New Survey Highlights The Average American’s Opinion Towards Investing In Gold Versus Bitcoin

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 25th October 2019, 03:09 pm

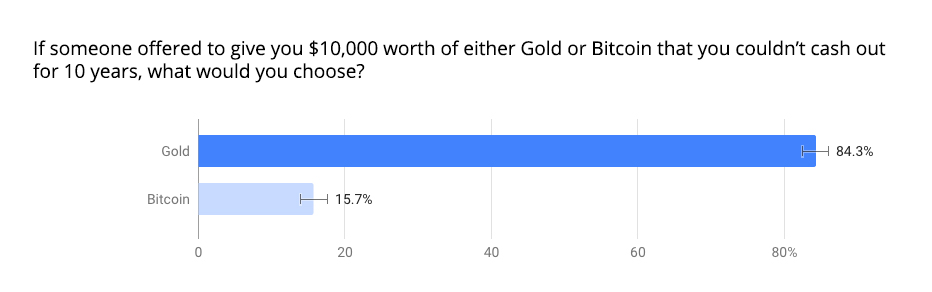

We conducted a survey asking 1,500 American respondents if they were given the option between $10,000 in gold or Bitcoin that couldn’t be cashed out for a decade, which they would choose. We used Google Surveys and targeted males and females between the ages of 18 to 65+ from coast to coast. We asked the following question with several possible responses:

If someone offered to give you $10,000 worth of either Gold or Bitcoin that you couldn't cash out for 10 years, what would you choose?

- Gold

- Bitcoin

Table of Contents

Gold Wins By A Landslide, Especially Amongst 65+

When asked which they would choose between $10,000 in gold or Bitcoin that couldn’t be liquidated for a decade, the resounding response was gold. An astounding 84.3% of all respondents indicated that they would choose the $10,000 in gold.

When demographic filters are applied to the survey result, the percentage increases even further with older demographics. Amongst 45 to 54 year-olds, it was 85.8%, and for 55 to 64 year-olds the percentage was 87.5%.

For those 65+, 91.3% of respondents indicated that they would choose the $10,000 worth of gold.

The drastic percentage difference for the most popular response is predictable, given that gold has been a familiar, dependable, and universally excepted investment for millennia. Bitcoin was created a mere 10 years ago, and thus, has little chance at competing with a long accepted investment option.

Additionally, the exponential percentage increase, especially amongst the 65+ demographic, is unsurprising. These results reflect the fact that individuals of retirement age are more inclined to take investment options, which are low-risk, thus maintaining a safe retirement nest-egg.

Younger Demographics Are Warming Up To Bitcoin, Especially 25 to 34 year-olds

Of the 1,500 respondents to the survey, a mere 15.7% indicated that they would take $10,000 worth of Bitcoin, which couldn’t be cashed out for 10 years.

Yet some compelling results occur when demographic filters are applied to the survey. Amongst those respondents between 18 and 34-year-old, 22% stated that they would choose the option of $10,000 in Bitcoin. Conversely, only 8.7% of respondents 65+ indicated they would take the Bitcoin option. The percentage decreased even further with females 65+, to 5% choosing that response.

Interestingly, when demographic filters are further applied to the survey results to reflect specifically the 25 to 34-year-old age bracket, 23.9% of the respondents indicated that they would take the option of $10,000 in Bitcoin. The percentage increases further (albeit slightly) with females of this demographic, to 24.1%.

Since its inception in 2009, Bitcoin has exploded in popularity. Over the course of 10 years, its worth has gone from a couple of cents to thousands, upon thousands of dollars. Although far more speculative and highly volatile compared to gold, Bitcoin could potentially prove far more rewarding given that many experts have stratospheric Bitcoin price predictions for the next 10 years.

Based upon the results from this survey, it would appear that younger demographics, especially “Young Professionals” between 25 and 34 are warming up to Bitcoin and the notion of cryptocurrency. Considering that this demographic is by and large, upwardly mobile with the means to take on riskier investment options, it is unsurprising that the percentages are higher. Given that the younger age brackets are afforded more time to accumulate wealth with fewer constraints, it is understandable why nearly a quarter of the 25 to 34 year-olds stated that they would take the option of $10,000 in Bitcoin to cash out in 10 years.

Conclusion

Historically, gold has performed well under a myriad of economic conditions and circumstances. It has been a desirable and dependable investment option for thousands of years. With the price of gold hovering at $1,519 US an ounce, by all accounts, analysts are leaning towards a bullish scenario for future projections.

Comparatively, Bitcoin is very much in its nascent phase as an investment. In its brief decade of existence, it has proven to be a variable, albeit, far riskier investment choice than gold. Yet, there is a tremendous potential for far greater returns in the next 10 years.

Ultimately, no one has been bestowed with the oft-coveted gift of foretelling the future. With no definitive way of accurately predicting long-term prices for gold, Bitcoin, or any other investment for that matter, always do your due diligence before investing your money. A diversified portfolio is always the best strategy for keeping your money safe. Investment choices are dependent solely upon individual circumstances and risk profiles. Only time will tell what the future holds for gold, for Bitcoin, and for all else under the Sun.

Details About The Study And RMS Score

Sampling

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,335.81

Gold: $3,335.81

Silver: $36.93

Silver: $36.93

Platinum: $1,394.91

Platinum: $1,394.91

Palladium: $1,141.81

Palladium: $1,141.81

Bitcoin: $108,104.05

Bitcoin: $108,104.05

Ethereum: $2,503.64

Ethereum: $2,503.64