How to Make Money with Bitcoin: 5 Steps to Succeed

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Bitcoin was the first-ever cryptocurrency, introduced back in 2009 by Satoshi Nakamoto. Although no one actually knows who Satoshi is, or if it may be a group of people rather than an individual. Bitcoin filled a need people had to eliminate middlemen when it came to payments and money.

Cryptocurrencies do exactly that, which also gives users of digital currencies the independence you cannot find with fiat money. Since Bitcoin first appeared on the scene its price has multiplied from around $10 to tens of thousands of dollars.

A big factor that may have also helped Bitcoin’s spectacular price revaluation is the limited supply. The algorithm that Bitcoin runs on is limited to the creation of 21 million coins, and so far around 19 million have been created.

Table of Contents

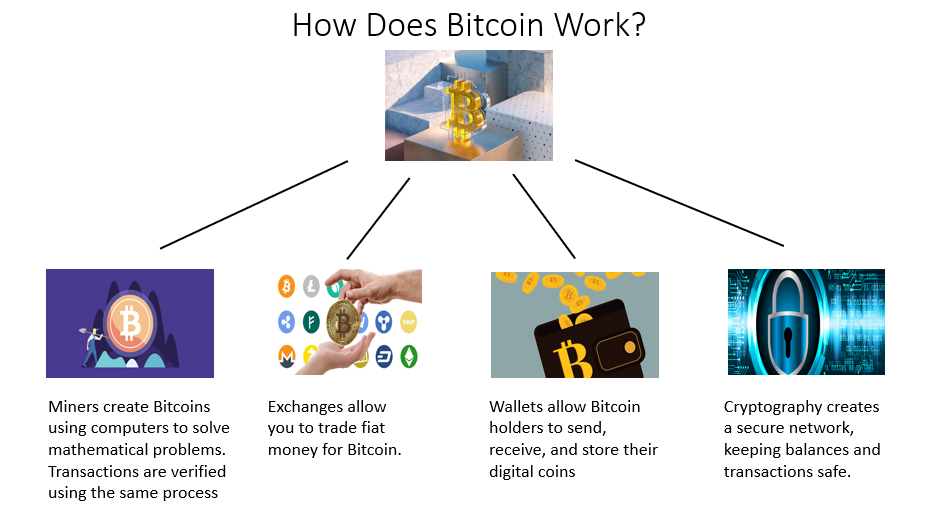

Understanding How Bitcoin Works

To understand how you can make money with Bitcoin, let’s first quickly go over how Bitcoin works. Digital currency is an algorithm that is produced by solving complex calculations. The algorithm is then kept on what is known as a ledger.

This ledger uses blockchain technology making it practically incorruptible. All transactions of the coin are also registered on the ledger using blockchain. This technology means it is almost impossible to destroy the digital currency or falsify transactions.

Digital coins are kept in a folder known as a wallet. This folder can be online or offline. Most long-term investors keep their cryptocurrency wallets offline. With offline storage, criminals can't hack your account and steal your digital coins.

Mining

This option is a hardware and energy-intensive activity. The algorithm that you need to solve is extremely complicated. The complexity involved means you need to have extremely powerful computers and of course a lot of electricity. If you don’t already own one, buying one will cost you a few thousand.

Mining Bitcoin is getting harder, this is due to the fact that there are fewer coins left to mine. The fewer the coins the harder the mathematical problem that needs to be solved to mine a coin. Your hardware will need to be running 24/7 to allow for you to get to a solution and mine a coin.

Miners are compensated for each coin they mine with a fraction of Bitcoin. This means your compensation can vary depending on the value of bitcoin, which we know can fluctuate substantially. However, if you live in an area with high energy costs there is also a cloud mining option.

Cloud mining can be achieved in two ways, mining pool, and online mining company.

The mining pool links the computers of several individuals so they can combine the computing power of all the computers involved. This makes mining faster and cheaper. The rewards are then split between the miners in the group.

Online Mining

Cloud mining companies allow you to invest your money on their platform. They then use the money to buy hardware and pay for electricity. Your investment goes towards buying computer power, typically under a 1-year contract. You then get a split of the rewards after the maintenance fee, usually paid daily.

Most of these companies allow you to start investing from as little as $250. You can lock in your investment’s returns for 1 year to earn extra interest. This means you cannot access either your funds or your returns for the period, but it gives you a higher return.

This type of mining creates a passive income as you won’t be doing any of the hard work. You won’t be setting up your top-notch computer, paying electricity bills, and running the machine. Always check that the company is legitimate, do some research to check it’s not a scam.

List of Cloud Miners

- Genesis Mining

- Trust Mining

- IQ Mining

- Hashshiny

- Crypto Universe

- Hashing24

- Bemine

- Mining Rig rentals

- Scrypt Cube

Lending Bitcoin

This is an option open to current holders of Bitcoin or for those who are thinking of holding the largest digital currency. The concept is very simple: you can lend the Bitcoins you own in return for an interest rate. The interest earned on crypto loans is typically much higher than any other fiat-based product.

Some of the cryptocurrency exchanges allow you to lend your Bitcoins through their platforms. However, you may want to shop around, several specialized online platforms allow you to lend your Bitcoin at very competitive rates.

