How to Invest in Mobile Home Parks (While Saving on Taxes)

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 26th October 2023, 03:31 pm

Key Insights

- The median house price has grown to $410,200, driven by limited supply, high demand, and institutional speculation.

- The U.S. housing market is growing at 3.4% per year, spurring investor interest in more agile housing solutions.

- There's a trend toward seeking alternative housing solutions, with mobile homes being a top choice for many Americans.

- Rental markets, especially in urban areas, are tight, leading to an increase in mobile home park investments and manufactured home communities by big players.

- Self-directed individual retirement accounts (SDIRAs) can be utilized to purchase mobile home rental properties with unique tax advantages.

The mobile home market is quietly booming. Between 2013 and 2020, the total transaction volume for mobile homes in the U.S. skyrocketed from $1.2 billion to $4.2 billion. Today, these figures are estimated to have grown higher amid hot housing prices and high interest rates that have locked many would-be homebuyers out of mortgages for regular detached properties.

Mobile home parks, often overlooked in the real estate sector, now offer an intriguing investment opportunity. Their steady cash flow, combined with growing demand and diminishing supply, makes them an interesting consideration for many. But how do you integrate these investments into a tax-advantaged structure? Let's take a closer look.

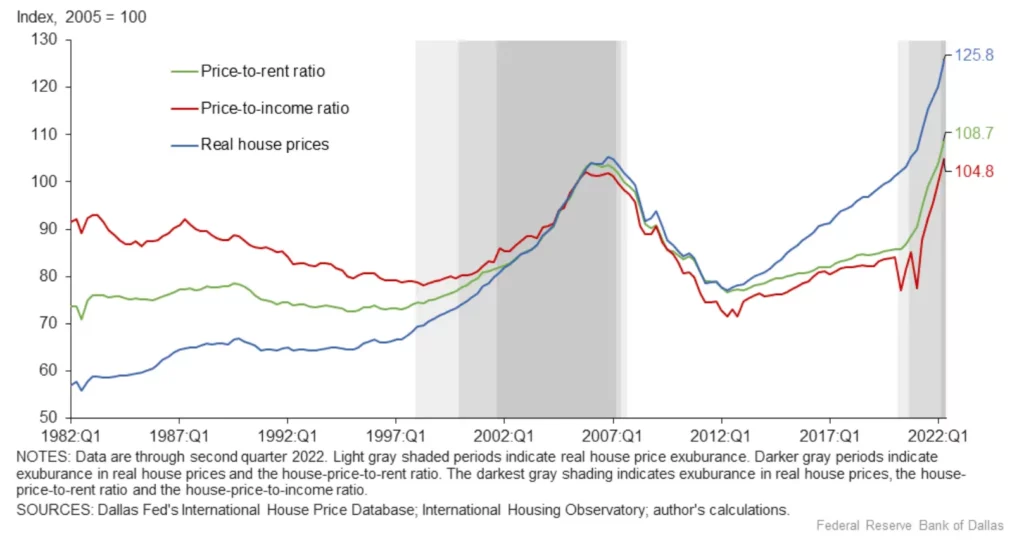

Figure 1: Chart depicting a global view of the U.S. housing market until Q1 2022 (Source: Federal Reserve Bank of Dallas)

Table of Contents

- The Investment Appeal of Mobile Home Parks

- Pros of Investing in Mobile Homes:

- Cons of Investing in Mobile Homes:

- 2023 U.S. Alternative Housing Market Insights

- What To Look Out For When Investing in Mobile Homes

- Steps to Invest in Mobile Home Parks

- The Self-Directed IRA Advantage

- Precautions & Considerations for Mobile Home Investing

- Are Mobile Homes a Good Investment?

The Investment Appeal of Mobile Home Parks

1. Steady Cash Flow: Unlike other real estate ventures, mobile home parks tend to provide consistent revenue streams. This is largely because the cost of moving mobile homes is prohibitive for residents, resulting in longer tenures and reduced vacancy rates.

2. Supply and Demand: New mobile home park development is limited due to stringent zoning laws, which restrict supply. Meanwhile, affordable housing demand is surging. These dynamics often lead to increased lot rents over time.

Pros of Investing in Mobile Homes:

1. Affordability: One of the most compelling reasons to invest in mobile homes is the cost factor. As of June 2023, the median house price in the U.S. has skyrocketed to more than $410,000, making traditional homes out of reach for many. In contrast, mobile homes remain a more budget-friendly option.

