- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Mountain of Low Quality Corporate Debt Evokes OECD Warning

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

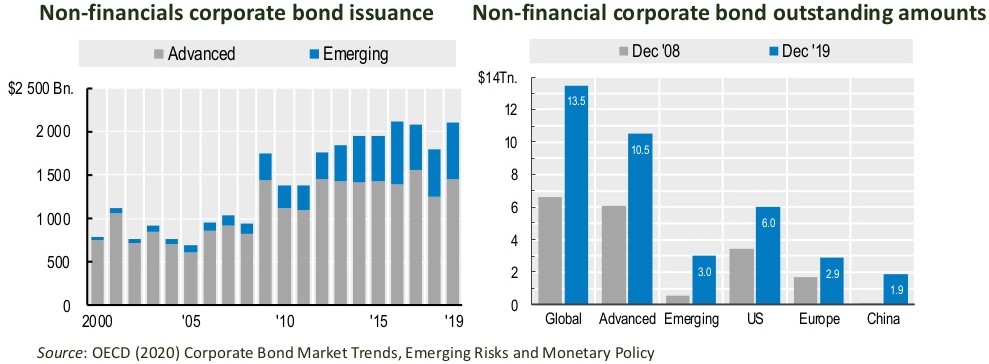

This past week the news emerge in a report showing that the total issuance of corporate debt has reached a record high of $13.5 trillion at the conclusion of 2019. The OECD report also revealed alarming statistics that the all around bond quality has dropped to levels not seen since before the decade past Global Financial Crisis. This has begun to raise concerns with analysts and economists about the sustainability of the current capital market funding model.

Expansionary Monetary Policy Driving Corporate Bond Issuing

The OECD stated that the growth in issuing of corporate bonds has been encouraged by easy money policy available around the globe and by structural reforms. This has led to the bonds becoming a practical means of longer-term financing for the non-financial corporations after the Global Financial Crisis. The end result is that these firms worldwide have borrowed approximately $2.1 trillion in corporate bond instruments for just year 2019. These charts below show the total amounts of (non-financial) corporate bonds issued in recent years and outstanding:

Significant danger according to the Organization for Economic Cooperation and Development lies in the all around lower credit quality of the issues. The OECD pointed out that in comparison to prior credit cycles, the vast amount of these corporate bonds have longer maturities, larger repayment requirements, and weaker protection for investors. CNBC has called this a rising $9 trillion corporate debt bomb.

It has since become worse. This massive amount of lower debt quality bonds could cause both corporations and the economy as a whole to be severe victims in an upcoming economic pullback.

OECD Says Capital Market Reforms Necessary

The OECD is recommending reforms in capital markets to address these problems. Secretary General Angel Gurria of the 36 nation member group has warned that these extreme amounts of leverage within the corporate sector:

“Make it essential to put in place reforms that make all parts of the capital markets fit for purpose. This must include steps to improve the ability of equity markets to strengthen corporate balance sheets and support long term investments.”

Consider investment bond rankings today. Fully 51 percent of the total new investment grade bonds had a BBB rating. This amounts to the poorest available investment grade for bonds.

Non-Investment Grade Bond Issuing Also Growing

The OECD also revealed that bond issuance in the non-investment grade category has also expanded. For 2019, one quarter of all non-financial issues in corporate bonds was in this category. In fact the category composition has been at 20 percent and higher since year 2010. This is the longest amount of time dating back to 1980 for non- investment qualities of issues staying so high. Because of this, the OECD is concerned that future economic pullback default rates will probably be worse than in the prior credit cycles.

As another example, a mere 30 percent of all worldwide (non-financial) corporate bonds carried a rating of A or higher and came from developed economy corporations. The rising stock of these bonds also means that there are greater future requirements for repayment lurking ahead. By the end of last year, companies around the world had to refinance or repay a never before seen $4.4 trillion of corporate bond debts in three years or less, per the OECD report. This equates to an all-time high 32.4 percent of all existing corporate bonds. Just a decade ago, this figure stood at only 25 percent.

Another point the OECD raised concerned the higher corporate debt ratios. The group concluded that this low interest rate scenario and the way that credit ratings work had made it possible for corporations to build up higher debt ratios while keeping their credit ratings in the process. The report warned that when another economic pullback occurs or should interest rates rise, the same credit ratings mechanics will lead to numerous downgrades that cause borrowing costs to rise significantly and reduce investment in the same companies.

Bonds Could Suffer from Unrealistic Economic Promises and Stagflation

Low rated bonds could be under pressure sooner than you might think. According to Chief Economist Steen Jakobsen of Saxo Bank, the rosy 2020 economic forecasts depend on what he calls the “increasingly toxic cocktail” of promises that could be upended by factors including the coronavirus pandemic. The general consensus in economic outlook forecasts a minor increase in economic growth. Markets around the globe have vaulted up to all-time highs in the last few weeks even though fears of global economic interruption from the epidemic are real. So far 72,436 cases of the virus have been confirmed that have killed 1,868 individuals in China, according to CNBC.

Jakobsen took issue with the economic models for growth that depend on assumptions of:

“low inflation and low rates forever, an abolishment of price discovery, a full acceptance of monopolies in technology and non-commitment to reduce inequality,” causing “permanently low growth, close to zero productivity, and a monetary policy with no exit path.”

Saxo Bank's economist pointed out that this has been evidenced in the American Federal Reserve's ongoing repo program. In this extraordinary monetary policy, the U.S. central bank has been compelled to inject money through the overnight borrowing market in order to keep it functioning in an orderly fashion.

More troubling was Jakobsen's present day comparisons to the 1970s era of stagflation that “killed growth and the markets” because of the “over easy Federal Reserve and supply constraints.” Jakobsen published another research note where he warned that the markets have been too slow in appreciating the potential of a serious downgrade to global growth because of the coronavirus' effects on consumer activities and supply chain disruptions.

Global Growth Being Revised Downward

Other research firms have taken notice of these impacts and have begun to adjust their economic outlooks to the downside too. On Monday, Moody's published a research note in which they cut their forecasts for worldwide economic growth by a significant two-tenths of one percentage point. Moody's base case is now for the G-20 economies to have total growth of 2.4 percent for 2020 as China's growth drops down to 5.2 percent. According to the Vice President Madhavi Bokil of Moody's, the anecdotal indicators have already shown significant disruptions in supply chains, both inside and outside of China.

Apple has revised its revenue guidance lower because of the impact on their supply chain since the virus outbreak. Jakobsen warned on Tuesday that there will be real concerns from corporations' cash flow taking hits. It will result in these firms attempting to build more local supply chains that have more independence from the operations in Asia. Jakobsen informed CNBC that the “There is No Alternative” view of risky assets is not sustainable due to the current amount of credit available.

Saxo's Jakobsen has been trying to diversify away from risk assets and is warning other investors to consider doing the same. He shared:

“I run a fund which is a capital preservation one, that has an exposure right now of about 34 percent to equity despite it being a defensive model.”

Jakobsen recommended that investors contemplate “buying puts on everything” and going back to the more sceptical investing present at the beginning of 2019.

The news this week about an unprecedented pile of low quality corporate bonds threatening to amplify the effects of an economic pullback is not good. It is one reason that explains why gold makes sense in an IRA. The IRA-approved precious metals are a way to diversify your investment and retirement portfolios. You can read about Gold IRA Rules and Regulations and Top Gold IRA companies to learn more.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81