- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

How Much More Can Consumers Borrow Before the Bubble Pops?

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 25th December 2020, 06:33 am

This past week the news revealed that Americans continued to prop up the U.S. economy in the fall by spending more money that they do not have. The most current data release from the Federal Reserve showed that consumer borrowing roared higher and set a new all-time record high in the month of October. The news is the latest sign that the unsustainable consumer debt bubble continues to expand dangerously.

Consumer Debt Reaches Staggering Record $4.165 Trillion

For the month of October, the Fed data showed that consumer debt increased by $18.9 billion. This figure amounted to a yearly growth rate of 5.5 percent. The overall consumer debt total is now up to an all-time high of $4.165 trillion. This Federal Reserve figure for debt includes categories of student loans, car loans, and credit card debt, but it does not take into account mortgage debts.

The category of revolving debt has shown mixed performance in the last few months. It actually fell in the month of August and was steady in September. Yet it grew at an alarming pace of 8.8 percent (or $7.9 billion) during October. The American consumers now have $1.09 trillion in total credit card debt.

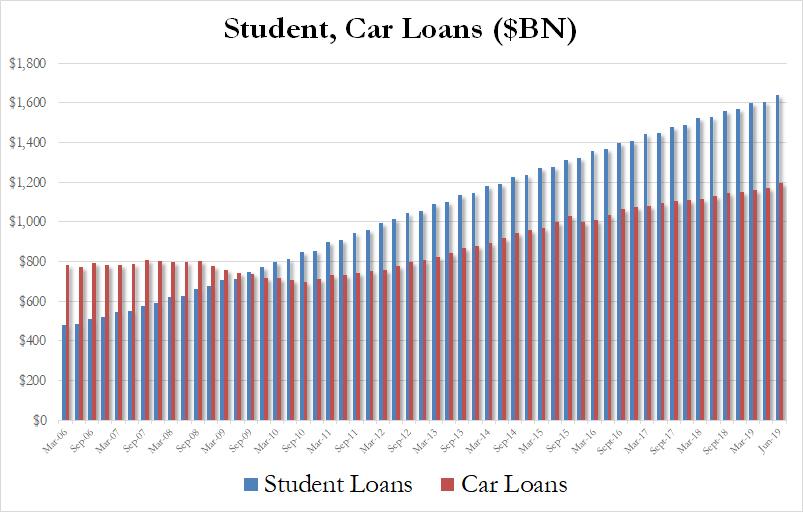

The category of non-revolving credit is mostly comprised of car loans and student loan debt. This increased by a strong 4.3 percent to reach $3.08 trillion. Economists have expressed mounting concern over the rising student loan burden in recent months as the federal government is ultimately backing this debt category. Subprime car loan defaults have also reached levels not seen since the peak of the Global Financial Crisis and Great Recession back in 2009. This chart below shows the dangerous trend in student and car loans:

Mainstream Media Still Spinning Skyrocketing Debt as Positive

The mainstream media has only begun to wake up to this danger. Many of the talking heads still consider higher levels of consumer debt to be good news. Their argument is that the economy relies on the consumer to purchase goods and services. MarketWatch reported on the October debt figures that:

“Consumers remain the key to the economic outlook given the sluggish business spending.”

Their argument centers on the idea that increased consumer confidence equates to greater amounts of borrowing needed to boost the economic outlook for the nation. Not all economists have held on to this idea though. Euro Pacific Capital Economist Peter Schiff states that increasing levels of debt could signal that the economy is in fact not doing well:

“If an economy really is strong, you would think consumers would be taking on less credit card debt because they wouldn't need it. They would be able to buy more stuff that they could actually afford. They wouldn't have to go into debt. Because credit card debt is the worst possible debt because the interest rate is so high on credit card debt. If you can afford to pay off your credit card, you're going to pay it off. They don't have the money. They can't afford to pay the credit card bills when they come. And so all they do is pay the absolute minimum that you're allowed to pay, and that means the balance never goes down. And so the fact that you're seeing this surge in credit card debt, I don't think that indicates the economy is good.”