2. High Demand: With the rise in housing costs and the search for affordable alternatives, there's an increasing demand for mobile homes. This provides an opportunity for investors to yield substantial rental incomes, especially in areas where housing is scarce.

3. Flexible Relocation: Mobile homes, by their very nature, offer flexibility in terms of relocation. If an area becomes less desirable, there's potential (with some limitations) to move the home to a more lucrative spot.

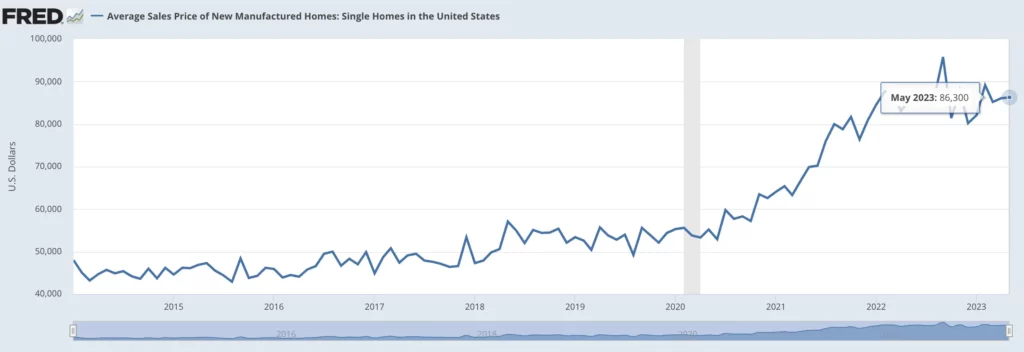

4. Lower Maintenance: Generally, mobile homes require less maintenance than traditional homes. This can translate to lower costs over the long term. Still, mobile homes can present costly maintenance-related issues and it is generally recommended to set aside one percent of the home’s value to cover annual maintenance costs. Therefore, a $125,000 mobile home would warrant a yearly savings of $1,250 to finance repairs.

Figure 2: Average manufactured home prices for single units alone (Source: St. Louis Fed)

Cons of Investing in Mobile Homes:

1. Depreciation: Unlike traditional real estate, which often appreciates over time, mobile homes typically depreciate. This means the home can lose value the longer you own it, which isn't ideal for long-term wealth accumulation.

2. Land Lease Challenges: Many mobile homeowners don't own the land their home sits on. Instead, they lease it. This can result in an additional monthly cost, and there's always the risk of land lease rates increasing or the land being sold.

3. Financing Difficulties: Lenders often view mobile homes as riskier investments than traditional homes. This can make securing financing more challenging, potentially leading to higher interest rates.

4. Perception and Stigma: Despite their benefits, mobile homes sometimes face a societal stigma. This perception can impact resale values and rental rates.

2023 U.S. Alternative Housing Market Insights

Expert forecasts see the U.S. housing market growing at a rate of 3.4% between August 2023 and 2024, down from 3.7% during the previous year. Therefore, expected growth models predict that the housing market will decelerate in the year ahead, but continue to grow nonetheless.

Manufactured home communities relate to trends seen in the broader real estate market, especially given their respective growth rates. The U.S. Census Bureau estimates that the total shipment of mobile home supply will increase by 31% in 2022.

