Naked Short Selling: What Is It, and How Might It Impact Gold Markets?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 11th October 2023, 09:01 pm

Private companies and financial institutions sometimes engage in less-than-savory investing practices to influence price movements and other financial data. Naked short selling is one of them.

While proponents argue that it provides timely liquidity to financial markets, abusive naked short selling can be damaging to investors and to the integrity of financial markets. It is also speculated to have far-reaching impacts on various commodity prices, such as gold.

Let’s take a closer look at the practice of naked short selling and discuss its implications for both conventional and alternative asset markets.

Table of Contents

Defining Naked Short Selling

Short selling, in general, involves borrowing shares of a stock and selling them with the expectation that the stock price will drop. Eventually, the short seller has to buy the shares back (to “cover” the short) and return them to the lender. If the price has dropped in the meantime, the short seller profits from the difference (minus fees and interest).

Naked short selling is a variant of this where the seller does not actually borrow the stock or ensure that it can be borrowed before selling it. This means the seller is selling shares that don't exist. In a naked short sale, an investor sells shares without first ensuring that they can be borrowed, effectively selling securities that they haven't even arranged to borrow.

In this way, naked short selling is functionally similar to “spoofing”—a practice whereby investors are tricked by manipulators who buy or sell their own orders without intending to fulfill them.

Is Naked Short Selling Legal?

In many jurisdictions, including the United States, naked short selling is illegal under specific circumstances:

1. Regulation SHO in the U.S.: Introduced by the Securities and Exchange Commission (SEC) in 2005, Regulation SHO provides guidelines to prevent naked short selling abuses. It requires brokers-dealers to have grounds to believe that shares will be available for borrowing before they can be sold short. Additionally, brokers and dealers must deliver the shares for short sales and immediately purchase or borrow shares to deliver them if they fail to do so.

2. Failures to Deliver: While short sales might sometimes result in a failure to deliver the borrowed securities, persistent failures can be a red flag for naked short selling. Regulation SHO aims to reduce such failures by introducing the “close-out” requirement, which forces brokers or dealers to close out fail-to-deliver positions by buying or borrowing the securities.

3. Temporary Bans: During times of significant market stress or volatility, some regulators around the world have introduced temporary bans or restrictions on short selling (naked or not) to stabilize markets.

It's worth noting that not all instances of failing to deliver securities are due to naked short selling. Operational issues or other benign factors can sometimes result in failures to deliver.

While traditional short selling is legal and regulated, naked short selling is illegal in many jurisdictions when it results in a deliberate attempt to drive down a stock's price without the intent to deliver the borrowed shares. Always consult local regulations and consider seeking advice from a financial professional or lawyer for specific inquiries about this practice.

Examples of Naked Short Selling

There have been several notable financial scandals that involved naked short selling or illegal short selling practices, including:

- Overstock.com (2005): Accused numerous hedge funds of practicing naked short selling.

- Bear Streams (2007): The investment bank was alleged to have manipulated its stock price via naked short selling.

- Lehman Brothers (2008): Similar to Bear Streams, this investment bank was accused of manipulating its stock price via naked short selling.

- JPMorgan (2020): Paid $920 million in fines for illegally trading in the precious metals futures market.

- GameStop (2021): Amid a social media frenzy, 40% more GameStop shares were sold than existed; a feat only possible with “phantom” sales from naked short selling.

Although naked short selling was first made illegal in 18th-century Europe, it is still practiced by those looking to manipulate financial markets for personal gain.

Why Do Investors Engage in Naked Short Selling?

The question naturally arises: Why would anyone engage in such a practice, considering the risks and liabilities involved? Naked short selling can serve various objectives. Some investors utilize it as a strategy to exploit perceived overvaluations in a security.

Others might use it as a hedge against other investment positions. The ability to sell securities without immediately borrowing them can provide traders with greater flexibility and speed, especially in volatile markets where rapid movements are anticipated.

Figure 2: Benefits vs. Limitations of Naked Shorting (Source: WallStreetMojo)

However, executing a naked short sale is not without its challenges and risks. Without borrowing the shares upfront, there's a risk that the short seller might not be able to procure the shares later on to cover their position. This can lead to significant losses, especially if the security's price rises instead of falling as anticipated.

Naked Short Selling and Gold Markets

Gold has not been immune to the implications of naked short selling. There have been speculations that institutions occasionally engage in naked short selling of gold to influence its market price. The rationale behind this is multifaceted:

1. Liquidity: The sheer volume of gold trading can sometimes outpace the physical availability of gold bars. Thus, the virtual or ‘paper' gold market, represented by futures, options, and other financial derivatives, can sometimes dwarf the physical market.

2. Price Suppression: Some argue that by engaging in naked short selling of gold derivatives, institutions can artificially increase the supply of ‘gold' in the market, thereby suppressing its spot price. This could serve various purposes, from protecting currency values to hedging against significant gold holdings.

3. Regulatory Scrutiny: As with other securities, the regulatory environment around naked short selling of gold is stringent. Authorities worldwide are vigilant against market manipulation, and naked short selling, due to its potential to artificially influence prices, often finds itself in the spotlight.

Some outlets, including the Nasdaq’s official blog, report that discrepancies are believed to exist between paper gold and the supply of physical bullion in the London Bullion Market Association (LBMA) that affect the asset’s price. While long-term manipulation of gold prices is seen by many to be untenable, it stands to reason that gold price manipulation by naked short telling is indeed feasible and potentially practiced on a short-term basis.

