Is Gold a Good Investment During a Recession?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 1st December 2021, 09:23 am

Gold has served as a reliable store of value for millennia. All across the world, every civilization current and past has valued gold for its rare and unique qualities.

Gold is malleable, ductile, and corrosion-resistant. It is also one of the best conductors of electricity which has driven its demand for industrial purposes and the manufacturing of consumer electronics. Given its unique chemical profile and scarcity, gold carries inherent value that generally makes it a safe investment during recessions and adverse economic events.

Resistance to inflation

For an investor, one of the most attractive characteristics of gold is its resistance to inflation. Gold has been known to keep its value through times of high inflation. If inflation rises, the value of the dollar decreases. In other words, you have to pay more dollars to buy the same goods, products, or services.

The same is true for gold. If a dollar is worth less then it will take more of them to buy an ounce of gold. Most stocks, on the other hand, will be adversely affected by high inflation. The economy will begin to contract as borrowing costs skyrocket and consumers purchase less, and, consequently, corporations see their revenues decline.

Most companies hold debt, and that debt will become more expensive to finance, reducing corporate profits. Companies with a high debt to equity ratio will be particularly hurt when inflation rises.

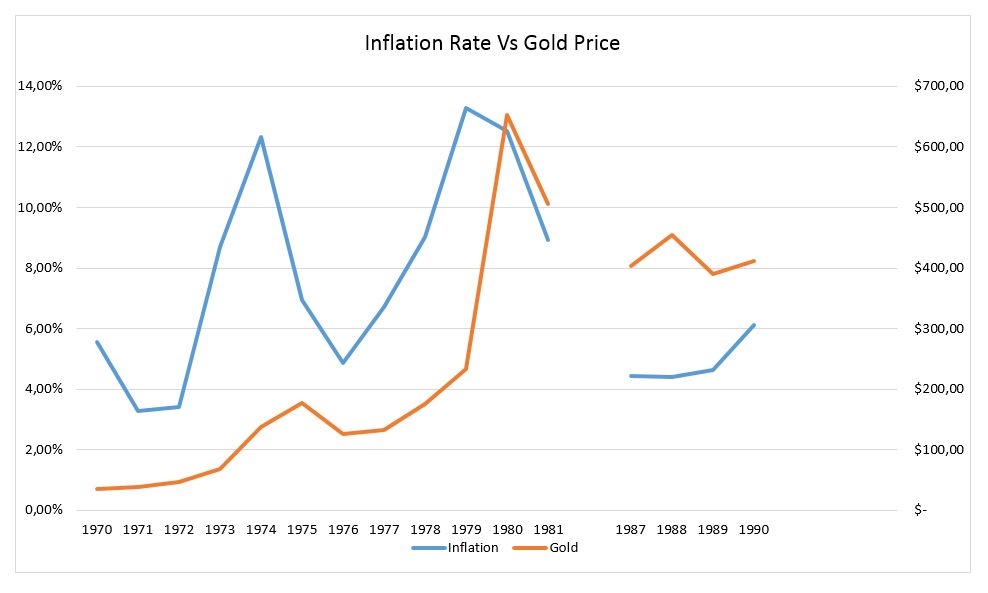

Gold performance with High Inflation

The chart below shows the US inflation rate over two periods of high inflation against the price of gold. The last sustained periods of inflation were from 1970 to 1981, and from 1987 to 1990. For the first period inflation was above 4% except for the two years 1971 and 1972. Over this 11 year cycle, inflation was above 10% in 3 different years and peaked at 13.29% in 1979.

We can see how the price of gold increased over both periods. The price of the shiny metal in 1970 was $34.83, and at the end of the inflationary phase in 1981 was $506.50. That's an increase of 1,354.2%.

Over the second period, the price of gold went from $403.43 in 1987 to $411.45 in 1990. Although not as spectacular as the first inflationary stage gold still managed to maintain its value.

Source: MacroTrends

Past performance of any asset is not a guarantee to future performance. But we can see how gold managed spectacular gains over the period of stagflation in the 1970s. We also see that in both periods of high inflation gold performed as would be expected of an asset that protects you from inflation.

Missed Expectations

Inflation is picking up and in a big way. The latest inflation data published shows an increase of 6.2% in prices. Considerably higher than expectations which were at 5.8%. Moreover, inflation has been on the rise since the beginning of the year when it was 1.4%, we have now had inflation over 5% for 6 consecutive months.

Table of Contents

How Does Gold Behave in a Recession?

