July 2022 Survey: Over 70% of U.S. Consumers Believe A Global Recession To Come in 2022

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 6th July 2022, 01:19 pm

Table of Contents

- Key Takeaways:

- July 2022 Survey: Over 70% of U.S. Consumers Believe A Global Recession To Come in 2022

- Recession Opinion by Age Group

- Recession Opinion by Gender

- Recession Opinion by Region

- Survey Methodology

- Study Details and RMSE Score

- Discussion and Conclusions

- Want Portfolio Protection from a 2022 Recession?

- Full Survey Report

Key Takeaways:

- Over 70% of Americans aged 25 and older believe a global recession will occur in 2022

- Results didn’t meaningful differ by gender, with 71.9% of men and 69.2% of women respondents believing that a recession is looming

- Retirement-aged respondents were the most pessimistic, with 74.3% of respondents aged 65+ answering “Yes” compared to the least pessimistic group, those aged 45-54 of which only 65.3% answered “Yes”

- Women aged 35-44 were the least pessimistic overall, with 64.3% believing in a 2022 recession, whereas 78.6% of men aged 65+ believe a recession is looming in 2022

- California is the least pessimistic state (61.5%) and the most pessimistic is Virginia (89.2%)

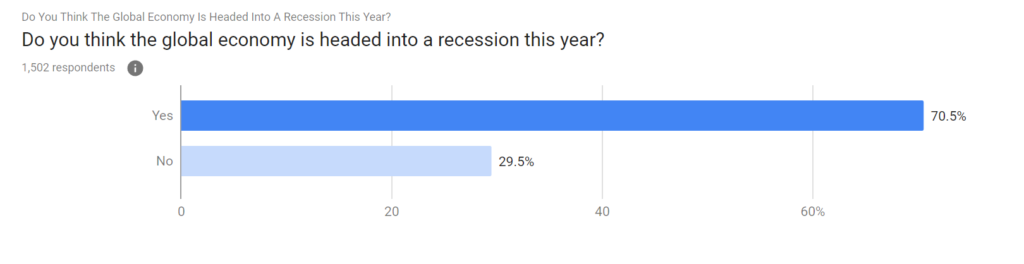

Figure 1. Source: Google Surveys

Consumer confidence plays a large role in forecasting future economic activity. According to a new nationwide survey published by Gold IRA Guide, consumer confidence has, in fact, reached a new low. Indeed, with CPI levels eclipsing 8.6% in May, over two-thirds of Americans believe that the global economy is headed into a recession this year.

These survey results demonstrate a large and demonstrable downturn in consumer and investor confidence since a Bloomberg poll in May that found that only 30% of Americans believed a U.S. recession loomed in the next 12 months.

Amid generationally high inflation levels, investor sentiment and consumer confidence are paramount. Until now, the true extent of the U.S. public’s pessimism had yet to be publicized. In this article, we will unpack this landmark survey and discuss the implications of growing recession fears.

July 2022 Survey: Over 70% of U.S. Consumers Believe A Global Recession To Come in 2022

Gold IRA Guide recently published the results of a nationwide survey that found that 70.5% of U.S. adults think that the global economy is headed into a recession later this year. The question was put as follows:

“Do you think the global economy is headed into a recession this year?”

The survey recruited 1,502 respondents weighted by age and gender, each of whom were residing in the United States and aged 25 and older. American adults between the ages of 18 and 24 were excluded intentionally in order to mitigate sampling biases and to target older working adults who are more likely to be active participants in financial markets.

The results displayed above (Fig. 1) demonstrate that a clear majority of U.S. adults believe that a recession is likely to occur later this year. Such a commanding response builds on an existing body of survey and polling data that indicate that recession fears are growing in the United States.

