- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

National Debt Grows By Half Trillion in Only One Month

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

The news came out last week that the annual fiscal year budget deficit soared over a trillion dollars last month. Higher spending deficits are causing the federal government to borrow more. The total outstanding public debt increased by a shocking $450 billion for just the month of August. It means that the country's debt which had been at $22.02 trillion back on August 1st roared higher to reach $22.47 trillion by August 27th. This radical increase is causing the government to have to take exceptional measures to hold down national interest rates.

Why Did the Debt Jump So Much At Once?

There is at least partial explanation for why the debt jumped so massively in only a month. According to SRSrocco, the US Treasury had to make up ground it had lost because of the debt ceiling. This had stopped the federal government from borrowing until they were able to reach a bi-partisan budget deal back in July.

The result of this deal suspended the limit on federal borrowing for a period of two years. In this same agreement, the government will be able to increase its discretionary spending category from this fiscal year's $1.32 trillion to $1.37 trillion for fiscal year 2020 and even higher the year following to $1.375 trillion. Both main political parties gain from the spending as military and domestic outlays will rise substantially. Thanks to this agreed upon deal, the US Treasury declared that it will issue another $814 billion worth of new debt from August to December.

Under the President Trump Administration Debt Has Jumped A Trillion Per Year

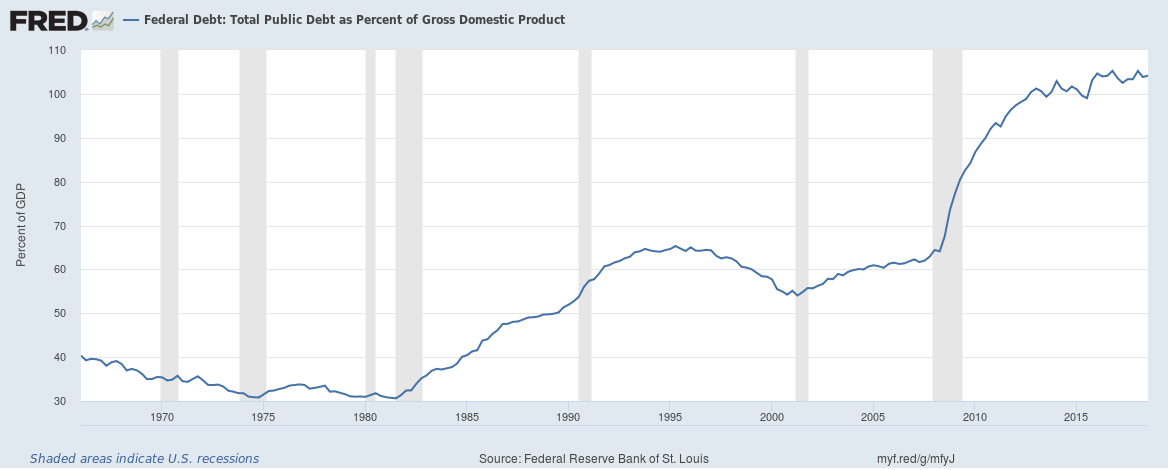

It was only back in February that the total national debt exceeded $22 trillion for the first time. Remember that back in January of 2017 (when President Trump took office), this debt stood at $19.95 trillion. Doing the math reveals that in slightly more than two years, the debt has grown by a substantial $2.06 trillion. This chart reveals how the American debt to GDP ratio is now over 100 percent:

Yet the pace for borrowing is only continuing to ramp up. Now the Treasury will borrow more than three quarters of a trillion additionally in a mere six months.

Mainstream news media blames the Trump tax cuts as the primary reason for the rocketing deficits and growing national public debt. Yet this is not the case. Government revenues have increased. The real villain is the runaway spending. The administration has spent $4.16 trillion this fiscal year (though it does not begin until October 1st). It represents a significant increase of more than seven percent versus last year's spending totals. For the fiscal year just beginning, the federal government has managed to outspend the entirely of fiscal year 2018.

