's 1.55 percent. The combined big five banks' total bad assets written off reached $40 billion (273.7 billion yuan) for the year so far. This makes it less likely that China will be able to have the worst part of its debt issues cleared up by next year as investors had hoped.

Year to date, the bad loan loss figures are 54.6 percent higher. This partly resulted from ongoing pressure from the Chinese central government to address the issue of bad debts. Meanwhile, big five bank net profits were flat and averaged only .89 percent. At the same time, the five biggest banks are trying to reduce their (government required) bad debt provision below the minimum 150 percent capital versus their bad debt balance. ICBC led this experiment by reducing its provision for bad debts to 136 percent from its prior 143 percent level. China's banking bad loans problem remains one to watch carefully.

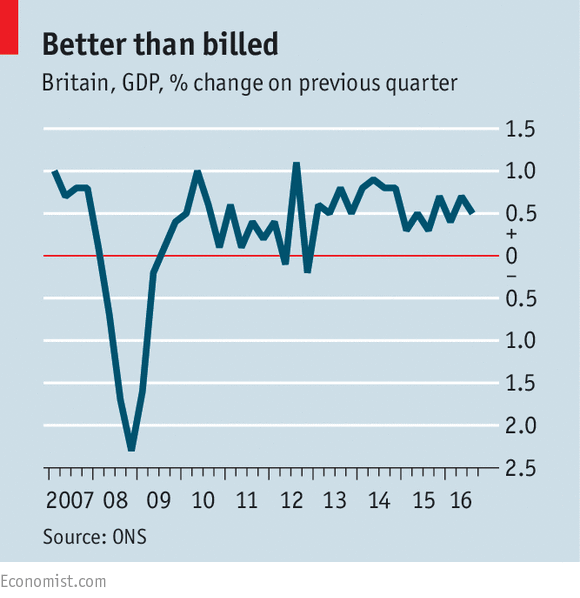

British Post-Brexit Vote Economic Growth Surprises

Thursday's economic data demonstrated yet again the resilience of the U.K.'s economy in a time of heightened uncertainty since the Brexit referendum vote put the country on track to leave the European Union. The third quarter gross domestic product for Britain grew by .5 percent through the end of September on a quarter by quarter basis. This was higher than the economists' consensus for .3 percent. The annual rate similarly surpassed forecasts, coming in at +2.3 percent versus the consensus for 2.1 percent. U.K. Finance Minister Phillip Hammond reacted with a confident statement that the numbers demonstrated the U.K. economy's fundamentals were strong.

Weakness was not entirely absent from the numbers though. “The number came better than expected. But manufacturing and industrial sector have performed badly and this is what we want to emphasize. It is certainly too early to call that Brexit effects are over or they will not have an impact on the U.K.'s growth,” Chief Market Analyst Naeem Aslam of Think Markets wrote in a note.

The net results from these figures are to curtail expectations for an interest rate cut from the Bank of England this week. Forbes has argued they should instead stop the quantitative easing program immediately. Gold benefits from a looser monetary policy so it will be interesting to see what happens.

Deutsche Bank Reworking Bonus Program Amid Ongoing Troubles at the Bank

Largest German lender Deutsche Bank continues to suffer from negative headline fallout in the press. They are still trying to come up with major cost savings as they wrestle with the potentially $14 billion settlement with the American Department of Justice for their improperly selling mortgage backed securities before the financial crisis erupted. Their latest efforts to come up with money for legal costs and fines center on the company's bonus scheme. The bank is now investigating linking the senior employees' compensation packages with improvement in share prices for their battered stock. Their shares are down 40 percent this year. If the bank's best talent leaves the company over the move, Deutsche Bank could suffer still more in the future.

Deutsche Bank Chief Financial Officer Marcus Schneck on Thursday said to investors, “We have taken down cash bonuses that we planned for this year.” The bank has been forced to do this even though it beat revenue and income projections for the third quarter at their last Thursday announcement. Third quarter net income reached $303 million (278 million euros) versus the 6 billion euro loss same time last year. Revenues also surprised at $8.17 billion (7.49 billion euros). Deutsche Bank has now put aside $6.4 billion to cover legal costs and fees. This number could still be woefully inadequate if the final fine amount ends up being anywhere near the $14 billion the DOJ has requested.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.67

Platinum: $931.67

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68