Consumers Can Not Continue To Borrow Indefinitely

The question remains: how much can American consumers borrow before the bubble explodes? Their spending is borrowing from the future to spend today in any event. It does not matter if the debt-driven spending is fueled by confidence or increasing desperation; it can not continue indefinitely. The credit card limits ensure that day will soon arrive. All of this money consumers borrow has to be paid back at some point (or defaulted on otherwise).

Federal Reserve Hints More QE Coming in Last Meeting of the Year

Even the Federal Reserve is concerned about threats these debt bubbles pose for the economy. Though the Federal Reserve did not cut rates further at their meeting this past Wednesday, they allowed the possibility for more in the future. Federal Reserve Chairman Powell admitted that they are dependent on the data. The Fed chair also hinted that the central bank would continue to cut rates further as the economy shows additional signs of weakening or if more pressure builds in the repo markets.

The Fed is engaged in more than simply cutting interest rates though. They are also doing quantitative easing again. They may avoid the name, but they are buying assets and expanding their balance sheet, creating more money and injecting it into the economy.

In the press release that followed the FOMC meeting, Powell stated that the Fed would contemplate expanding the easing program from just purchasing Treasuries now to buying coupon securities that are shorter term. He also stated that the American central bank will keep injecting emergency liquidity into the unstable overnight repo markets as it has been doing. An analyst informed Barron's that:

“Without cutting rates, or signaling any upcoming easing, Powell and Co. managed to ‘out dove' expectations. Lower for longer remains the operative framework, even in the face of increasing underlying inflation.”

The quantitative easing 4 program appears to be here to stay for some time.

Federal Reserve Has Gone From Raising Rates Aggressively to Cutting Them In Only A Year

It has taken the Federal Reserve less than a year to go from raising interest rates to aggressively cutting them and resorting to quantitative easing. In the FOMC meeting of December 2018, the Fed increased its benchmark lending interest rates and announced that they were forecasting raising the rates another three times in 2019. They were allowing the balance sheet to be reduced each month automatically back then.

Fast forward to today, and the Fed has cut interest rates enough that they could conceivably reach zero percent by next December in 2020 if they keep it up. Any hopes of them ever getting their bloated balance sheet (from the last financial crisis a decade ago) back to normal are also gone for years to come.

Goldman Sachs Recommending Wealthy Hold Physical Gold

Goldman Sachs is also nervous enough about the bubbles in the economy to be recommending to their wealthy clients to buy physical gold. They published a note last weekend suggesting that clients diversify away from their longer term bond positions using gold. Specifically Goldman referred to a “fear-driven demand” for the safe haven metal.

This note from Goldman referenced recession fears as well as political uncertainty as the catalyst for the rich moving into gold. They specifically brought up the central bank's new loose monetary policy as well, along with interest in the theory behind money printing (Modern Monetary Theory), and concerns about a tax on wealth.

Goldman Sachs referred to the fact that the smart money large speculators and hedge funds increased their bullish positions on the yellow metal by an impressive 8.9 percent through week ending December 3rd, per government data that came out Friday, December 7th. It was the largest gain going back to the end of September. The advisory firm also reported that vault demand for gold is surging around the world.

Consider Diversifying Your Portfolio To Protect Against the Dangers of A Bubble Implosion

The news this past week on rising consumer indebtedness and continued Fed loosening for the future is not good for your portfolio. It helps to explain why gold makes sense in an IRA. One way that you can diversify your portfolio away from investments that suffer from bubbles popping is by buying gold in monthly installments. Using Gold IRA rollovers makes this an easy way to acquire the yellow metal. It is always a good idea to learn more about Top Gold IRA companies before committing to one.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.67

Platinum: $931.67

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68