Recession Opinion by Age Group

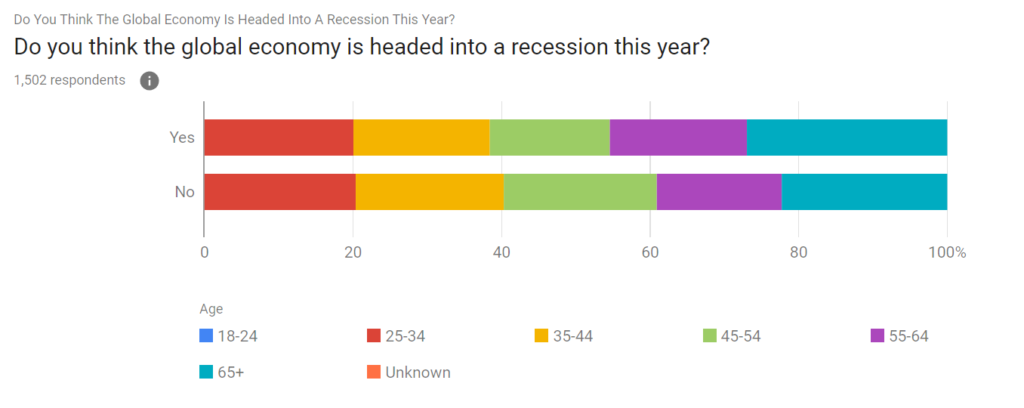

Figure 2. Source: Google Surveys

Age-based differences in survey responses were apparent but not particularly significant. In general, older respondents took a more pessimistic approach as compared to younger ones.

For instance, retirement-aged respondents were the most pessimistic, with 74.3% of respondents aged 65 and older answering “Yes.” By contrast, the least pessimistic group, those aged 45 to 54, only answered “Yes” 65.3% of the time. Therefore, those aged 65+ were about 14% more likely to think a recession is coming later this year than those aged 45 to 54.

Recession Opinion by Gender

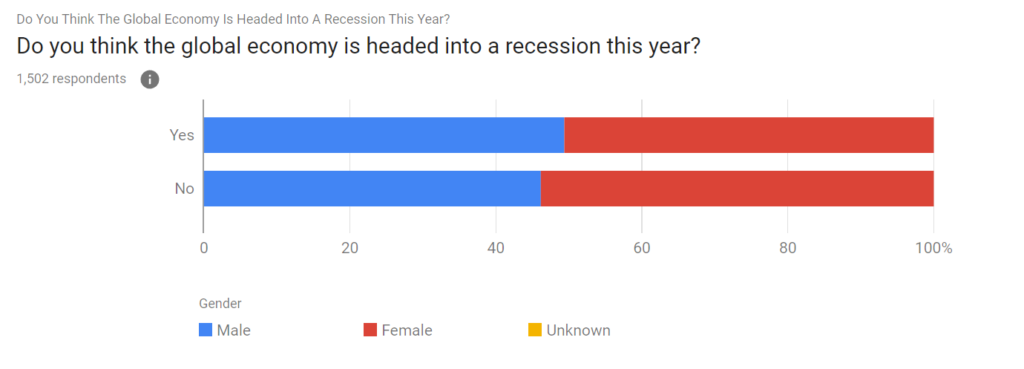

Survey responses did not differ meaningfully by gender. Both men and women responded “Yes” in far greater numbers than those who responded in the negative. This indicates that there is broad support for the belief that a global recession is to come within the next six-month period, support that extends across genders.

Figure 3. Source: Google Surveys

As indicated by the chart above (Fig. 3), women were slightly more likely to not believe that a recession is coming this year. Whereas men responded “No” 46.2% of the time, women responded “No” 53.8%, making women +16% more likely to think that a recession is not coming this year compared to men.

Recession Opinion by Region

No significant geographical differences exist in terms of survey responses across the regions of the United States. There were, however, significant disparities between certain states. Below, we’ve listed the top and bottom two states for those that responded “Yes”:

Highest “Yes” Rate

- Washington: 81%

- Virginia: 89.2%

Lowest “Yes” Rate

- California: 61.5%

- Kentucky 61.7%

Given the geographical and political disparities that exist between each of the states listed above, there does not appear to be a trend compelling certain states toward answering in a particular way. Rather, it’s more likely that survey responses were motivated primarily by the respondents’ lived experience and personal economic and career outlook.

Survey Methodology

The survey was conducted over a 24-hour period between June 23 and June 24, 2022, with a sample size of 1,502 adults. Respondents were geographically limited to the United States, were at least 25 years of age, and were users of the AdMob Network by Google Surveys.

The methodology made use of convenience sampling and including a weighted and representative sample of men and women.

