- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Jackson Hole Meeting Leaves Fed Members Warning More Economic Pain Coming

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Despite the new highs the stock market has made in the past week, an economic reality check from the Federal Reserve at their virtual Jackson Hole annual central banker meeting revealed that the U.S. economy is far from booming. One top Federal Reserve Regional President Loretta Mester warned that the Fed will need to continue major support of the American economy as the post-coronavirus pandemic recovery “is going to be a slow one.” This week's published NABE survey of economists polled showed that they agree with the downbeat assessments from some high ranking officials on the Federal Reserve Board as well.

Fed Warns that More Economic Pain Is On the Way

President Loretta Mester of the Cleveland Fed shared her thoughts from the end of the annual central bankers meeting at the Jackson Hole conference this past week with her interview to CNBC. She warned that the worst may not be over with:

“There's more pain out there that we're going to have to support the economy through. What that looks like, we're going to have to take our time to evaluate that, but I think that accommodative monetary policy is going to be very important throughout this recovery. And I do believe that fiscal policy is going to need to be at the table too in order to support the economy going forward.”

Cleveland Regional President Mester brought up the high frequency data that Fed officials examined in her interview. It revealed that national economic activity has slowed down since the United States began the process of economic reopening. Last Thursday saw the Federal Reserve Chair Jerome Powell speak. He presented his conference keynote address, going through a groundbreaking new approach to inflation policy that will see interest rates stay lower for possibly much longer.

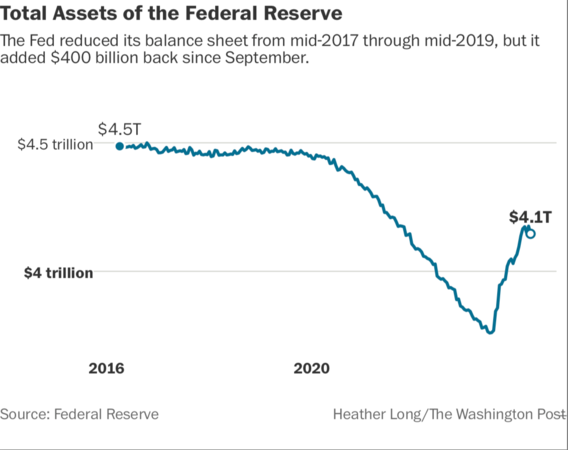

Earlier in the year, the Federal Reserve cut rates to almost zero percent when the outbreak of the Covid-19 pandemic forced policymakers to shut down the American economy. At that time the U.S. central bank created an open-ended program for asset purchases combined with other monetary policy measures, as the chart below shows:

It was all in an effort to help the economy through the difficult period and sharpest contraction seen in modern American history.

Fed Member Mester Blames Coronavirus Pandemic for Ongoing Economic Uncertainty

Mester cautioned that the economic pullback (that has already emerged since the national reopening began in a chaotic manner) is still with us. She warned that:

“That's what you'd expect. It's going to be fits and starts here. It's definitely true that, when the economy started to reopen, you saw better data on hiring and you saw activity increase. But I think the virus is sort of driving things.”

In fact the data released by John Hopkins University underscores her point. Over 5.8 million cases of the coronavirus have gripped the United States so far. This has caused employers to re-evaluate how many staff they need to bring back on for the foreseeable future. Mester expounded on the topic with:

“At least in our district, we have seen a tempering in hiring, and firms are reevaluating the number of new hires they want to bring back on board because they don’t know what the outcome is going to be.”

Fed's Bullard Warns of Need for Long Term Low Interest Rates To Support Economy

This week the Fed's St. Louis Regional President James Bullard also shared his opinion on whether or not the Fed would engage in significant changes to the current fiscal policies. These include the once-again historical lows of the benchmark target interest rate as well as Federal Reserve programs for purchasing government and corporate bonds. Bullard explained that:

“I don't really think this is about monetary policy. This is about the virus, and the economy adapting to the virus, the risk management around the virus, and the contagion that would otherwise occur. I think our monetary policy is just right for this situation. We have a low policy rate, and we're going to stay low for a long time.”

Several Federal Reserve officials including the Chairman Jerome Powell have stated over the last few months that the economy continues to require additional fiscal assistance from both the Congress and U.S. President Donald Trump in order to sustain its nascent recovery. At the end of July such key hardship relief programs as the Paycheck Protection Program and certain initiatives provided by the CARES Act expired. The Labor Department's weekly initial jobless claims data revealed that over one million Americans filed to receive their unemployment benefits for last week with rising unemployment claims renewing concerns.

Could it Be NABE Economists Seeing A Serious Chance of a Double Dip Recession Is Weighing on the Federal Reserve?

In the prior week some important and under-discussed economic data was released that may have weighed on Federal Reserve policy. According to the data released by the National Association for Business Economics, the majority of member economists they surveyed in the United States see a 25 percent chance that the American economy could plunge into a painful double dip recession. A more sobering two-thirds of the NABE economists stated that the U.S. economy has not yet emerged from the recession that began back in February officially. Eighty percent of the economists surveyed believe that there is at least a one-quarter chance we will see a second dip recession after the economy makes an initial recovery.

The NABE survey is composed of 235 national economists who share their findings in the twice a year survey. Fully 75 percent of them argued that the Federal Reserve's present monetary policy has been appropriate. Around 60 percent of them anticipate that the target federal funds rate will stay unchanged in today's from zero to .25 percent range or will even be lowered below this level by the conclusion of 2021.

Forty percent of the economists felt that Congress had provided enough stimulus to the economy, with 37 percent stating that their support was adequate, and another 11 percent declaring that it had been excessive. Meanwhile, over half of the members at 52 percent believe that the best result from the upcoming fiscal package out of Congress should be minimally $1.5 trillion with 20 percent believing that it ought to be in the $1 trillion to $1.5 trillion range. A minority of 17 percent considered that an under $1 trillion package would be ideal.

National Economists Are Right to Be Worried About Soaring Federal Debt Levels

One thing that the NABE economists agreed on overwhelmingly is the skyrocketing level of American federal government debt. A stunning 88 percent were at least somewhat concerned at the statistic that U.S. federal public debt is now on target to exceed 100 percent of national GDP. This would be more than in any national historical era dating back to the Second World War. Of this amount, 22 percent were very concerned about this debt level while 34 percent were concerned.

Unfortunately for everyone, the news from last week on the sidelines of the annual Jackson Hole central bankers' meeting along with the worries of the leading national economists of the NABE was not good. Such continuing economic headwinds and economist worries help to explain why gold makes sense in an IRA. Now is a good time to read about Gold IRA allocation strategies and a Gold IRA rollover. It is always prudent to learn more about the Top Gold IRA companies before considering any potential portfolio diversification.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81