Inflation Rate Definition: 4 Main Types of Inflation Explained

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 5th March 2025, 04:24 am

Currencies function as mediums of exchange, and their value is influenced by supply and demand dynamics, monetary policy, and economic conditions. When demand for a currency increases, its purchasing power strengthens, making imported goods cheaper. Conversely, if the supply of money expands faster than economic output, inflation occurs as more money chases the same amount of goods and services. Central banks, such as the U.S. Federal Reserve, manage this balance through interest rate adjustments and monetary policy interventions.

This is the concept of inflation in a nutshell. On a macro level, understanding inflation helps us make more informed decisions as investors, better predict the behavior of financial markets, and foresee the long-term outlook of an economy.

Inflation is measured in numerous ways. Below, I’ll explain the inflation rate definition, inflation rate formula, and unpack the various types of inflation that affect economies.

Table of Contents

Is Inflation A Bad Thing?

When we talk about inflation, we’re usually talking about currency inflation, which refers to changes in the purchasing power of one’s currency over time. When properly restrained, inflation isn’t bad. In fact, it provides a necessary incentive for keeping an economy afloat.

Governments pursue monetary policies with the intention of reining in, but not eliminating, currency inflation. Generally, a small degree of inflation is desirable because it encourages consumer spending.

Over time, inflation causes currencies to devalue and the cost of goods rises. The upside is that wages, at least in theory, are supposed to rise in step with inflation, which makes the higher prices affordable to consumers.

Without inflation, the wealthy could horde their money and have no interest in spending it or recirculating it in the local economy. There is an instrumental value in having one’s currency devalue with time—it provides a psychological incentive to invest in goods and services and keep the economy functioning as necessary.

Inflation Rate Formula: How To Calculate Inflation

You can use the inflation rate formula to easily calculate the rate of inflation over a given period of time. The simple method of calculating inflation involves taking a start and end date and subtracting the difference between the Consumer Price Index (CPI) for a specific basket of goods. Then, divide the results by the price at the start date. Take the decimal sum and multiply it by 100 to receive your end inflation rate in percentage form.

The inflation rate formula is: X-Y/Y*100 if X refers to the starting CPI for a basket of goods and B is the ending CPI for the same basket. To frame the concept in simpler terms, you can think of inflation as a the change in CPI between two years.

Let’s take the example of January 1, 2019 and January 1, 2020, which we’ll pretend had respective CPI scores of 100 and 105 for the same basket of goods. (Note that the real CPI for those years is 251.712 and 257.971 respectively) When plugged into our formula, we get the following: 105-100/100*100=5%. Therefore, we conclude that the inflation rate was 5% percent between 2019 and 2020.

Types of Currency Inflation Explained

Below, I’ve listed a few of the main types of currency inflation and its relation to monetary policy and overall macroeconomic health.

Mild Inflation

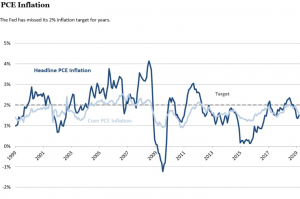

Mild inflation refers to inflation that is under 3% in a given year. This is a healthy degree of inflation that governments try to maintain in the long run because it boosts aggregate demand as consumers expect prices to rise modestly in the future. This explains why The U.S. Federal Reserve aims for an average 2% inflation rate over time to ensure price stability and moderate long-term interest rates. However, recent economic conditions have caused fluctuations, with inflation peaking at 9.1% in June 2022 before moderating to 3.0% as of January 2025 due to interest rate hikes and economic adjustments (Source: Trading Economics).

Source: Brookings Institute

Strong Inflation

Moderate inflation (3-5% annually) can signal a growing economy, but sustained inflation above 5% can lead to economic instability. Inflation between 5-10% is often labeled as ‘high inflation' and may result in declining consumer confidence, rising wages failing to keep pace with price increases, and potential recessionary pressures. The U.S. saw a significant inflation surge between 2021 and 2022, leading the Federal Reserve to raise interest rates aggressively to curb price increases. Inflation of this scale is indicative of very rapid economic expansion that is not conducive to long term stability and real output growth.

When an economy inflates at this pace, consumers may panic and purchase and horde goods at an alarming rate because they expect prices to surge in the future. Periods of destructive inflation are marked by economic slowdown because suppliers cannot keep up with surging consumer demand. Similarly, wages cannot keep pace with demand growth, which makes popular goods unaffordable to a greater share of the population.

Runaway Inflation/Hyperinflation

Runaway inflation refers to destructive inflation rates of 10% or more, whereas hyperinflation is characteristic of economies with inflation rates of over 50% in a given month. The latter is an extremely rare form of inflation that was seen during the 1920s in interwar Germany, and in Zimbabwe in the late 1990s.

Hyperinflation renders a country’s currency virtually worthless and causes widespread distrust in the currency. Often, barter systems emerge among populations that experience hyperinflation because the currency is no longer trusted to hold value as a medium of exchange.

Stagflation

Stagflation refers to stagnant economic growth despite inflated prices of consumer goods and services. Stagflation is a negative economic event that last occurred in the United States in the 1970s as the U.S. monetary system fully embraced fiat currency and shed its final ties to the gold standard. It is marked by high unemployment, high price inflation, and slow GDP growth.

Inflation: The Bottom Line

In this article, we covered the four main classifications of currency inflation, provided an inflation rate definition, and learned how to calculate annual inflation using the CPI.

As an investor, it’s your responsibility to hedge against inflation and safeguard your wealth from a weakening U.S. dollar. One of the best wealth preservation tools at your disposal is gold bullion. Adding gold and other precious metals to your self-directed gold IRA can protect your hard-earned wealth during times of economic downturn and shield your investments from systemic risk caused by runaway inflation and growing distrust in financial markets.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $4,954.17

Gold: $4,954.17

Silver: $78.34

Silver: $78.34

Platinum: $2,097.90

Platinum: $2,097.90

Palladium: $1,701.68

Palladium: $1,701.68

Bitcoin: $67,776.94

Bitcoin: $67,776.94

Ethereum: $2,010.96

Ethereum: $2,010.96