Nickel ETFs Ranked: Top Nickel Funds for Investors in Q4 2022

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 14th October 2022, 04:48 pm

Which nickel ETF is the best performing over the last 3 years? Which nickel ETF has the cheapest fees? We will answer these questions and many more as we list the top nickel ETFs in this article. Investing in a nickel ETF is an efficient way to gain exposure to the returns of nickel. Adding nickel or other commodities can be an effective way to diversify your portfolio.

What use does nickel have in modern times? Nickel has traditionally been used to produce metal alloys such as stainless steel. More recently it has found a use in a variety of applications in the production of renewable energy, aerospace, and electronic industries.

Also, demand for electric vehicles has increased dramatically and with it so too has the demand for nickel. We can expect demand for this metal to remain constant and grow as the electric vehicle market continues to expand.

Table of Contents

What’s a Nickel ETF?

ETFs or exchange traded funds are securities issued by funds that invest in a basket of assets, commodities, or other securities. They may invest in a specific sector of the stock market, bond market, or physical commodities.

Some even use futures on commodities for ease of portfolio management and some also short-sell assets and give returns that reflect short positions in the securities. In the case of nickel ETFs, these are funds that invest in companies that mine nickel.

So, instead of you having to pick and choose which mining companies are more exposed to nickel projects you get that done for you. A nickel ETF also allows you to diversify your holdings in nickel stocks with relatively small amounts of cash.

For those looking to gain exposure to the pure price of nickel, holding enough nickel may create storage problems. At the time of writing a ton of nickel costs $3,616 so it’s going to take a lot of space if you want to hold this metal physically.

To offset that problem, you can invest in a nickel ETF that holds futures contracts on nickel. A futures contract gives you the right to buy or sell a predetermined quantity of a commodity at a set expiry date.

Most futures investors do not take possession or deliver on the contract as positions are closed before the expiry date. This allows the fund to manage exposure to nickel prices without having to care about storage and subsequent costs.

Advantages of a Futures-Backed Nickel ETF

- Direct exposure to nickel prices and returns.

- No exposure to corporate risk or non-copper mining activities.

- Investors can invest in futures using professionals and their know-how.

- No need to set up and maintain a futures account.

- High level of liquidity offered by exchange-traded products.

Best Nickel ETF List

When investing in a nickel ETF you should consider if the fund invests in direct exposure to nickel prices or if it buys securities of companies that mine nickel. Another factor to consider is the expense ratio, larger fees have more drag on return in the long run.

You also may want to check which countries the companies operate in as foreign countries will generate other risks such as foreign exchange exposure and geopolitical risk.

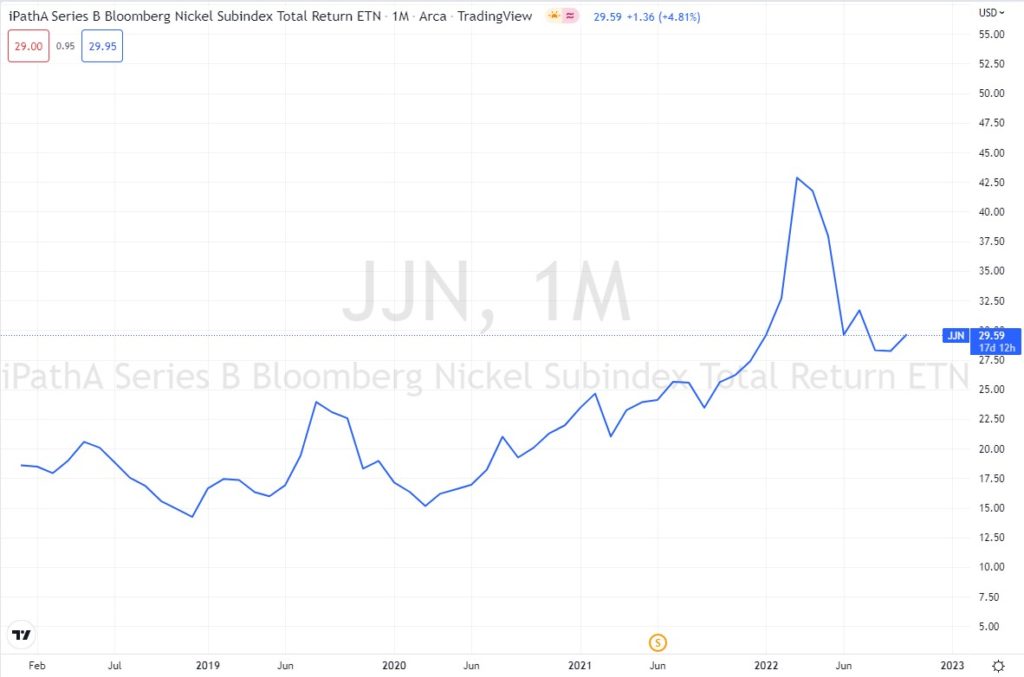

- iPath Series B Bloomberg Nickel Subindex Total Return ETN (NYSEArca: JJN)