Fed Injecting Cash Into System to Hold Down Interest Rates

All of this Federal government spending and subsequent borrowing is causing problems as the debt grows and interest rates threaten the government's public finances. This past week, the Federal Reserve increased its efforts to keep the shorter term interest rates lower. They did this by injecting what is called “longer-term” cash into the financial system.

It was the New York Fed branch that started engaging in repurchase operations so that they could move liquidity to the financial system. These operations began Tuesday a week ago and entailed approximately $53 billion worth of debt instruments. They extended the operations during the week. In total, the New York Fed flushed $270 billion of cash through the banking system a week ago. They have pledged to extend these daily repo operations (amounting to minimally $75 billion per diem) to October 10th.

Such repurchase operations are crucial in the banking system function. This repo market makes it possible for banks to borrow cash to have sufficient liquidity to cover their daily needs. With repo trades, banks and other financial institutions put up “high quality” securities such as Treasuries for these short term loans' collateral. Afterwards, the banks buy back their bonds and pay a token interest rate, and all within 24 hours time typically.

These interest rates for repo arrangements are typically about that of the Federal Reserve benchmark rate. These days this rate is from 1.75 percent to two percent. The problem is that Monday a week ago the available cash vanished. In short order, the rates roared up to more than 10 percent for repo operations. This forced the hand of the New York Fed into performing emergency measures. The so-called “Bond King” Jeffrey Gunlach stated that:

the Federal Reserve is “baby stepping their way to doing QE. Is it an imminent disaster? No. The Fed is going to use this warning sign to go back to some balance sheet expansion.”

What it amounted to was the markets forcing up interest rates and the Fed jumping in to bring them back down utilizing billions of dollars in injections to the banking system. Economist Peter Schiff said that this was truly a “big deal”:

“It shows that the Fed is losing control of the short end of the curve, that market forces are beginning to overwhelm the Fed's attempts to artificially suppress interest rates.”

The New York Fed provided its cash injections using 14 day repurchase options through primary dealers. Reuters reported that the Fed held two more such 14 day term operations on Thursday and Friday for $30 billion apiece. It marked yet another step towards quantitative easing in which the Fed grows its balance sheet over the longer-term.

The mainstream media has picked up on the necessity of the Fed continuing to do this in the need to stabilize the repo market. Economists focused in on two main reasons for the unexpected cash shortage over the last week. One involved corporations pulling funds out of money markets so they could do quarterly tax payments. The other centered on investors and banks settling up on accounts of $78 billion in U.S. Treasuries that the federal government sold.

There is also a systemic problem involved. Reuters explained that the Fed makes other banks' cash reserves (which they park with the Fed) available to other banks at an overnight interest rate that is lower than at any point since 2011. It results from the balance sheet reduction the Fed was engaging in until recently. This is to say that the problems in the repo market are resulting from the quantitative tightening that the Federal Reserve had pursued.

Skyrocketing Debt Means Interest Rates Are Headed Lower

The federal government's skyrocketing debt is a key reason for why the Federal Reserve will almost definitely continue forcing interest rates lower. Washington simply can not keep spending so much if interest rates become high. A key proof of this is that the federal government has already paid $379 billion in interest on its current debt. Historically normal interest rates are around five percent versus today's under two percent. You can imagine how much higher the interest would be in a historically typical interest rate environment (over two and a half times as much).

The government's long out of control spending habits and runaway deficits are worrisome enough by themselves. They are terrifying if you contemplate that such incredible budget shortfalls are occurring in the midst of an economic expansion. Spending numbers like these are typically seen in the midst of serious recessions. It begs the question: What will happen as the next recession breaks out?

This past week's unfortunate news is another reminder that gold makes sense in an IRA. One way to acquire IRA approved precious metals is through buying gold in monthly installments. The IRS even allows you to store such holdings in top offshore storage locations for gold nowadays.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81