- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Imminent Return of Stagflation Argues For Gold Exposure in Your Portfolio

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 2nd August 2017, 10:05 am

Long time brilliant Chairman of the Federal Reserve Alan Greenspan has recently weighed in on the near-future of the United States' economy. Despite the wildly rising stock markets, his prognosis is anything but good. He sees both slow to little growth and climbing inflation in the future American economic cards.

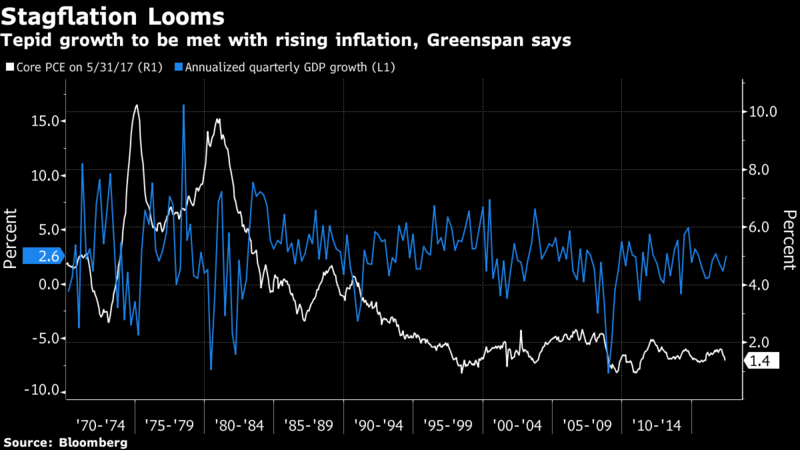

Greenspan warned that this present epoch of slow-moving expansion that has not seen any meaningful rise in inflation is imminent to conclude with more rapid price gains rather than a pickup in the pace of tepid growth. In layman's terms, he is warning of the return of the dreaded 1970's era stagflation in the near future. This bodes very poorly for the U.S. economy as a whole.

While you can still get some gold in your retirement portfolio via a gold IRA rollover, now is the time. Gold makes sense in an IRA. Such IRA-approved metals have protected people from inflation and stagflation for thousands of years now.

The Return of Stagflation Will Spell the Ruin of Bond Prices

Greenspan opined in a phone interview to Bloomberg:

“We've been in a period of stagnation since 2008 as a consequence of the sharp decline of capital investment and productivity growth. But stagflation is about to emerge. We are moving into a different phase of the economy — to a stagflation not seen since the 1970's — that is not good for asset prices.”

In fact this chart below says it all:

As inflation levels rise off of the ridiculously and historically unheard of low levels, bonds (which move inversely to interest rates) are doomed. In fact, Greenspan warns that those equity bears trolling the stock markets could make far more money by looking to short bond prices. The true bubble is in bond prices not those of stocks. When it explodes, it will hurt every individual investor and almost all traditional asset classes. Greenspan reminded:

“By any measure, real long-term interest rates are much too low and therefore unsustainable. When they move higher they are likely to move reasonably fast. We are experiencing a bubble, not in stock prices but in bond prices. This is not discounted in the marketplace.”

Pay no attention to the tricky Wall Street consensus forecasts for stubbornly lower interest rates to hang on for the foreseeable future. Greenspan is not the lone voice crying in the wilderness about interest rates being imminent to break higher and quickly at the same time as the dramatic end of the unprecedented epoch of loose global central banking monetary policies arrives.

Binky Chada of Deutsche Bank warns you that Treasury yields are at a far lower level than one corresponding with the present day levels of growth. Similarly, the Chief U.S. Economist Tom Porcelli of RBC Capital Markets declares that it will not be much longer before the rising inflationary pressures dramatically impact the bond markets. Greenspan continued his dramatic warning with:

“The real problem is that when the bond market bubble collapses, long-term interest rates will rise.”

This will mean higher costs on everything, from the United States Federal interest on the national debt, to corporate bonds and loans, to consumer-impacting mortgages, student loans, auto loans, credit cards, and personal lines of credit. It will constrict the economy massively, leading to an all-around enormous downturn.

Collapsing Bond Prices Will Harpoon Stocks As Well

Don't think for a minute that this doomsday scenario for bonds will simply bypass stocks and leave the equity markets relatively unscathed. Rapidly escalating interest rates will destroy one of the last valuation cases that encourage these runaway high P/E's in stocks.

