- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Jobless Claims Soar to Record High Amid Continuing Economic Fallout

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 31st March 2020, 10:58 am

Americans who are out of work because of the coronavirus filed for unemployment claims in all-time record numbers this past week. The Labor Department announced a shocking escalation up to 3.28 million filed claims last Thursday. These numbers may be the highest ever, but with department stores now starting to furlough their employees nationwide this week, the unemployment claims look set to skyrocket still higher in coming weeks.

Consensus Estimates Had Been for Less Than Half the Actual Jobless Claims

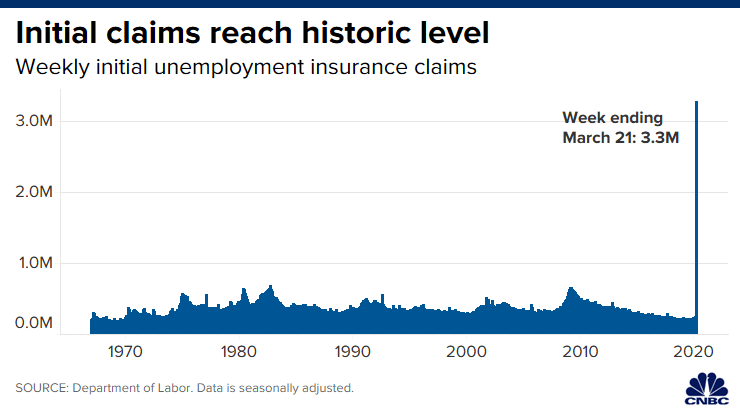

The current unemployment numbers destroyed the prior records during the Global Financial Crisis that topped out at 665,000 back in March of 2009 and the previous record high of 695,000 from October of 1982. The over three million number compared to the previous week's level of 282,000 jobless claims, also greater than economists had forecast for that point, according to data from CNBC. This chart below makes clear what a dramatic increase the jobless claims experienced:

Economists who had been surveyed by the Dow Jones had offered consensus estimates of approximately 1.5 million new jobless claims. Some individual forecasts out of Wall Street had been expecting a significantly larger number. The devastating jobless numbers spike resulted from the shutdowns resulting from the global coronavirus crisis. Even the four week moving average was dramatically impacted by the week's shocking increase. With weekly distortions removed, this number touched 1,731,000, up 27,500 from the prior week's revised average.

Economic Shutdown Wreaking Havoc on U.S. Economy

Companies all over the United States have closed their doors in the new era of social distancing designed to keep the coronavirus from spreading. The filed claims were so many that a number of states announced their websites had crashed. CEO Tom Gimbel, the founder of Chicago-based LaSalle Network employment agency, explained that:

“We've known this number was coming for a week and a half. It doesn't surprise me at all. When you see a city like Las Vegas get shut down, I don't know what other options there were than seeing a number like this.”

Such unemployment claims are the most current revelation of the present deteriorating economic conditions. The majority of economic data releases over the past few weeks covered timeframes before the coronavirus severely impacted the country. They had been falsely painting a picture of an American economy in a comparatively good position ahead of the crisis. Federal Reserve Chairman Jerome Powell cautioned that:

“This is a unique situation. People need to understand, this is not a typical downturn. At a certain point, we will get the spread of the virus under control. At that time, confidence will return, businesses will open again, people will come back to work. So you may well see a significant rise in unemployment, a significant decline in economic activity. But there can also be a good rebound on the other side of that.”

Yet he admitted that the short term damage to the economy will be shocking. Not seasonally adjusted, the advance numbers for actual initial claims of state programs amounted to 2,898,450 for the past week. It represented a rise of 2,647,034 from the prior week, or a 1,052.9 percent gain.

State Level Jobless Claims Rise Is Breathtaking

The numbers on an individual state level were simply breathtaking. Pennsylvania's roared twenty times higher from the prior 15,439 to 378,908. New York experienced a quintupling of numbers from 14,272 to 80,334. California's tripled up to 186,809. In Louisiana, which saw the infections multiply at a scary rate the claims increased from 2,255 in the prior week up to 72,620.

In a hoped for bright spot for the legions of now unemployed, these numbers came out a day following the Senate passage of the much-touted over $2 trillion stimulus rescue package in response to the global pandemic. This is by far the largest emergency aid package authorized in American history.

Jobless Numbers to Worsen As Department Stores Start Furloughing Employees

The jobless numbers look set to worsen in the coming weeks. Both Macy's and Kohl's announced this Monday that they will now furlough the overwhelming majority of their employees as the mega department store chains attempt to grapple with devastating sales declines in the pandemic. Beginning this week, most of Macy's employees will be on furlough, while Kohl's announced that its employees in both distribution centers and stores (and some related corporate positions) will enter furlough this week as well.

The numbers are significant. Kohl's will furlough around 85,000 of its roughly 122,000 employees, per corporate spokeswoman Julia Fennelly. The company's 1,159 store locations will still offer curbside pickup and will keep shipping orders out with skeleton staffs on site. Macy's refused to reveal the precise number of its employees who would be furloughed.

Kohl's and Macy's are only two of the several dozen retailers that have been closing down stores to try to halt the spread of the virus in the United States. All of the Kohl's and Macy's stores have been closed without a date announced for their reopening. A great number of the retailers keep selling products online, though with the loss of their physical venues where most consumer purchases occur, their revenues have suffered greatly.

Macy's and Kohl's Desperately Trying to Save Themselves From Collapse

Macy's has taken a number of steps so far in a bid to stave off collapse. The company with its 551 Macy's stores drew on its line of credit, suspended dividend payments, froze all spending and hiring, and canceled a few orders. The firm has pulled its financial outlook for this year. Shares in the company have declined a shocking 68 percent from the beginning of 2020. A company statement announced that:

“While these actions have helped, it is not enough. Across Macy's, Bloomingdale's, and Bluemercury brands, we will be moving to the absolute minimum workforce needed to maintain basic operations.”

The coronavirus is only the latest attack on the major department stores. These companies were reeling from weakened sales before the outbreak hit. Kohl's drew on its $1 billion in unsecured credit facilities. Nordstrom drew on its $800 million revolving credit facility and suspended all dividend payments. J.C. Penney pulled its financial outlook for the year, as did Kohl's.

The shuttered outlet locations are squeezing these brands even worse. Cowen and Co.'s analysis has revealed that Macy's and Kohl's only possessed sufficient liquidity to remain in business for five months. Nordstrom and J.C. Penney were slightly better with sufficient cash to hold out for eight months with all of their stores closed. Kohl's has been attempting to minimize its costs by slashing capital expenditures around $500 million, suspending stock buybacks, considering stopping dividend payments, and cutting costs through operations and marketing departments. Kohl's stock price has plunged 69 percent so far this year. The CEO Michelle Gass will not draw a salary while the crisis continues, she announced.

Meanwhile Macy's announced this past week that CEO Jeff Gennette will stop being compensated from April 1st to the conclusion of the crisis. It is also slashing pay for all management director level and higher positions of its executives. Macy's revealed that it will not furlough as many people from the digital portion of its businesses. Call centers' and distribution centers' employees will fare better. All furloughed employees will keep receiving their health benefits, and Macy's will pay the full premium. Macy's affirmed that:

“We expect to bring colleagues back on a staggered basis as business resumes.”

Unfortunately the economic news from this past week is disturbing. This week's abysmal economic releases are only the latest argument for why gold makes sense in an IRA. One way that you can diversify your investment and retirement portfolios is with time-tested, IRA-approved gold. You can read more to learn about the process of a Gold IRA rollover as well as Top Gold IRA companies.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.67

Platinum: $931.67

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68