Study Details and RMSE Score

- Audience: Users of the AdMob Network and Google Surveys

- Method: Convenience

- Age: 25+

- Gender: All genders

- Location: United States

- Language: English

- Frequency: Once

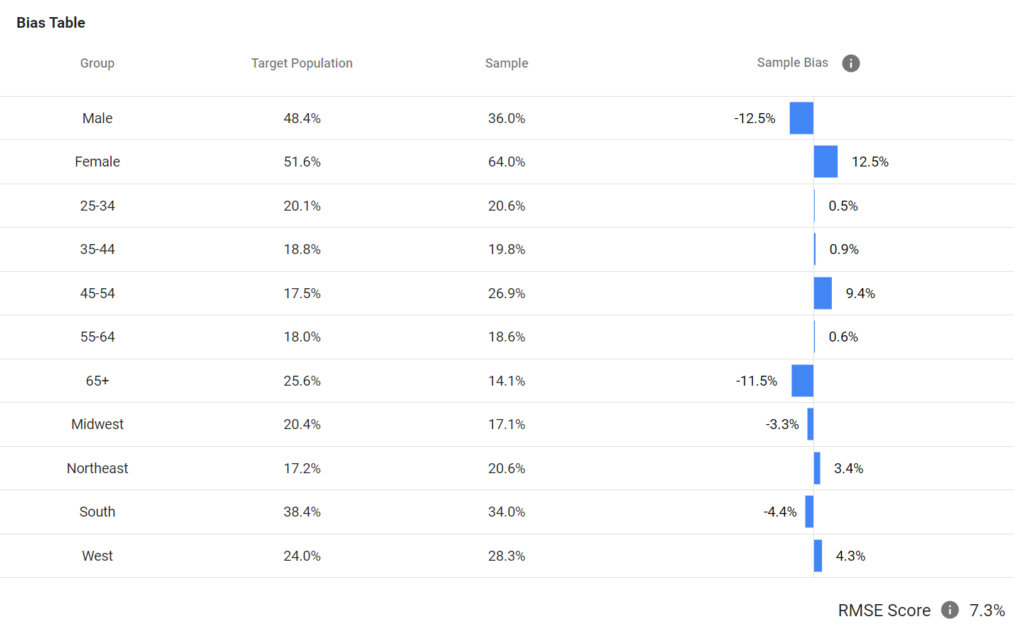

Root mean square error (RMSE) is a weighted average of the difference between the predicted population sample (CPS) and the actual sample (Google). The lower the RMSE score, the smaller the total sample bias.

Discussion and Conclusions

Expert opinion largely dictates that a recession is looming in the medium to short terms. A recent Bloomberg Analytics report, for example, found that there is a 72% chance of a recession by 2024. However, the present survey finds that the timeline for a recession, in the eyes of the U.S. public, is much more accelerated than that.

For more information on 2022 recession risks, we encourage you to read this compilation of expert opinion on the current economic forecast.

It is notable that no significant regional nor gender-based differences are present in the survey results. One might assume that certain states suffering from the highest inflation rates, such as New Jersey, or the highest unemployment rates, such as Nebraska, would respond “Yes” in disproportionately high numbers. However, this wasn’t the case.

Our analysis of the survey results indicate that responses were motivated by one’s personal experience and economic situation, rather than by political beliefs or general economic trends within their locality.

Older respondents, especially those within the conventional retirement age range (65+), were more likely to believe that a recession is upcoming. In fact, more than 78% of men aged 65 and older responded “Yes” to the survey question. This affirms prior scientific literature, including a 2011 study published in the Annals of the New York Academy of Sciences, that found that older adults are more likely to be cautious and pessimistic in their financial decision-making, and that they are biased toward negative information.

In sum, the results present compelling evidence that a diverse and demographically varied sample of American adults are becoming increasingly pessimistic regarding the short-term future of the global economy.

Want Portfolio Protection from a 2022 Recession?

Both the economic experts and the general public believe that a recession is nearing. Whether it arrives this year, next, or the following year, it’s crucial that your IRA or 401(k) is prepared to withstand it. To learn more about portfolio protection from the effects of a recession, we strongly recommend you read our exclusive guide to diversifying with gold during a recession.

Full Survey Report

For a more detailed look at the data included in this article, view the full survey report on Google Data Studio.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $4,606.48

Gold: $4,606.48

Silver: $91.09

Silver: $91.09

Platinum: $2,358.45

Platinum: $2,358.45

Palladium: $1,787.20

Palladium: $1,787.20

Bitcoin: $95,421.48

Bitcoin: $95,421.48

Ethereum: $3,302.69

Ethereum: $3,302.69