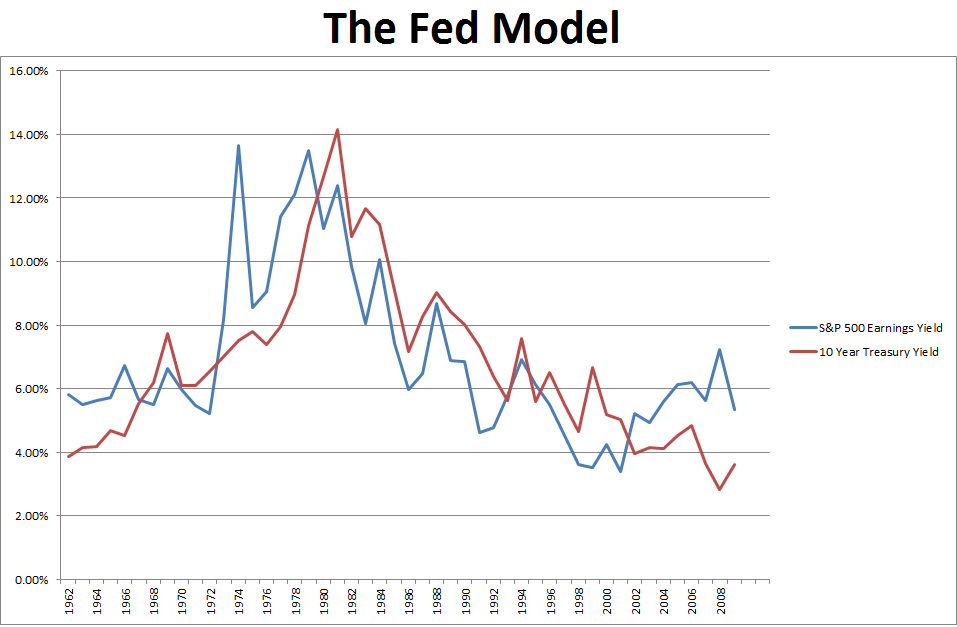

This Fed Model argues that so long as the bond market is outperforming the stock market, investors are being sensible in going with the less inflated value asset. This means that stocks will similarly suffer with the rout in bonds when it all starts to fall apart.

At the moment, the Fed Model makes the case for stocks with American equities being at one of their most attractive levels in history compared to bonds. Employing the 10 year inflation adjusted bond yields which sit now at .47 percent, this gap to the S&P 500's yield is presently at about 4.7 percent.

This is still about 21 percent greater than the 20 year-long average. Analysts and investors loudly argue that this justifies record-high prices in the major stock market benchmarks as well as P/E ratios which sit close to the post-financial crisis highs.

When rates begin to increase rapidly, Greenspan argues that investors should abandon stocks quickly. Rising inflation levels are a primary reason that Chief Economist David Kostin of Goldman Sachs Group Inc. refuses to go along with the other Wall Street bullish analysts in increasing his S&P 500 estimates for the end of 2017.

If inflation were to remain tame, this would suggest a fair market value of approximately 2,650 on the S&P 500 index. Yet Kostin argues that the more likely base scenarios is for the gap in between earnings and bond yields to narrow. He believes the index will decline to 2,400 by the end of the year. This represents a not insignificant decline of around three percent lower from levels these days.

In the past few years the bond market has endured a few shocks that ended up being temporary, with slower American economic growth working hand in glove with lower inflation to ensure that both nominal and real longer- term yields remained at historically low levels.

This one-two combination is rapidly disappearing with the Federal Reserve starting its long-dreaded unwind of the $4.5 trillion in its balance sheet at the same time as the other global central bankers are eyeing plans to scale back their own financial stimulus programs. Chadha of Deutsche Bank continues to echo Alan Greenspan's prescient warnings, with:

“The biggest mis-pricing in our view across asset classes is government bonds. We should start to see inflation move up in the second half of the year.”

Gold's Track Record in the Era of Stagflation Is Unparalleled

For those of you who are too young to recall the terrifying decade of stagflation that the 1970's were, this was a veritable economic nightmare that created countless sleepless nights for American policymakers, economists, and investors. This worst of all words involves both concurrent economic recession and inflation simultaneously.

It is represented by economies that contract at the same time as their cost of living goods and prices keep increasing. As the writer-analyst Stephen Roach of Morgan Stanley famously opined:

“Many of today's investors were still in diapers during the great stagflation of the 1970's. Those who weren't will never forget the darkest period in modern financial market history.”

Yet aside from the beneficial boost to gold prices for gold investors, the word stagflation remains a four letter one on Wall Street. This is because it proves to be extremely hard to eradicate once it gains a solid foothold. The difficulty in effectively battling it comes down to the economic paradox implied by stagflation. Tightening monetary policies only amplify stagnation in areas like oil prices. It also leads to pricing distortions which leave policymakers with no appetizing choices.

While one section of the economy may be growing, such as services, another like manufacturing is shrinking. This causes wages to rise in the service sector while they are similarly falling in the manufacturing one. It causes massive difficulties in attempting to fine tune the economy as a whole. Sometimes it even disguises the real economic issues to the point that economists have a hard time determining whether the economy is actually growing or shrinking.

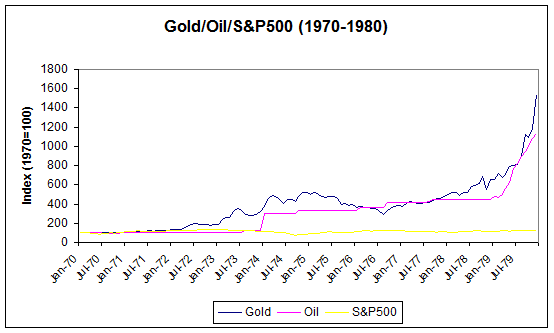

As a case in point, consider what happened in the only comparable era to what Greenspan and others are calling for, the epoch that started in 1973-1974 in the 70's decade. From 1973 to 1974, the most terrible bear market hit stocks since the end of the Great Depression in the 1930's-1940's. While the Dow Jones collapsed an eye-watering 45 percent, the London-based gold prices catapulted from $66 per ounce to $186.50 per ounce.

The gold-oil-S&P 500 chart above shows what represented a shocking increase of over 282 percent to gold prices in under two years. Gold was where you wanted to be as stagflation ravaged all other traditional asset classes throughout much of the 1970's decade.

IRA-Approved Gold will be your best and only historically proven line of defense in the upcoming return of stagflation to the United States' economy. Now is the time to review the top 5 gold coins for investors while you still can.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.67

Platinum: $931.67

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68