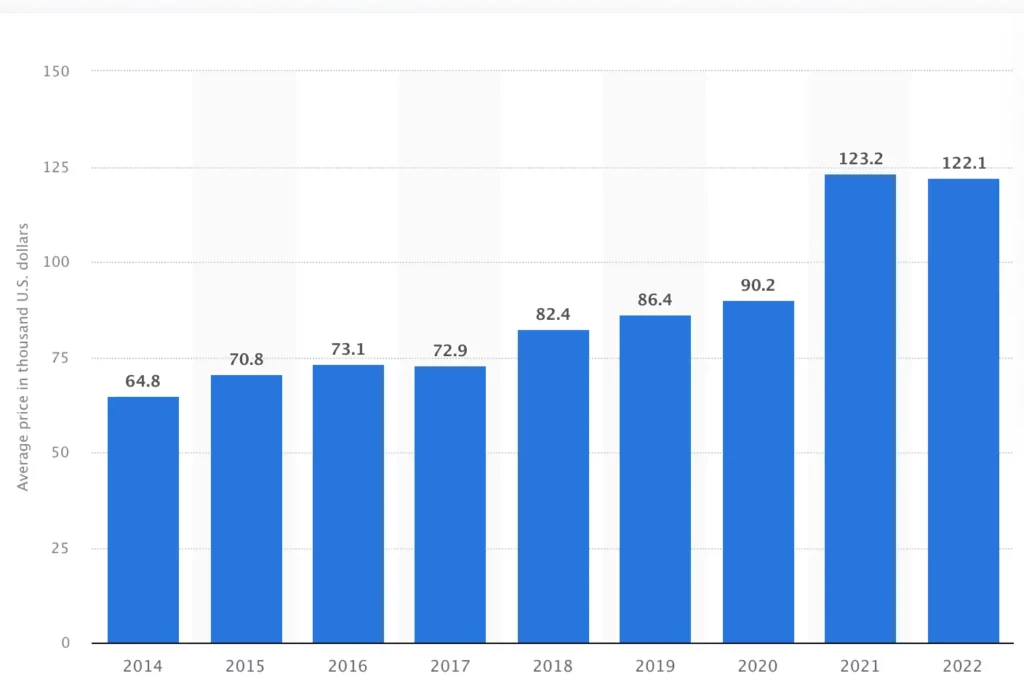

The latest pricing data for mobile homes—again, from the U.S. Census Bureau—indicates that the median manufactured house price in America is $125,200. Given what we know about the average cost of a house in the U.S., this represents a cost savings of about 69.5%. Denoted differently, suggests that a mobile home only costs 30.5% of what a regular detached home normally costs.

Mortgage delinquencies are rising in the U.S., and more affordable mobile housing solutions provide a lower barrier to entry for Americans who cannot afford or do not qualify for credit with which to buy a regular detached home.

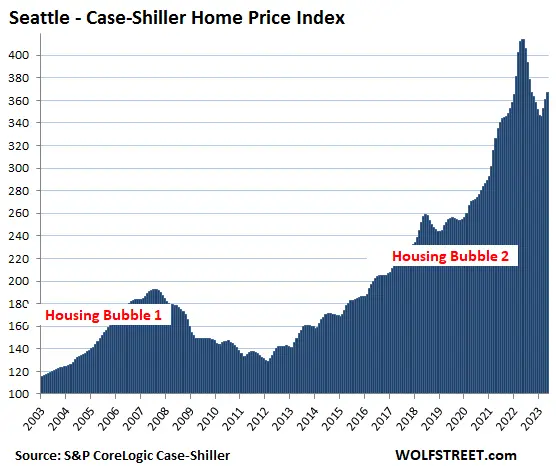

Figure 3: Home Price Index indicating bubble formations, 2003-23 (Source: Wolfstreet)

What To Look Out For When Investing in Mobile Homes

1. Land Ownership: Determine if you're buying just the mobile home or if it includes the land. Buying the land provides more control, whereas leasing can introduce variables like increasing rent or potential eviction.

2. Depreciation: Unlike traditional homes, mobile homes tend to depreciate over time. Ensure you understand this dynamic and how it might affect your investment.

3. Location: The location of the mobile home or the mobile home park can significantly impact your investment's value. Research the area, local amenities, crime rates, and future development plans.

4. Park Management: If you're investing in a mobile home within a park, the management's quality can make or break your experience. Check reviews, speak to residents, and get a feel for how the park is run.

5. Zoning and Local Regulations: Some areas have strict regulations concerning mobile homes. It's essential to understand any restrictions, requirements, or fees associated with mobile home ownership in your chosen location.

6. Financing Challenges: Traditional mortgage lenders might view mobile homes as a riskier investment, leading to higher interest rates or tougher qualification requirements. Explore your financing options carefully.

7. Condition of the Home: Since mobile homes can depreciate and show wear more quickly than traditional homes, it's crucial to get a thorough inspection. Look for roof leaks, structural problems, and outdated electrical systems, among other structural issues.

8. Home Age: Older mobile homes might not meet current safety standards, leading to potential upgrade costs. They may also be less energy-efficient, resulting in higher utility bills.

9. Insurance Costs: Mobile homes can sometimes come with higher insurance premiums due to perceived risks. Research potential insurance costs and ensure you're getting adequate coverage.

10. Utility Hookups: Ensure the mobile home has proper utility connections. If you're relocating a mobile home, the cost of moving and setting up utilities can be substantial.

11. Tenant Base (if renting out): Research the tenant base if you plan to rent out the mobile home. Higher turnover rates can impact your return on investment.

12. Resale Value: Investigate the potential resale value and how easy it might be to sell the mobile home in the future. Consider factors like the home's age, condition, and local market conditions.

13. Lease Agreements: If you're considering a mobile home in a leased land community, scrutinize the lease agreement. Look for clauses about rent increases, maintenance responsibilities, and the process for selling your home in the future.

