Fed Chair Anticipates Most Severe Downturn in Our Lifetime as GDP Suffers Record Plunge

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 31st July 2020, 10:55 am

This week saw U.S. Fed Chairman Jerome Powell at a briefing warning Congress about the country's most severe economic downturn “in our lifetime.” The Federal Reserve held interest rates at zero percent as the raft of economic data this past week and the prior week continued to show significant deterioration in the U.S. economy. Most alarming to some observers was the record decline in U.S. GDP output for the second quarter.

Fed Chairman Sounds An Unprecedented Alarm on the Economy While Holding Rates at Zero Percent

Even as the Fed Chair warned about the seriousness of the economic downturn facing the U.S., the Federal Reserve kept the national benchmark interest rates at almost zero percent. He pledged to deploy all of the central bank's tools in order to help promote recovery, with:

“The path forward for the economy is extraordinarily uncertain, and will depend in large part on our success in keeping the virus in check. Indeed, we have seen some signs in recent weeks that the increase in virus cases, and the renewed measures to control it, are starting to weigh on economic activity.”

The Federal Open Market Committee released a statement with the policy decision. It stated that this pandemic:

“Poses considerable risks to the economic outlook over the medium term” requiring the federal funds rate to stay close to zero “until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.”

Powell explained to the reporters that encouraging a recovery would require assistance from both fiscal and monetary policy. This was his not too subtle reference to the Washington negotiations that are ongoing between Congressional lawmakers and the president's administration. Economists have expressed concerns about the dramatic cliff edge of the ending unemployment supplement and other financial assistance to taxpayers.

The Fed's vote to keep the targeted federal funds rate in the 0 percent to .25 percent range was unanimous. The central bank committed to boosting its inventory of both U.S. Treasuries and mortgage-backed securities (MBS) in the upcoming months “at least at the current pace.”

Powell and the Fed have maintained their almost zero interest rates since the pandemic began back in March. Separately on Wednesday, the Fed revealed that it had extended the critical dollar liquidity swap lines as well as the temporary repurchase agreements for international monetary authorities up to March 31, 2021.

U.S. Economic Data Releases Showing Signs of Renewed Deterioration

Economic data releases over the past two weeks have continued to reveal a sharp deterioration in economic activity. A resurgence in coronavirus cases has played havoc with business' efforts to reopen around the United States. Weekly jobless claims had slowed down for a while, but now they are rising once again. The consumer confidence level declined more dramatically in July than the economic forecasters had expected. Meanwhile the expectations among Americans for six months‘ future conditions has dropped by its greatest amount since March.

Besides these releases, the high-frequency economic indicators have pointed to a reversal in the prior brief rebound. Consumers are withholding from typical spending habits like flying and eating out. These indicators had begun to make a comeback after the first pandemic wave tapered off, but they are once again on their way down.

U.S. Q2 GDP Crashes By 32.9 Percent in Worst Ever Decline

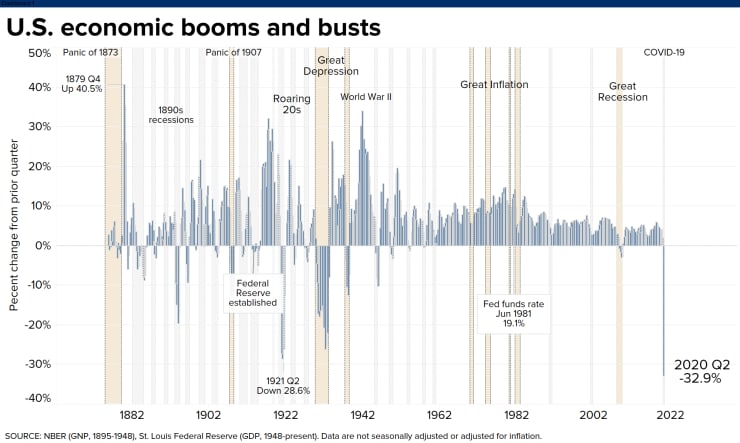

The biggest headline of troubling economic data to emerge this week centered on the release of the United States' second quarter GDP figure. Economic output for the nation plunged by an unprecedented 32.9 percent in its most stunning decline ever. This worst drop of all time beat the previous record from the middle of 1921 and the Great Depression crashes. It was also worse than the three dozen economic downturns in the last two centuries as the chart below reveals:

The GDP collapse measured from April through June prompted Chief Economist Mark Zandi of Moody's Analytics to state:

This report “just highlights how deep and dark the hole is that the economy cratered into in Q2. It's a very deep and dark hole and we're coming out of it, but it's going to take a long time to get out.”

Practically All Key Measures of U.S. Economic Activity Slide Precipitously

The recession had actually begun before the coronavirus hit the U.S. according to the National Bureau of Economic Research (NBER). This latest economic pullback started in February and caused the growth in the first quarter to decline by five percent. There were painful pullbacks in many categories, including personal consumption, spending by local and state governments, inventories, exports, and investment.

The critical category of personal consumption that traditionally makes up roughly two-thirds of the United States' total economic activity reduced Q2's GDP by 25 percent. Services made up practically this entire component drop. Yet spending also fell in goods including footwear and clothing as well as in health care. Declines in inventory investment were led by auto dealers. New family housing and equipment spending were among investment categories that suffered.

Personal income soared because of the government's economic recovery transfer payments that helped see personal income climb to $1.39 trillion with disposable income increasing 42.1 percent up to $1.53 trillion as a result. Even with the significant increase in personal income because of the temporary stimulus measures, personal outlays declined by $1.57 trillion (largely thanks to the drop in spending on services).

Record Economic Decline Is A Self Inflicted Wound

During the global financial crisis in 2008, the most negative quarter saw a decline of 8.4 percent of GDP for the fourth quarter. The prior modern low point had been a ten percent drop during the first quarter in 1958. The previous historical worst GDP collapse was the 28.6 percent seen during the second quarter of 1921.

What made this current record smashing economic plunge different from any that came before was it was the government-led economic shutdown to try to fight a global pandemic. As Chief Investment Officer Peter Boockvar of Bleakley Advisory Group explained:

“Bottom line, the numbers of course are alarming but all self inflicted with about half the quarter reflecting almost full shutdown and the other half the slow reopening. That said, it does reflect the hole out of which we now need to climb out of as we rebound in Q3 and Q4.”

Unemployment Claims Remain Over One Million for 19th Consecutive Week

In a final bit of sobering news from this week, the U.S. government announced the unemployment claims from the past week. The total filing for unemployment benefits amounted to 1.434 million claims, per the department of labor report. This figure was not appreciably worse than expectations, yet it did represent the 19th consecutive week where the initial jobless claims exceeded one million claims as well as the second consecutive week where the initial claims increased following 15 weeks of declines.

Unfortunately this week's economic news releases regarding the GDP figures, unemployment claims, and troubling testimony from the Federal Reserve Chair Jerome Powell are not great. It is hard to dispute the argument that gold makes sense in an IRA these days. You can learn more about how to diversify your investment and retirement portfolios using IRA-approved gold by reading all about the Top Gold IRA companies and the Top Five Gold Coins for Investors.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,743.15

Gold: $2,743.15

Silver: $33.71

Silver: $33.71

Platinum: $1,029.92

Platinum: $1,029.92

Palladium: $1,129.14

Palladium: $1,129.14

Bitcoin: $67,051.76

Bitcoin: $67,051.76

Ethereum: $2,465.95

Ethereum: $2,465.95