You may not already hold Bitcoin, or you may not want to send your digital coins to another platform. Most of these online crypto lenders allow you to deposit fiat money and exchange them for digital currency. Usually, only the cryptocurrencies with the largest market capitalizations are supported.

You can find platforms that pay up to 17% annual percentage yield (APY) for some cryptocurrencies. The APY changes depending on the digital currency you want to lend. Of course, holding Bitcoin is a volatile experience. But while you hold them in your portfolio you can achieve some passive income at least.

A list of online crypto lending platforms includes:

Buy and Hold

Crypto investors have named this strategy HODL, which is a long-term strategy that lending Bitcoin is complementary to. Many investors who get involved in Bitcoin look at short-term trends and get involved in trading rather than investing.

Past performance is never a guarantee of future performance. But we know that Bitcoin has a lot going for it. Acceptance of this digital currency is getting more and more mainstream, and supply is finite. Bitcoin funds are appearing around the world, in the US for now, you can even invest in a Bitcoin futures mutual fund.

The SEC has approved the first Bitcoin futures ETFs, this fact seems to bode well for the near future when spot Bitcoin funds will also be approved. When funds are allowed to buy spot Bitcoin and stores and companies worldwide continue to accept Bitcoin as payments, demand can only grow.

The buy-and-hold strategy is therefore one to apply for the long term. We have seen how Bitcoin's price has multiplied many times over the years, and those spectacular increases may have gone. However, given all the factors driving this digital currency the HODL approach to Bitcoin could bring its benefits.

Crypto Platform Affiliate

This is an activity for those that are well versed or willing to get the knowledge and expertise needed to answer any question a prospective investor might throw at you. Affiliate programs are run by most cryptocurrency platforms with very differing rewards.

The greatest thing about this activity is that it doesn't have to be full-time. You can do this in your spare time without a doubt. You can start by reaching out to all your friends and family and then spread to their connections.

Social media is also a powerful tool but learn to use it wisely. A lot of social media users have become affiliates of various crypto programs and the space is crowded right now. You would probably need to try a less direct approach and try to get people to follow you rather than contacting them yourself.

Staking & Yield Farming

Staking and yield farming generate interest payments that allow your crypto holdings to grow. The payments are made in digital coins so the value of those payments as well as your holdings can change drastically with the volatility experienced by cryptocurrencies.

Staking involves holding your Bitcoins on an account where they are committed to blockchain validators. Every transaction gets validated by a blockchain validator and the process generates fees. And a part of those fees goes to the stakeholders.

This form of passive investing with Bitcoin is popular and is offered by most online Bitcoin exchanges such as CoinBase or Crypto.com. Interest earned by stakeholders tends to be lower than the interest you might earn in lending.

Depending on the digital currency, you may get returns as low as 0.15% per year, while some digital currencies may earn you around 6% per year. Some stakeholding services require that you lock your assets for a specific period. This means you cannot withdraw your funds until the lock-in period is over.

Yield Farming

This gets a bit more complicated but it's similar to stakeholding. You combine two digital currencies and commit them to a liquidity pool. In return, you receive rewards in the form of digital currencies or tokens. Yield farming gives an incentive to liquidity providers to lock up their crypto assets in a liquidity pool.

Incentives can be based on a percentage of transaction fees, interest from borrowers, or governance tokens. The APY in yield farming varies greatly among the different protocols available. Linking the Raydium token with USDC might create a combined token yielding as much as 54% APY. That does sound amazing, but some protocols can yield even higher APYs.

Returns are generated 24/7 and usually paid in the form of tokens. You can harvest these digital assets and invest them in the liquidity pool to increase your yield. The process works in the same way as compound interest. You can also harvest the tokens and convert them into cash.

Most of the yield farming protocols are operated by decentralized exchanges. The list below includes some of the most popular:

When it comes to Bitcoin, there are no protocols that pair off the digital currency with another altcoin. However, you can wrap Bitcoin (WBTC) and you will find various protocols and decentralized exchanges where you can invest these coins in.

Bottom Line

Bitcoin is an extremely volatile asset, and you should always speak to your financial advisor before making any investment decisions in the crypto finance world. Having said that, Bitcoin is the largest cryptocurrency, has the starter advantage, finite supply, incorruptible protocol, and predominant acceptance even among traditional finance firms.

We have outlined how to make money with Bitcoin from an investor's point of view. This requires getting all the information you need before committing any funds. You should always double-check any online platforms and exchanges. Note that scam sites are posing as legitimate sites.

You can take advantage of the tax-deferred status by investing in Bitcoin through an IRA. Setting up a Self-Directed IRA allows you to invest in many alternative assets and Bitcoin is on the list. Several IRA companies offer specialized services when it comes to Bitcoin IRAs, and you can read our reviews here.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,316.03

Gold: $3,316.03

Silver: $36.41

Silver: $36.41

Platinum: $1,367.82

Platinum: $1,367.82

Palladium: $1,142.11

Palladium: $1,142.11

Bitcoin: $111,339.83

Bitcoin: $111,339.83

Ethereum: $2,773.71

Ethereum: $2,773.71