- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

No Deal Brexit Expectations Push UK Gold ETF Holdings to Historic Highs

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 30th August 2019, 03:59 pm

This week the Daily Telegraph newspaper reported that the European Union now believes that Britain will depart from the EU block with no deal. Up till now, this had not been the working expectation on the continent. The EU has now accepted that new British Prime Minister Boris Johnson “isn't bluffing.”

It is a dramatic change in the situation between the world's fifth largest economy and the world's largest economic block. EU officials are now operating on the basis of “a working hypothesis of no deal” after Monday's meeting between Brexit diplomats and EC officials from all remaining 27 EU countries. Speculation is soaring that Prime Minister Johnson will then call for a British general election after the October 31st leave date. This is despite the fact that he has recently said it is the last thing that he wants.

48 Hour Brexit Planning Deadline Shifts EU's Working Assumption on Brexit

The EU has more than speculation fueling their new shift in working assumption on the upcoming end of October Brexit deadline date. Johnson's government just issued a 48 hour deadline to all governmental departments. They must demonstrate their preparation for the no deal scenario within two days.

The Telegraph has also reported that the EU 27 were driven to this revised position in part by reports that Johnson's chief strategist Domnic Cummings has declared it is already too late for the members of parliament to stop a Halloween no deal Brexit. Prior to these significant developments, the EU officials felt confident that Johnson would not actually take Britain out of the EU with no deal. This started to change in the past week when his senior adviser David Frost met with the EU Brexit officials. The final blow came when Brexit Secretary Stephen Barclay published his explosive opinion article in the Daily Mail.

After the meetings with Frost, a high ranking EU diplomat declared:

“Our working hypothesis is now no deal. It was clear the UK does not have another plan. No intention to negotiate, which would require a plan. A no deal now appears to be the UK government's central scenario.”

After the meeting, the EU diplomats concurred that they could not count on British MP's to stop a disorderly exit.

New British PM Moves Against Pro-EU Rebels in Government

EU officials' fears have been magnified by PM Johnson's decision not to meet in person yet with any EU leaders. The takeaway for Brussels has been that Britain will not compromise on the exit negotiations any longer.

On Monday, Johnson's Chief Strategist Cummings purportedly threatened to fire any official among the Downing Street staff if they attempted to block a no deal Brexit. Cummings launched a scathing verbal attack on those former cabinet Remain ministers who he blamed for frustrating Brexit while they were in office. This included prior chancellor Philip Hammond and prior business secretary Greg Clark.

At this meeting, Cummings also insisted that every government department head must report on their no deal planning no later than Wednesday morning. Cummings warned:

“If you don't flag problems now and they blow up in the next two weeks then it will be your fault.” There needs to be “a note from all government departments in the next 48 hours detailing what has been done to prepare for a no deal and what more needs to be done.”

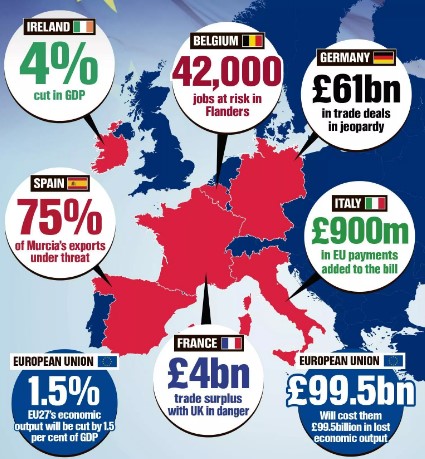

EU officials have good reason to fear an upcoming rupture as Britain leaves the block. This potential outcome will have significant economic effects on the EU member countries too, as the graphic below reveals:

October EU Summit Becomes No Deal Brexit Meeting

Officials at the EU have decided that the October Brussels summit will now be the “no deal Brexit summit.” Prior to this past week, they had anticipated debating a second British extension request on the deadline of Article 50 to leave.

Meanwhile, Johnson's Brexit point man Frost has informed the EU that the U.K. will wait until after the no deal Brexit to negotiate a free trade agreement with the European Union. Despite this dramatic change in plans, Brussels has not compromised on the hated Irish border backstop. Observers content the EU will still insist on this arrangement as well as the £39 billion (approximately $47 billion) Brexit divorce bill before they will begin trade talks following a no deal departure.

Diplomats now await the upcoming G7 meeting to be held in France later in August. They will watch to see what PM Johnson says to EU leaders at the conference. No one is anticipating that this will alter the present trajectory towards no deal though.

European Commission Refuses to Accept Blame for Breakdown in Negotiations

The European Commission is not backing down or even accepting responsibility for the critical turn of events. The EC states that it will not bear the blame should a no-deal Brexit transpire. Their spokeswoman stated that:

No-deal would harm both Britain and the EU, causing a “serious economic impact” for Britain “proportionally higher” than the one in Europe.

The EU appears to be better prepared at the moment for such a scenario than the U.K. Back in March, the block claimed it had already finished its plans for a no deal Brexit. This involves 46 measures that were drafted to alleviate the most serious impacts.

Two primary concerns for the EU are the lost British contributions to the budget and lost income to EU fishermen when Britain reclaims its territorial fishing waters. Other EU measures take into account travel and transport, the financial sector, exports and customs, agriculture, international trade, climate policy, and coordination of social security. The EU spokeswoman claimed the EU would not back down on its red lines for renegotiating the Withdrawal Agreement:

“For a negotiation to be successful it takes two to tango. If the music and the rhythm is not right then you have no dance but that doesn't mean that it was a failure.”

Prime Minister Johnson is holding fast to his position that the Withdrawal Agreement has to be renegotiated with the Irish backstop removed.

UK-Based Gold Holdings Reach All Time High In July

The developments between Great Britain and the European Union are having a marked impact on gold markets. In the month of July, gold net flowed into ETF's in every part of the globe. On an international basis, gold-backed funds currently inventory 2,600 tons of the yellow metal. This represents the highest inventory dating back to March of 2013. It has driven gold prices to a six year high of over $1,500 per ounce this past week.

Inflows into the funds have been particularly pronounced in Europe and Britain. European ETFs have experienced positive gold inflows for all months of 2019 besides April, per the World Gold Council which explained that:

“Looming concerns over Brexit, generally weaker currencies, negative interest rates… have supported gold investment demand.”

European ETFs added 94.6 tons of gold so far for 2019 (compared to 73.5 tons from North American ETFs). Meanwhile, United Kingdom-based gold fund holdings reached all-time highs for July as they hit 556 tons. This equates to a staggering 21 percent of all worldwide gold-backed ETF holdings.

Diversifying a retirement account into IRA-approved gold has never been easier. Now you can buy gold in monthly installments. The IRS will even permit gold holdings to be stored in top offshore storage locations for a gold IRA. You can review top Gold IRA companies and bullion dealers for more information.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81