- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Latest U.S. – China Trade Deal Does Not Fix The Big Problems

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 16th December 2019, 11:44 am

Over the weekend the news emerged that the United States and China have reached a first phase trade war agreement. In the headlines it sounded like great news, but digging deeper beneath the surface revealed that there are several serious problems with it. Thanks to Beijing not firmly committing to balance bilateral trade flows with the U.S., America's unacceptably huge trade deficits with China will continue. Trade disagreements will keep simmering just beneath the surface.

China and U.S. Agree on Murky Phase One Trade Agreement

On Friday the 13th of December, the U.S. and China revealed that they have come to a phase one trade deal agreement. This provides for some relief of tariffs, larger agricultural purchases, and structural adjustments to technology and intellectual property issues. Unfortunately a number of the partial deal's details still look murky.

U.S. President Trump announced the terms of what he labelled the “amazing deal” even as the Chinese officials were briefing reporters with the agreement details on Friday morning. The two biggest economies in the world are now working towards signing the deal in an effort to calm down the raging trade war. At first the major United States stock indices leaped higher, but they surrendered the gains after traders had a chance to better scrutinize the deal terms.

According to the arrangements in the phase one agreement, the U.S. will gradually phase out tariffs on Chinese goods. This has been a priority for the Chinese side. Yet Vice Commerce Minister Wang Shouwen did not reveal when these duties would roll back.

Later that day, President Trump announced that his administration would stop the pending next round of Chinese goods' tariffs that had been set for Sunday, December 15th. He clarified in a series of tweets that the White House will leave the existing 25 percent in tariffs on the $250 billion imports, but will reduce the present duties to 7.5 percent on another batch of $120 billion worth of products. Vice Finance Minister Liao Min stated that China will possibly cancel its retaliatory tariffs set for Sunday.

Concessions On Big Issues Were Still Theoretical

Over the weekend, the Chinese Vice Minister for Agriculture and Rural Affairs Han Jun stated that China will boost its purchases of U.S. agricultural products substantially. Yet he did not clarify by what amount. The two sides also declared that there would be changes in intellectual property protection, financial services, and transfers of technology. These have been key demands from a White House that is eager to stop China's trade abuses.

The U.S. Trade Negotiator Robert Lighthizer revealed that the administration has not pledged to eliminate existing tariffs for the future. He added that the United States will not erect any new duties if China now negotiates in good faith. President Trump also announced that the United States will start to negotiate the trade deal's next phase:

“Immediately, rather than waiting until after the 2020 election.”

Previously the President had hinted that these negotiations would be on hold until after the November 2020 elections. Investors had been worried by this stance. Yet the agreement still has a number of legal procedures to get through before Beijing and Washington can sign it. U.S. Trade Representative Lighthizer told reporters Friday that the two countries are working to sign this first phase agreement in January back in Washington.

Existing Tariffs on China Will Continue

Speaking to reporters in the White House later Friday, Trump said that he would use the existing tariffs as a negotiating tool in future discussions. He added that he thinks China will start buying $50 billion in U.S. agriculture goods “pretty soon.”

President Trump has employed these tariffs as a tool to pressure China to sign up to a larger agreement that will address forced technology transfers, intellectual property theft, and the enormous trade deficit. U.S. Trade Representative Lighthizer stated that:

“President Trump has focused on concluding a Phase One agreement that achieves meaningful, fully enforceable structural changes and begins re-balancing the U.S.-China trade relationship.”

Acceptable Balance of Bilateral Trade Accounts Will Be Difficult to Reach at Best

When you drill down into the most recent trade numbers between the United States and China, it becomes difficult to see how last week's agreement could facilitate a bilateral trade accounts balance that is acceptable. The Chinese surplus for its trade in U.S. goods over the first 10 months of 2019 amounted to $294.5 billion. It represented 40 percent of the entire American trade gap.

Over the same time frame, China cut back exports from America to China by 14.5 percent down to only $87.6 billion. Compare this to the Chinese goods sold in the U.S. that are four times bigger, or $382.1 billion. Despite this reality on the ground, Reuters reported Beijing has suggested that it will boost its purchases of American services and goods (over the next two years) by $200 billion.

Assuming that this is all China has pledged to offer, then its U.S. exports would need to drop by 50 percent from today's yearly rate of $462.4 billion in order to appreciably reduce the U.S.-China trade deficit. Given China's drive to export more and not less, it does not seem remotely possible.

U.S. Wealth and Technology Transfers to China Will Continue

Reality is that the United States will keep suffering from enormous financial and technology transfers over to China. These are necessary to finance the rising net position of foreign debt from the U.S. that continues to be net foreign assets to the Chinese on Beijing's books.

The other important issues of the dispute included Beijing's forced technology transfers, lack of intellectual property protection, exchange rate management, and illegal Chinese industry subsidies. The statements on these issues were merely declaratory and not substantial or well defined legal arguments. Instead the mechanism for enforcing them will be more bilateral technical consultations that could be escalated to higher levels if a major disagreement surfaced.

While Washington has highlighted China's vague promises to buy more American goods and farm products, the analyst estimate of $200 billion in forecast Chinese imports from the U.S. in the next two years will still leave the U.S. with enormous trade deficits. Equally troubling is the fact that China has not agreed nor even referred to these so-called promised numbers. The official state media in China has stated that:

Beijing concluded its “trade agreement based on the principle of equality and mutual respect” and that China's markets expanding will allow for rising imports of services and goods from overseas, “including the United States under the WTO rules as well as market rules and business principles.”

Sadly this officially sanctioned wording reads much more like a truce than a believable end to America and China's trade war.

U.S. Imbalances of Trade Can Not Realistically Continue

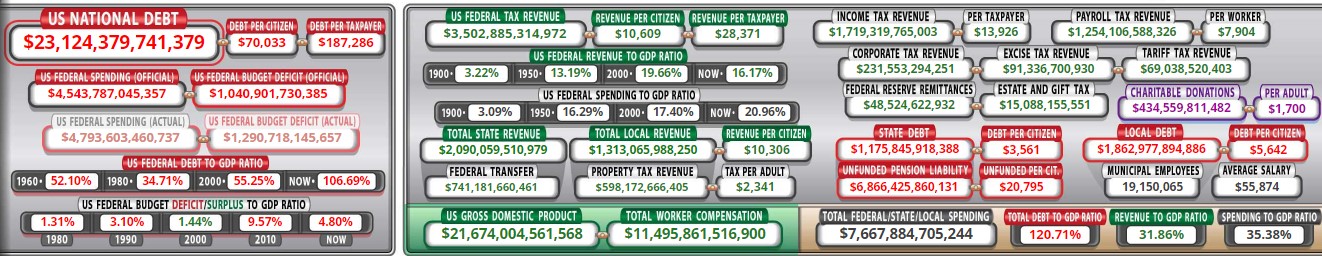

China has not accepted the fact that these systemic and massive U.S. trade imbalances can not keep going. They are an alarming problem for the U.S. with its over $23 trillion in public debt, disastrous net foreign investment position amounting to -$10.56 trillion, and harshly deteriorating current budget restrictions as the graphic below shows:

Unfortunately the news this week shows that the trade deficits between the U.S. and China will continue to be much too big to ignore. Instead of ending the trade problems between the two countries, the newly announced first round trade deal will allow them to continue simmering. The agreement does not address the other important security and political issues that the two countries must address to reduce tensions between the combative superpowers. It is the latest argument for why gold makes sense in an IRA.

You have the ability to diversify some of your assets into IRA-approved precious metals. The IRS will even allow you to store these in top offshore storage locations today. You can read about the Top Gold IRA companies to learn more.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81