- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Looming Unemployment Benefits Cliff Threatens to Steal the Holidays

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

This past week, the news emerged of a looming unemployment benefits cliff that is threatening to cut off millions of unemployed Americans who have been badly impacted by the effects of the coronavirus and business shutdowns. With negotiations to agree on a second coronavirus bill stymied in Congress, the only hope for many cash strapped Americans appeared to be that a few helpful measures will become attached to a needed spending package that has to pass no later than December 11th in order to prevent a government shutdown.

Unemployment Benefits Set to Expire in December

The unemployment benefits that have kept many American families going in these difficult times of Covid-19 and shutdowns of businesses across the country are coming to an end at what many would consider to be the worst possible time of the holidays. While Congress has been attempting to work out a deal to extend the emergency weekly subsidies to beneficiaries, they have been unable to come to an agreement despite months of intense negotiations.

Congress had provided an additional $600 each week for those desperate six million individuals who were unemployed in the original CARES Act law they agreed to back in March. This critical extra payout ended in July of this year. One of the items almost assured of making it into a new Congressional relief package is an additional weekly unemployment subsidy. Policy experts estimate that this renewed additional benefit would amount to somewhere between $250 to $600 each week. It would probably be a retroactive benefit that covered back through September.

Signs of Movement on Unemployment Benefits and Stimulus Lacking

The Director Michael Strain of Economic Policy Studies at the American Enterprise Institute warned that counting on additional help from a gridlocked Congress was not wise, with:

“If we are going to get another round of stimulus, I can't imagine that won't be included in it. It's far from certain we will get another round.”

Unfortunately the timing could not be more critical ahead of the more costly holidays either. The burden of evidence from analysis at cnbc indicates that unemployed individuals and families had no choice but to use their savings with alarming speed. More of them are now being forced to go hungry more frequently than those who have managed to hold on to their jobs, if not all of their hours and previous rate of pay.

The worst part for those who are depending on these continued unemployment payouts is that the time to solve the approaching benefits cliff is nearly expired. In addition to the loss of unemployment extended payments, the protections afforded renters to not be evicted and forbearance on student loan payers are all set to disappear at the same time. This has not been enough to motivate Republicans and Democrats to agree to a compromise on the relief package.

An example of the conflict that is preventing a deal from being struck is the total dollar amount of the potential relief bill. Republican leader Mitch McConnell is hard set on a $500 billion total bill at the same time that Democrat leader House Speaker Nancy Pelosi insists on a far wider and deeper package in excess of $2 trillion total value. Meanwhile the new President-elect Joseph Biden is asking the Congress to get a bill done before his January inauguration. It comes as no surprise that he agrees with his fellow Congressional democrats regarding the total size of the relief bill. Senior Economic Analyst Mark Hamrick of Bankrate opined that:

“I don't think there's any sign of visible momentum. It's one example after another of Lucy moving the football before Charlie Brown goes to kick it.”

Many observers and economists now earnestly hope that the answer will come at the last minute with a pending spending bill that the U.S. Congress has to pass no later than December 11th if they want to head off another government shutdown. Senior Fellow Andrew Stettner of the progressive think tank the Century Foundation argued that:

“The most likely thing to move will be that budget legislation.”

Without the government's additional unemployment supplement, the benefits paid by the states typically cover around fifty percent of the lost income of workers in America (to a certain pre-determined dollar cap that is determined by every state). For the month of October, the average state paid nearly $1,300 in unemployment benefits to the average American, per the Labor Department. Bankrate's Mark Hamrick warned that for many Americans around the country, this supplemental income will not cover the individual or family expenses, with:

“Good luck making that go very far in many areas across the country.”

The idea of lawmakers with their supplemental $600 per week increase was to totally compensate for wages that the typical worker had seen evaporate in the depths of the coronavirus and the most severe spate of joblessness dating back to the United States' Great Depression.

Research on this timely help to many Americans along with single stimulus checks amounting to $1,200 for adult citizens revealed that as many as 18 million Americans were pulled out of poverty in the month of April, according to the study run by Columbia University. When the money was spent though, financial troubles increased the study learned. Meanwhile the situation has grown worse, with U.S. coronavirus cases hiting a new high even as Germany, France, and Britain locked down again.

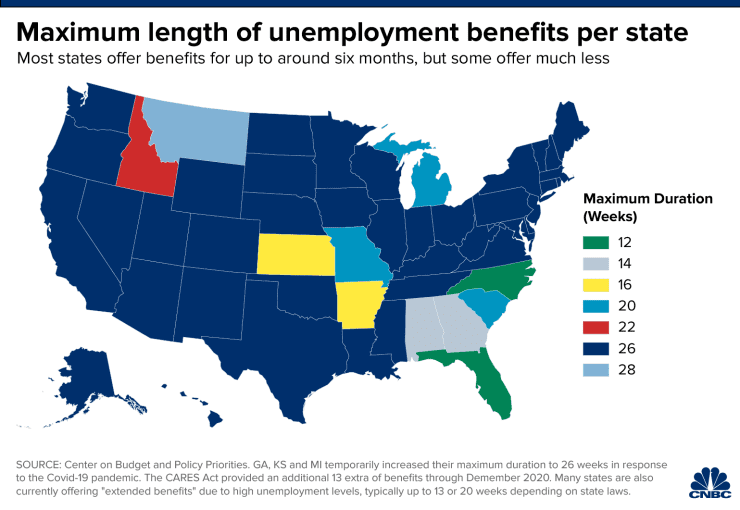

Yet partisan differences of opinion kept the two sides from coming together. Republicans worried that too much largesse would cause people to not be interested in going back to work. Various economics studies argued against this line of reasoning during the summer. The graphic below shows the unemployment maximum length benefits on a state by state breakdown:

The dynamic might change as the economy improves per some economists. It may worsen before it gets better though as JP Morgan has projected a drop in Q1 2021 GDP. Republicans are instead encouraging the Congress to pass benefits that total between $250 and $400 per week supplemental amount, for a grand total of $1,000 to $1,600 per month. President Trump would also agree to this amount his Treasury Secretary Stephen Mnuchin has argued as he pitched a $400 per week compromise in later negotiations that took place in the month of October.

In fact, the President of the United States did approve an executive order program that increased the monthly boost by $300 in the form of the Lost Wages Assistance back in the early part of August. By calling up federal emergency disaster funds, it was able to pay out as many as another six weeks of unemployment benefits supplement. Unfortunately for hundreds of thousands of lower income earners, they were not eligible for the program.

Yet the Democrats in Congress continue to insist that for them the absolute minimum amount that they will agree to is $400 per week or $1,600 per month. Their bill includes a second boost of $600 per week or $2,400 per month. Hamrick is still optimistic that they can work out some sort of arrangement to help the struggling population as the fallout from the coronavirus only seems to grow worse with an ever increasing number of infections this November. He stated that:

“Compromise can take any number of different paths.”

While no one can control the government and its infighting or influence the policies that actually come out of Washington, you can take steps to diversify your own retirement and investment portfolios. There is a good reason that gold makes sense in an IRA. If you want to learn more you can read all about top gold IRA storage options.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $908.46

Palladium: $908.46

Bitcoin: $68,179.41

Bitcoin: $68,179.41

Ethereum: $3,277.20

Ethereum: $3,277.20