- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Italian Sovereign Credit Rating Suffers Downgrade to One Level Over Junk Status

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 25th December 2020, 06:23 am

This past week, the credit ratings agency Fitch struck again, this time at Italy and its troubled sovereign credit rating. Fitch lowered the credit rating on Italian debt from its prior rating of BBB to BBB-. This represented a single level over the dreaded junk rating. It reflects the agency's growing doubts surrounding the credit worthiness of the great G7 country of Italy. This is just another proof that the dramatic rebound from the U.S. financial markets is both overdone and misplaced given the current ongoing crises in the world that promises to have long lasting and negative consequences for years to come.

Fitch Blames Italy's Latest Financial Troubles on the Coronavirus

It is no great surprise that Fitch points the finger of blame for Italy's latest downgrade squarely at the effects brought on by the terrible coronavirus in the country. According to Fitch, the downgrade takes into account:

“The significant impact of the global COVID-19 pandemic on Italy's economy and the sovereign's fiscal position.”

Italy's economy was already fragile, but now things are increasingly looking dire and desperate for the eighth largest economy on earth. Fitch opined that it doubts Italy's ability to recover from the severe economic and societal harm that the coronavirus has inflicted on the country. If there was any silver lining, it was that they affirmed their credit ratings outlook as “stable” for now.

Italian Economy Predicted to Shrink by Eight Percent for 2020

Fitch's report on Italy's deteriorating financial position made for grim reading. They predicted that the Italian economy will shrink by a sobering eight percent for the full year 2020. Fitch warned that their baseline case risks lie to further downside. The company is assuming that Italy will contain the virus during the critical H2 period of this year and enjoy a comparatively significant economic comeback for 2021. Whether this will be the case or not is anybody's guess at this point. Fitch further warned that:

“In the event of a second wave of infections and the widespread resumption of lockdown measures, economic outturns would be weaker for 2020 and 2021.”

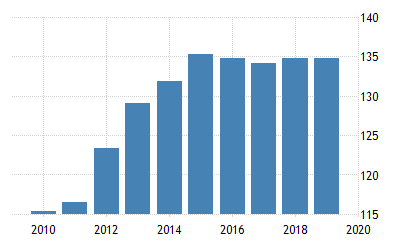

Fitch also warned investors that the closely watched Italian debt to GDP ratio will rise dangerously by another 20 percentage points in 2020 to reach a sobering 156% of its entire annual GDP by the year's end. Italy is already the third most indebted country on the globe (following Japan and Greece). Fitch's baseline scenario for Italian debt dynamics state that this debt to GDP level:

“Will only stabilize at this very high level over the medium term, underlining debt sustainability risks.”

The downgrade and review is more alarming still for Italy as there was not an officially scheduled review for Italian debt until July. Fitch stated that they moved early because of the:

“Situations where there is a material change in the creditworthiness of the issuer… we believe makes it inappropriate for us to wait until the next scheduled review date.”

The news is not good for Italy. The economy already stood in a precarious position before the coronavirus smashed into the nation back in February. It quickly became the epicenter for the entire European outbreak of the virus. For 2019, real GDP growth only amounted to a paltry .3 percent, according to Fitch's own analysis. They warned that the Italian economy had already entered stagnation during the last two years.

If there is any good news from the devastating cut to Italian sovereign credit rating, it is that Fitch feels the country deserves the stable outlook because of their base case that the European Central Bank's ongoing net asset buys will enable Italy to marshall a significant fiscal response to the pandemic to reduce risks of refinancing through maintaining lower borrowing costs for the short term at least. Yet they hedged even this somewhat positive assessment, with:

“Nevertheless, downward pressure on the rating could resume if the government does not implement a credible economic growth and fiscal strategy that enhances confidence that general government debt/GDP will be placed on a downward path over time.”

This chart below shows how dramatically Italy's debt to GDP ratio has risen over the last decade:

Italian Lockdown Continues With Devastating Consequences for Economy

Unfortunately, Italy's precarious financial situation has only been made far worse by the largest death toll in Europe from the coronavirus. John Hopkins University showed Italy had more than 28,000 deaths as of today. In economic desperation, Italy has begun to lift the total lockdown of the nation by allowing smaller stores to reopen (such as bookshops and stationers). The primary travel restrictions and quarantine measures remain in effect through May 3rd.

This past Sunday, the Prime Minister Giuseppe Conte announced the so-called Phase Two steps for unwinding the lockdown. He claimed that as of May 4th, factories, companies, and parks will be permitted to open back up so long as Italians maintain effective social distancing in these locales. Restaurants and bars will be permitted to offer take out services then too. Come May 18th, museums will be permitted to reopen their doors. Schools will not be back in session until September for the fall semester.

Millions of Italian Jobs May Never Return

The ensuing massive upheaval in the Italian economy is very serious. This is the third biggest economy among the European Union 27 member states. Sadly, the crisis is the result of a manmade solution to the coronavirus pandemic that is now showing just how serious the situation is for millions of people who are in severe financial crisis because they were forced to cease working by the government lockdown in an effort to save lives. The cure that governments have elected is so much worse than the disease would have possibly been. Britain's Financial Times forecasts a fourth recession in only a decade for Italy as a result of the decision to shut down the entire Italian economy.

Italy has a demographic ticking time bomb that is also exacerbating the terrible situation. The country of 60 million has the second oldest population of any nation in the world (only Japan's is older) based on the percentage of its population that exceeds 65 years of age. Its national birthrate is also negative, compounding the problem. Now millions of Italians can not earn a wage with all non-essential economic production halted.

To give you an idea of how serious the national disaster is today, over 178,000 Italian firms were forced to let go over three million employees because of the prolonged national shutdown. That is three million individuals who had to queue for the casa integrazione (state unemployment assistance), but unfortunately it is only limited in effective duration.

The real question is how many of these Italian businesses will ever reopen following the viral emergency response. The country once had among the biggest of tourism industries in Europe and the world. Many Italians depend on this national activity to live as it comprises roughly six percent of the national gross domestic product. It means that literally hundreds of thousands of Italians and emigrants living in Naples, Venice, Florence, and Rome primarily (along with certain seaside resorts) depend on this tourism to live. Another 1.7 million workers were in the hospitality and accommodation industries which have ground to a screeching halt. The fact that tourism has come to a standstill for at least the remainder of this year (with the peak summer tourism season completely wiped out) means disaster for countless business enterprises.

Three Million Italian Business Owners Are On the Ropes Now

All told, a full three million self employed Italians are experiencing terrible financial trouble now. The government has offered them a 600 euros ($650) per month benefit for three months as part of their 25 billion euro rescue deal to try to keep them from starving. The biggest problem is that business owners are having a terrible time getting access to this money. The Istituto Nazionale Previdenza Sociale national welfare system website crashed because of the huge demand it experienced on the initial day of applications for the monthly support. Literally 100 requests per second on average came through to total 400,000 applications for the one day.

The stark and scary plight of Italy is all too familiar to most of the developed world economies nowadays. Italy at least has a major resource on its books that it can fall back on — its massive gold holdings at the central bank. Others are not so fortunate (Britain sold nearly all of its once-considerable gold reserves under the term of Prime Minister Gordon Brown for about 1/6 of the current gold prices).

This all helps to explain why gold makes sense in an IRA. Now is an ideal time to consider the possibility of acquiring some IRA-approved gold. It is wise to read all about a Gold IRA rollover and the top Gold IRA companies before you make any decisions.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81