This fund is operated by Barclays Bank and was set up in January 2018. It is currently the only pure play on nickel. The fund invests in nickel futures contracts that compose the Bloomberg Nickel Subindex.

As the fund is structured as a debt obligation you are investing in a product with credit exposure to Barclays Bank. Having said that, you can buy and sell these ETN shares on the secondary market. The average trading volume is 16,781 shares daily.

The fund currently has $33.8 million in assets under management and an expense ratio of 0.45%. This Nickel ETF has managed an 11.6 percent yearly return since inception. With a YTD of 8.35 percent. While over the last 3 years the fund has managed a return of 35.46 percent.

The fund’s objective is to match the returns of the Bloomberg Nickel Subindex less expenses.

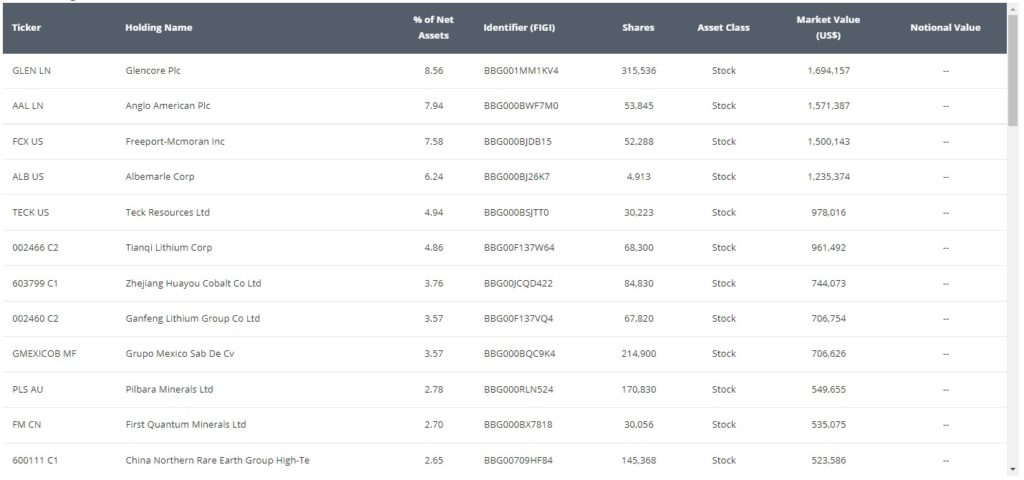

- VanEck Green Metals ETF (NYSE: GMET)

This nickel ETF was set up in November 2021, so is the most recent on the list. That also gives us a smaller window to view the fund's performance. However, that fund has $21.2 million in assets under management and a 0.59 percent expense ratio.

The fund has generated negative returns since inception along with the broad stock market. At the time of writing the fund is down 22.1 percent since inception, and YTD is down 23.3 percent. The fund’s objective is to invest in mining companies whose main revenue comes from mining green metals.

In other words, mining, recycling, and processing ores that are used in the production of renewable energy. The fund currently holds 51 different stocks creating a large amount of diversification within the sector.

- SPDR S&P Metals & Mining ETF (NYSEArca: XME)

State Street Global Advisor runs the largest nickel ETF with $1.72 billion in assets under management. It also is the cheapest fund in the list with an expense ratio of 0.35 percent. The fund also has a very liquid secondary market with an average of 3.9 million shares exchanged daily.

The fund invests in a variety of mining and production companies, for ores, precious metals, and coal. The objective is to match the returns of the S&P Metals & Mining Select Industry Index. As the company holds a large portion of its portfolio in steel production companies you have a high exposure to nickel prices.

The YTD for this fund is up by 1.69 percent, which is a small number, but when compared to the more than 20 percent drop YTD in the S&P index it seems very positive. The fund was set up in June 2006, and from inception has returned negative 6.41 percent. While over the last 3 years the fund has returned 67.43 percent.