Let’s have a closer look at the behavior of gold prices during a recession. Looking at gold performance over any given period is important. However, to get some sense of relevance we will then compare it to the performance of stocks over 2 of the most recent periods.

We will look at the last 50 years, not only because being relatively more recent they are also more relevant, but also because the US dollar’s convertibility to gold was ended in 1971.

The chart below shows gold prices since 1969, the gray areas correspond to recession cycles. We can see that throughout all of these periods gold managed to gain in value. In some cases, the recession in the early 1980s and the recession of 2008, gold initially dipped in value but ended the recessionary phase in a bull trend.

Source MacroTrends

Gold’s Performance Compared to Stocks

We have seen that gold price has performed positively over various periods of recession, but how did it perform compared to stocks? I often get asked ‘if the stock market crashes will gold go up?’ Having a look at gold prices compared to the broad S&P 500 index should give us the answer.

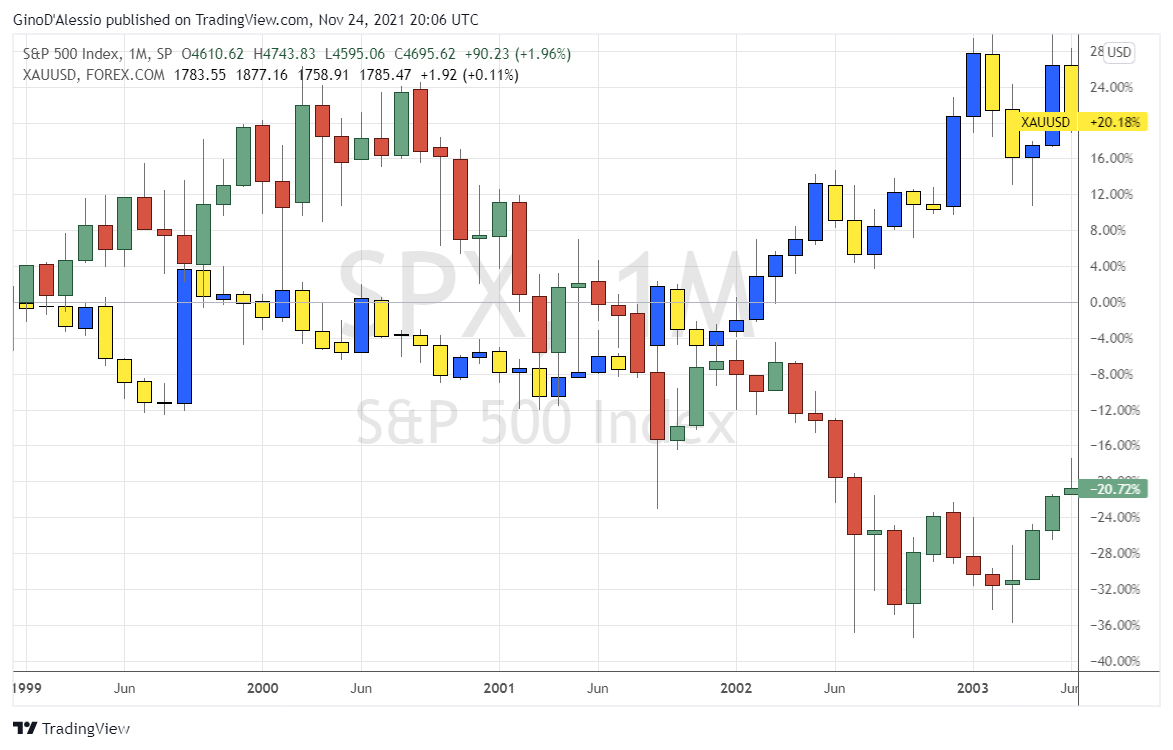

The last two stock market crises go back to 2000 and 2008. The S&P 500 went from its peak in March 2000 at 1552.87 to its trough in October 2002 at 768.63. In October 2007 the stock market hit a new all-time high at 1576.09 to then tumble to a low of 666.79 in March 2009 before recovering a bull trend.