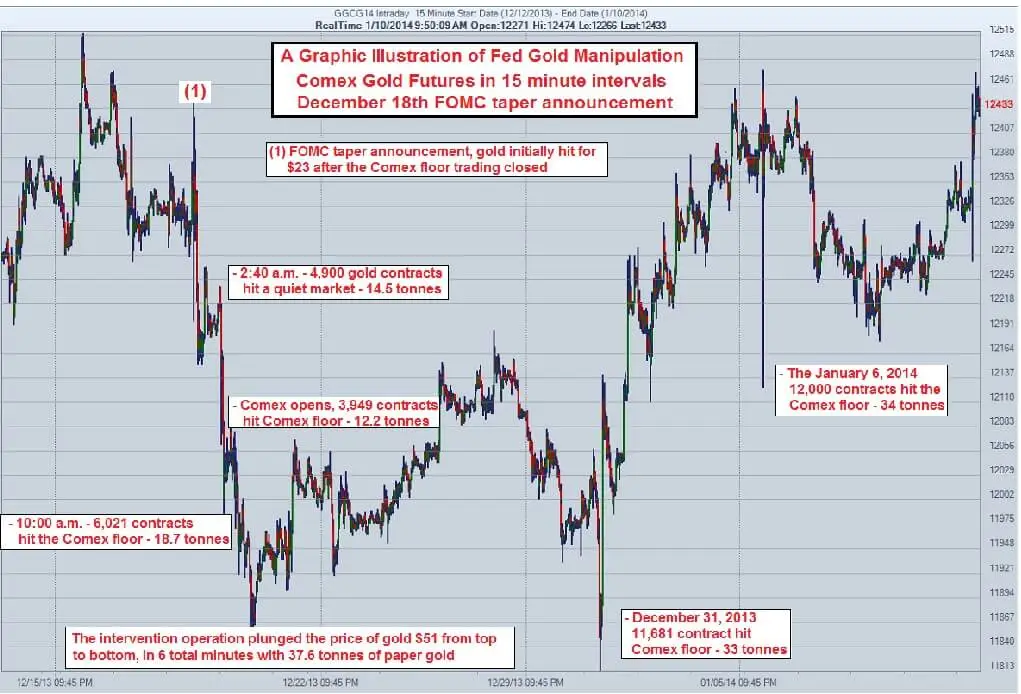

Additionally, Paul C. Roberts and Dave Kranzle, two high-profile traders at Golden Returns Capital LLC and fellows at the Institute for Political Economy, allege that the New York Comex serves as a venue for the Federal Reserve to manipulate gold prices.

Roberts and Kranzle cite suspicious historical market activity on the Comex as evidence in support of their claim. For instance, on January 6, 2014, gold prices fell by $35 immediately after 12,000 futures contracts, or ten percent of the exchange’s daily trading volume, were sold over a span of 60 seconds. These contracts, together, account for 1.2 million ounces of gold, which is multiple times more than the amount held in Comex vaults.

Figure 1: Roberts & Kranzle’s naked short selling hypothesis (Source: Nasdaq Blog)

The traders go on to cite other notable cases in which the Comex is suspected to be used as a venue for naked short selling. Another major case occurred on December 18, 2013, in which gold futures were sold en masse following a Federal Open Market Committee (FOMC) decision to taper its bond-buying campaign.

The theoretical basis for claims that the Federal Reserve and the FOMC are engaging in naked gold short selling is that high gold prices, supposedly, would negatively impact the dollar’s exchange rate. A sudden drop in the relative value of the U.S. dollar could precipitate a run on the currency wherein the currency is sold to escape its falling value. These allegations are backed by Dr. Keith Weiner of the Gold Standard Institute USA.

Naked Short Selling: The Invisible Hand Behind Market Movements?

It’s sometimes said that short sellers buy risk and sell certainty. The seller in the transaction is the one who is wagering on the short-term price fluctuation of the asset they are selling, whereas the buyer knows exactly what they are getting at a determined price.

This principle, unfortunately, is violated by naked short sellers. And, in some financial markets, such as the gold futures market, the effects of naked short seller may lead to considerable price manipulation.

Naked short selling, while both illegal and controversial, remains a component of the modern financial landscape. Its mechanics and implications, especially in relation to commodities like gold, are intricate and multifaceted. While theories abound that gold markets are manipulated by central bankers and bullion banks, no empirical studies or authoritative investigations have been able to conclude that such activity is truly going on.

The topic of naked short selling is, unfortunately, replete with unfounded conspiracy theories and allegations. Nonetheless, it is an accepted fact that financial markets are subject to regular external manipulation and that banks hold large short positions in the gold futures market.

Do Your Due Diligence, and Shop for Gold With Confidence

I advise investors and market participants to approach this topic with a blend of caution, understanding, and continuous learning. As always, thorough research and consultation with financial advisors are essential when navigating such complex terrains.

Those interested in diversifying their investment portfolios with gold, silver, and other precious metals may want to consider purchasing their assets through a top-rated gold IRA company. This way, you can ensure that you receive real physical bullion instead of paper gold.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,328.02

Gold: $3,328.02

Silver: $37.77

Silver: $37.77

Platinum: $1,404.65

Platinum: $1,404.65

Palladium: $1,226.98

Palladium: $1,226.98

Bitcoin: $117,368.41

Bitcoin: $117,368.41

Ethereum: $3,090.52

Ethereum: $3,090.52