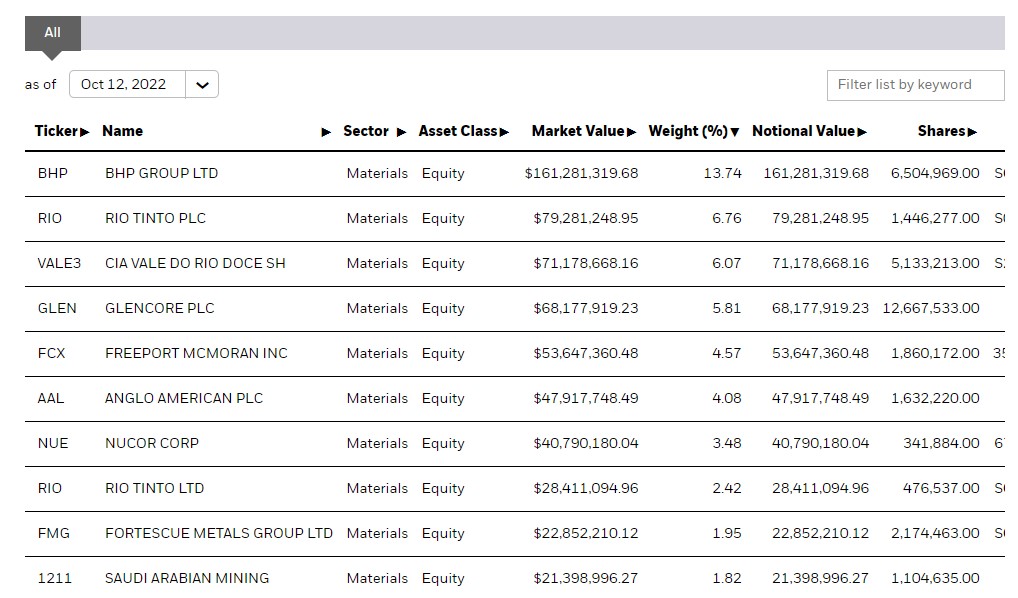

- iShares MSCI Global Metals & Mining Producers ETF (NYSEArca: PICK)

BlackRock’s nickel ETF has $1.22 billion of assets under management and an expense ratio of 0.39 percent. This ETF also has a large secondary market with an average of 341 thousand shares exchanged daily.

The fund attempts to match the returns of the MSCI Global Metals & Mining Producers index. And invests in a variety of companies involved in the extraction and production of metals and minerals. The ores mined include nickel and gold, and production stocks include aluminum and steel.

The fund holds 281 stocks in companies from the developed world as well as emerging economies. As of writing, 50.7 percent of holdings are in diversified metals and mining stocks. While 33.2 percent of funds are in steel production.

The fund has had a negative performance YTD having lost 16.8 percent. While from the inception of the fund, in February 2012, the return has been negative 30.7 percent. Over the last 3 years, this nickel ETF has returned 24.68 percent.

Nickel ETF Performance Ranking

| Nickel ETF | Return 3 Years | YTD | Return Since Inception |

| XME | 67.43% | 1.69% | -6.41% |

| JJN | 35.46% | 8.35% | 59.23% |

| PICK | 24.68% | -16.80% | -30.70% |

| GMET | N/A | -23.3% | -22.10% |

Conclusion

Using nickel ETFs can help diversify and protect, in some measure, your portfolio from the adverse effects of inflation and recession. However, we feel that the highest diversification comes from holding assets that have very little or no correlation to stocks.

Physical assets like gold and silver or nickel have a very low correlation to the returns of traditional assets like stocks and bonds. As we continue to move forward in an environment of high inflation, we can still take steps to protect our portfolio from higher prices.

Bottom Line

When investing for your retirement it’s wise to take advantage of tax-enhanced savings accounts such as 401(k)s or self-directed IRAs. If you are going to add precious metals to diversify and protect your investment you will want to make use of a gold IRA company. We have identified some of the best in the industry, you can read their reviews here.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $4,985.30

Gold: $4,985.30

Silver: $103.27

Silver: $103.27

Platinum: $2,776.88

Platinum: $2,776.88

Palladium: $2,030.07

Palladium: $2,030.07

Bitcoin: $89,419.40

Bitcoin: $89,419.40

Ethereum: $2,950.90

Ethereum: $2,950.90