The chart below compares the S&P 500 against gold during the crisis of 2000. We can see that gold in March 2000 closed at $279.03 and managed to climb to $319.70 by October 2002. That run equates to an increase of 14.6% for the price of gold. For the same period, the S&P produced a drop of 50.5%

Source TradingView

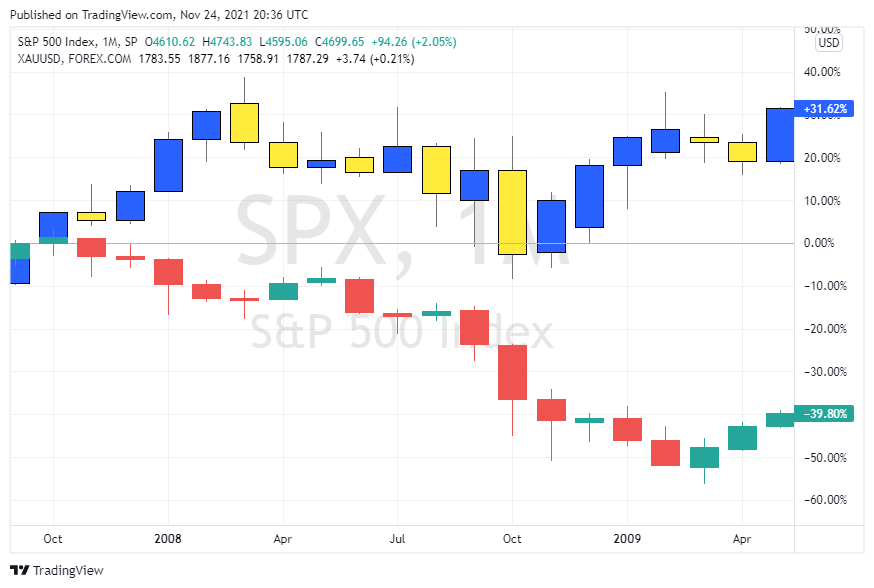

In the chart below we can see price action for the S&P 500 and gold during the recession of 2008. In October 2007 gold closed at $796.75 and during the following recession climbed to $918.58, for an increase of 15.3%. During the same period of turmoil, the S&P 500 fell by 57.7%.

As we can see, not only has gold produced positive returns during times of recession, but it has also outperformed the broader stock market.

Source TradingView

How to Invest in Gold

There are three ways to invest in gold, buying physical bullion and coins, investing in a gold ETF, or buying gold stocks. Let’s take a quick look at these different ways of investing in gold.

Gold Bullion & Coins

You can buy gold bullion or coins from various providers online, make sure they are trusted and reliable. You would then keep the gold you receive at home, perhaps in your safe, or in a bank deposit box.

You can also buy gold bullion through your self-directed IRA or 401k. However, in this case, your gold must be kept by an approved custodian and vaulted by non-bank trustees.

Holding physical gold has its advantages, such as no counterparty risk. You have bought a commodity you own and hold in a safe place, and there is no risk of default or failure on the part of the other party. The only drawback is liquidity, as buying and selling physical gold can be relatively time-consuming.

Gold ETFs

Gold ETFs are a way of gaining access to the returns of holding gold without actually acquiring physical gold yourself. The fund buys gold bullion and stores them in secure vaults. The price of these funds follows that of spot gold closely.

You are investing in the stocks of these funds that are quoted on an exchange. As the funds are publicly traded you benefit from a great deal of liquidity, making selling and buying these stocks relatively quick. However, you are still exposed to counterparty risk, as your money is invested in the securities of a third party.

Gold Stock

An alternative to buying physical gold directly or through a fund is to gain exposure by buying mining companies. The profit of gold mining companies depends heavily on the value of gold.

By buying these stocks you are also gaining exposure to the value of gold, using securities that have the liquidity of being traded on an exchange.

This type of investment in gold brings other risks not associated with holding physical gold. Highest of all corporate risk. The choice of holding mining stock to gain revenue from gold price leaves you open to the operating risks of that company.

A way to diversify corporate risk is by investing in a mining ETF, these funds invest in several mining corporations. Spreading the investment in mining stocks across various companies allows for you to reduce the risk you would have from holding the stock of one corporation.

Wrapping Up

We have seen how adding gold to your portfolio can help fight against inflation, reduce the negative effects of a stock market crisis or recession, and still reap the rewards of positive capital growth.

Overall, gold is a valuable asset and a great diversification tool for your portfolio, during periods of economic growth and especially during recessions. You may want to consider including gold in your retirement plan. Gold is a great investment in the long-run especially through a gold IRA, for the advantages offered.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,346.73

Gold: $3,346.73

Silver: $36.44

Silver: $36.44

Platinum: $1,419.54

Platinum: $1,419.54

Palladium: $1,158.22

Palladium: $1,158.22

Bitcoin: $108,843.26

Bitcoin: $108,843.26

Ethereum: $2,572.57

Ethereum: $2,572.57