14. Hidden Costs: There might be hidden costs associated with mobile home investments, such as setup fees, transportation (if relocating), utility connections, or park entry fees.

15. Community Amenities and Fees: If in a mobile home park, what amenities are offered, and are there any associated fees? Amenities can be a selling point for potential renters.

Steps to Invest in Mobile Home Parks

Below, we’ve listed the basic steps involved in investing in a mobile home park for novice and experienced investors alike.

- 1. Research & Education: Start with due diligence. Understand the industry, local laws, and the intricacies of park management.

- 2. Location Selection: Focus on areas with steady job markets, reasonable property appreciation, and where demand outpaces supply.

- 3. Financial Analysis: Assess the park's current and potential revenue, expenses, and capitalization rate.

- 4. Due Diligence: Inspect the infrastructure, rental agreements, and pending legal issues.

- 5. Financing: Secure favorable financing terms. Remember, mobile home park financing differs from traditional real estate loans.

Optionally, you may want to invest in a mobile home through a self-directed IRA. Although IRAs, as tax-advantaged retirement accounts, are not typically utilized as a vehicle for real estate investing, there are known methods for investing in real estate through an IRA.

For those interested in investing in mobile homes within an IRA, your first step is to contact a self-directed IRA service provider such as Broad Financial or Equity Trust. For a more detailed procedure, see the section below.

Figure 4: Average mobile home price in the U.S. up to 2022 (Source: Statista)

The Self-Directed IRA Advantage

A self-directed IRA (SDIRA) allows for a broader range of investments, including alternative assets like gold and other precious metals as well as real estate and mobile home parks. Here's how you can utilize an SDIRA to invest in mobile home parks:

- Open an SDIRA: Work with a custodian who allows real estate investments. This will enable you to transfer funds from an existing retirement account or fund a new one. Here is a consolidated list of the best SDIRA custodians that allow real estate investment properties.

- Due Diligence with Custodian: Ensure your desired investment complies with IRS regulations. It's essential to be aware of prohibited transactions that might jeopardize the tax-advantaged status.

- Direct the Investment: Use the SDIRA to fund the mobile home park purchase. All income and expenses related to the property must flow through the SDIRA.

- Tax Benefits: The income generated, whether it's from lot rents or park-owned home rentals, can grow tax-deferred or even tax-free in the case of a Roth SDIRA.

Note, however, that SDIRAs cannot hold properties that the account owner lives in. Therefore, any mobile home purchased within an SDIRA cannot be used as your primary or secondary residence. Rather, they need to be purchased through a limited liability corporation (LLC) and utilized as a rental property.

Precautions & Considerations for Mobile Home Investing

Unrelated Business Income Tax (UBIT): Even within an SDIRA, some income can be subject to UBIT. Engage with a tax professional to navigate these intricacies.

Prohibited Transactions: Ensure you don't engage in transactions that the IRS prohibits for self-directed IRAs, such as personally managing the property or providing services to the park.

Liquidity Concerns: While mobile home parks can be profitable, they're not as liquid as other investments. Ensure you're comfortable with this before investing a substantial portion of your retirement funds.

Through adequate preparation and consultation with tax professionals, home inspectors, and real estate agents, you can mitigate the risks associated with mobile home investing.

Are Mobile Homes a Good Investment?

Investing in mobile home parks offers an intriguing avenue for diversification and growth. When combined with the tax benefits of a self-directed IRA, the appeal becomes even stronger. As always, thorough research and consulting with professionals in both the real estate and tax sectors are crucial to navigating this investment landscape successfully.

With American housing prices rapidly on the rise, mobile home parks and other affordable alternatives present appealing solutions for investors. Therefore, they can be considered a good investment if proper precautions and vetting procedures are followed.

To get started investing in mobile homes, open an account with a top-rated SDIRA custodian today. Although SDIRAs cannot be used to purchase primary residences, these unique accounts can be used to buy physical properties—including mobile homes—that can be utilized for income-generating passive real estate investing purposes.

(The opinions expressed in this article do not constitute financial advice. Speak to a licensed financial advisor before making any investment decision.)

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,329.45

Gold: $3,329.45

Silver: $36.82

Silver: $36.82

Platinum: $1,388.07

Platinum: $1,388.07

Palladium: $1,153.30

Palladium: $1,153.30

Bitcoin: $109,622.77

Bitcoin: $109,622.77

Ethereum: $2,590.46

Ethereum: $2,590.46