July 2021 Newsletter: Is This Platinum’s Moment? Plus, Deep Discounts in Crypto and Gold This Summer

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 27th August 2021, 06:35 pm

Big changes are coming to our economy.

As the economy heats up, the Federal Reserve Chairs have acknowledged that they intend to hike interest rates by the latter half of 2023. Previously, they had announced their intention to keep rates near-zero through the year. Fed Chairman Jerome Powell’s announcement caused an immediate slip in the Dow Jones by 0.8%.

The Fed isn’t playing around. As inflation continues to rise, they’re ready to take action and put an end to the “easy money” monetary policies we've enjoyed for the past 18 months. When this eventually happens, there’s no telling how the stock market will react. But one thing’s for sure—it won’t be positive.

We’ve seen time and time again that the stock market will slide at the slightest news of interest rates increasing. If the equities market is propped up by a Federal Reserve with its thumb stuck to the money printer, investors should think twice about keeping most of their wealth in stocks.

Stability In Precious Metals

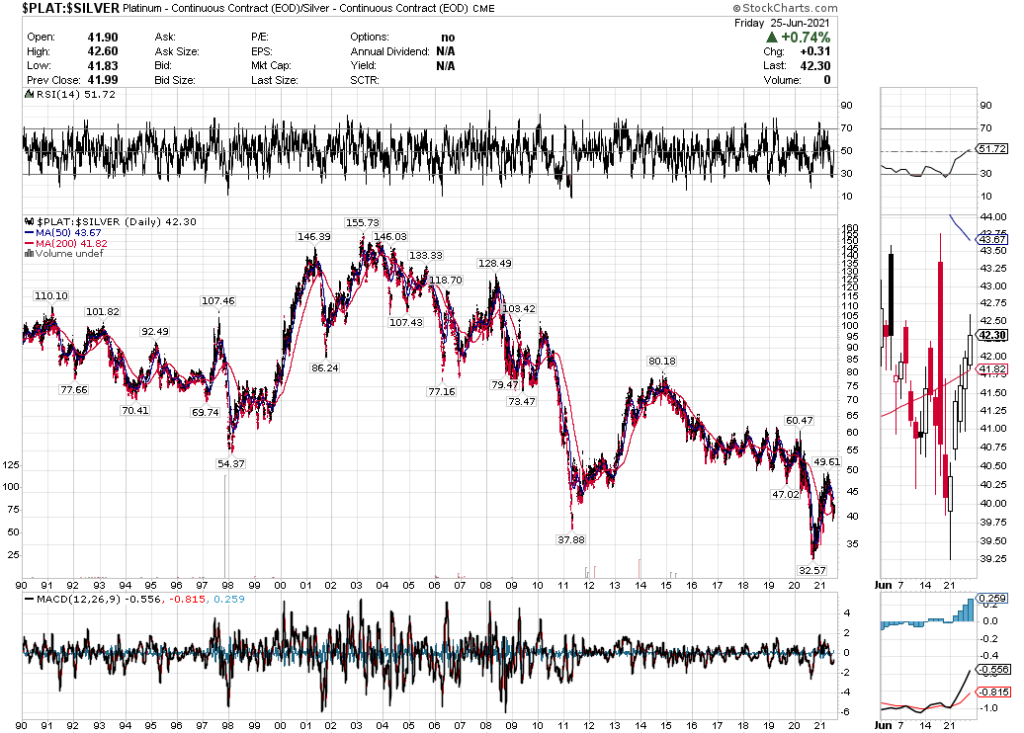

If you look beyond the CNBC headlines, you’ll find that there are plenty of stable alternative assets. At the moment, platinum has the spotlight. It’s by far the best-valued precious metal opportunity in years. Currently, the $PLAT:$SILVER ratio is the lowest it's been since at least 1990.

At the same time, platinum demand is expected to rise by 25% by the end of 2021 due to new environmental regulations (Euro 6D and China 6A) in the global auto sector. These new rules, which will ramp up the use of platinum-group metals as catalysts in emissions control systems, will impact over 31 million motor vehicles.

Automotive demand for platinum, particularly within China, is set to skyrocket at least 14% in the months ahead. This could send the spot price to all-time highs. While platinum is trading at generational lows next to the price of silver, now looks like an ideal time to recalibrate your portfolio in favor of platinum.

Time To Get In On The Action

Not only that, but the crypto market is stabilizing around $35,000. Now is the time to get back into Bitcoin, or load up on discounted tokens, while you still have the chance. When the next bull market takes off, you’ll wish you took the opportunity when you had it.

Don’t know where to start? We’ve got you covered.

Read our guide to opening a Platinum IRA today, so you can add platinum bullion to your self-directed retirement savings account. While you’re at it, you can also add IRA-approved gold for even better diversification—after all, the price of gold fell by -7.5% in the month of June, leaving retirement investors with a unique entry point for two deep value metals.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,355.83

Gold: $3,355.83

Silver: $38.43

Silver: $38.43

Platinum: $1,468.02

Platinum: $1,468.02

Palladium: $1,286.05

Palladium: $1,286.05

Bitcoin: $117,574.14

Bitcoin: $117,574.14

Ethereum: $2,959.38

Ethereum: $2,959.38