- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Now Even The Federal Reserve Chairman Lectures Congress on Runaway Spending

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 22nd November 2019, 10:18 am

This past week a prominent government official vociferously objected to the massive runaway spending that the U.S. Congress continues to pursue. Even as Fiscal Year 2019 ended with an enormous federal budget deficit, Fiscal Year 2020 only worsened the trend.

In what can only be seen as an ironic display, Federal Reserve Chairman Jerome Powell (whose money printing helps to make the Congressional spending possible in the first place) sternly lectured the Congress on their profligate spending ways in a rousing live session. Powell noted that October's budget shortfall proved to be 34 percent larger than the deficit in October of 2018. It came in short by $134.5 billion, per the most recent report from the U.S. Treasury Department.

2020 Budget Deficit To Exceed a Trillion Dollars?

It means that for Fiscal Year 2020, the government is already on pace to pass a trillion dollars in federal budget deficit for this coming year. This latest month's deficit is nothing out of the ordinary either. With a 2019 Fiscal Year deficit of $984 billion, this was the biggest financial shortfall in the federal budget since year 2012. On only four occasions has the federal government managed to surpass the trillion dollar deficit mark. Each of these instances occurred following the Global Financial Crisis in 2008.

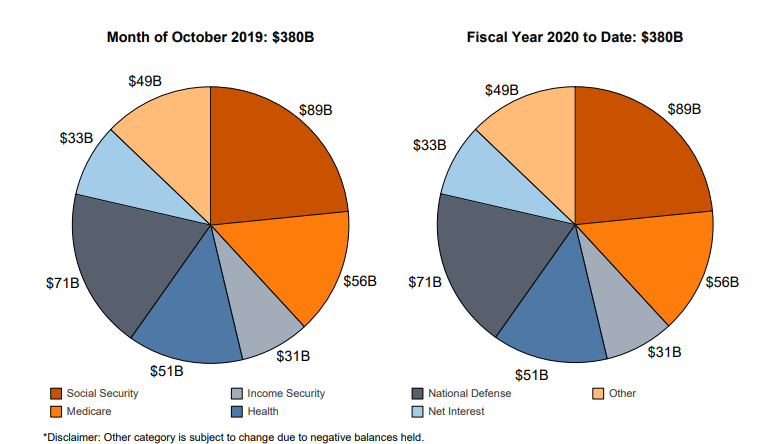

For Fiscal Year 2019, the budget deficit amounted to an incredible 26 percent more than the huge budget miss for Fiscal Year 2018. Without a doubt, Washington keeps spending huge sums of money. For the month of October all by itself, the government managed to go through $380 billion. This amount represented over eight percent more than October of last year. Federal spending categories were higher across the board, particularly in education, defense, Social Security, and healthcare.

This chart below reveals the spending patterns for October of 2019 and that of Fiscal Year 2020 so far:

Powell is right — any way that you slice it, this is not a pretty fiscal picture.

Spending Is Up Even While Federal Receipts Are Down

In rational thinking, you might expect the federal government to spend less money when it collects a smaller amount of revenue for the year. Yet this past year, the government's receipts declined by three percent even as federal spending expanded again. Powell took the opportunity in his testimony to Congress to label the federal government debt as “unsustainable,” with:

“Over time, this outlook could restrain fiscal policymakers' willingness or ability to support economic activity during a downturn.”

For Powell to be concerned is telling. The man is one of the primary architects of Congress' ongoing ability to continue outspending its means. The chairman is worried that federal spending is so high that Congress might find itself in the unenviable position of being unable or unwilling to apply significant quantities of economic stimulus when the next recession hits the country.

The chair himself is all too well aware of the central bank's historical incapability of normalizing interest rates since the Great Recession. It means that they have precious little in the way of ammunition to bring to the battle when it happens. He warned Congress of this, with:

“Nonetheless, the current low interest rate environment may limit the ability of monetary policy to support the economy.”

Federal Reserve Working From A Position of Fear?

If you did not know better, you might assume that our own Federal Reserve was working from a position of fear. It is what Powell's remarks indicate. While he does his usual to insist that the economy remains strong, Powell and company are already busy running an extraordinary monetary policy from behind the scenes.

They recently slashed interest rates for the third time even as they have just launched the latest round of quantitative easing. Economist Peter Schiff recently warned that the U.S. central bank does not have any intention of (or ability to) normalize monetary policy, with:

“Despite the fact that the economic data is deteriorating. Despite the fact that corporate earnings are falling, it is the Fed that is pushing this market to new highs by cutting interest rates, by indicating to the markets that they don't have to worry about rate hikes no matter what happens with inflation. The Fed's not going to raise interest rates. Oh, and by the way, they're doing quantitative easing, and they're going to print as much money as they have to keep the markets going up and to keep the economy propped up.”

The Irony of Powell's Congressional Lecture Is Almost Laughable

What makes Powell's dressing down of Congress so laughable is that he is calling them out for spending money that his own personal actions continue to make possible. The motivation behind the Federal Reserve purchasing Treasury bonds is so that the borrowing and spending can keep on going without forcing interest rates to move higher. It is like a doctor lecturing you about all of the pills that you take daily as he writes you another three prescriptions. Schiff warned that:

“Powell pretends that the trend of falling interest rates despite rising government deficits has nothing to do with Fed policy. It's entirely due to Fed policy, and because an accommodative Fed has enabled the debt to grow so large, the Fed owns the coming debt and dollar crisis!”

Yet Inflation For October Was “Better Than Expected?”

Despite all of the massive runaway federal government spending last year and in October, economists call inflation better than expected. When they make this claim, they are expressing satisfaction that consumer prices for October came out higher than anticipated for the month, per the most recent Labor Department report. In fact, the Consumer Price Index revealed an increase of .4 percent for last month. Meanwhile, in the 12 months ending in October, this same CPI showed 1.8 percent for the year, with the core CPI up 2.3 percent following a 2.4 increase for September.

This over two percent result is called “better than expected” because the Federal Reserve has an expressed goal of keeping inflation to at least two percent each year. It means that they are actively aiming for your purchasing power to decline by two percent every annum. You might expect the higher CPI data to force the Fed's hand in at least slowing down the pace of its ongoing interest rate cuts.

Yet the Federal Reserve Chairman Powell has already made clear that he will not raise rates even if inflation increases more. He stated adamantly that it would require a “really significant” and “persistent” move higher in inflation before the Fed would contemplate any rate hikes. In other words, he has admitted that they will not be keeping inflation under check. This is one of their two core mandates by the way.

Gold Is A Hedge Against Rising Inflation

This past week's revelations and news on government spending and inflation show why gold makes sense in an IRA. Gold proves to be a proven hedge against inflation. Higher inflation is bullish for the yellow metal.

You can consider diversifying your retirement accounts away from sole reliance on the dollar by buying gold in monthly installments. Nowadays the IRS will even let you store your precious metals in top offshore storage locations for Gold IRAs.This is all possible as part of a Gold IRA rollover. It is a good idea to learn more by reading about the Top Gold IRA companies before you buy.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81