- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Great Opportunity To Invest In UK Shares At Bargain Prices Compared To US Dollar Peers

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

- 32 Year low In Sterling US dollar exchange rate

- Improving Economic Data Post Brexit Vote

- Bank of England Willingness To Take Action

With US stock prices at record highs and little room for further price growth in the immediate future given the hawkish outlook from the Federal Reserve, it could be time to look at stocks across the pond. The UK stock market suffered an increase in volatility straight after the referendum vote showed that the Leave campaigners had won. However, the stock market recovered very quickly thanks to action by the Bank of England guaranteeing economic stimulus, which helped push the Pound lower. The FTSE 100 stock index as recently as last October 4 managed to reach a new all-time high of 7128.75.

Currency Depreciation Creating Attractive Stock Price

The British pound hit levels last week not seen for the past 31 years. Fear of a Hard Brexit, or unfavorable trade terms for the UK when it does leave the EU, being the main driver of the fall in price. But this factor is only partly correct. The market is well aware, as the BoE has repeatedly stated, that it will do everything in its power to stabilize the market and stimulate the economy. This would mean another round of quantitative easing and or cutting interest rates. So far the central bank has limited its action to returning to a program of bond buying.

Given the strength of the stock market, it would seem more the actions of the Bank of England that have sent the British currency into free-fall. Trade terms seem unlikely to be the real direct reason; if not the stock market would not have hit a new record high.

Since the referendum vote, the Pound has dropped approximately 18.53% to its current levels. Of course, that makes imports more expensive, but it also makes exports cheaper. And above all in US dollar terms these stocks have become 18.53% cheaper too. There is still a risk the British currency could see new lows, but that will mostly depend on whether the BoE takes any further dovish action and economic data from the UK.

Effects of an interest rate hike in the US are already well discounted, and it would take very hawkish comments from Fed chair Ms. Yellen after the next rate hike to put any further downward pressure on the Pound.

Economic Data From The UK Surprisingly Bullish

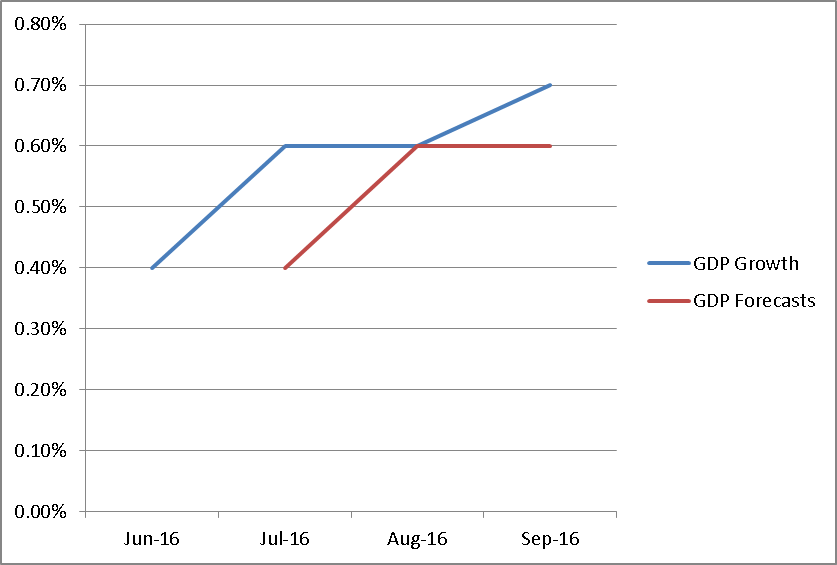

The latest string of economic data from the UK has mostly been better than expected since the referendum vote on June 23. During the previous 3 months of data for GDP Growth Rate, the actual number beat expectations twice and matched it on one occasion.

The GDP Growth Rate has managed to increase during 2016 despite the uncertainty created because of the referendum on EU membership. The average growth rate for 2015 was 0.36% whereas so far this year the average GDP growth rate has been 0.60%. The IMF recently declared the UK the fastest growing major economy. The UK also has an extremely mobile workforce, and laws in the past were much easier on companies looking to hire or fire. There is a great likelihood that the UK outside of the EU would revert to laws making it easier and less expensive to increase or decrease a company’s workforce.

Central Bank Action Helping Bull Market

The BoE Governor has already taken action in the aftermath of the leave victory in the referendum; action came soon after voting as the central bank set up a new bond-buying program. The Bank also committed to repeating and or increasing the bond buying program as would be necessary to stimulate the economy and assure liquidity to the financial system.

The stock market took positively to this commitment and although it lost more than 10% in one day after the referendum, within 3 days it was trading above pre-referendum levels, and by October 4 had reached an all-time high. The market has since receded, but the Bull trend would seem still intact. It also seems little affected as to what the outcome may be for a trade deal with the EU once the UK does leave. Countries like China and India have already stated that they are very interested in signing free trade agreements; it’s possible this kind of factor helps. Nevertheless, despite the negative talk from the skeptics the stock market feels very confident about the UK’s role outside of the EU, trade deal or not.

There are various ETFs that track the FTSE 100, what is important to bear in mind is that the ETF chosen should not hedge the currency exchange risk. Part of the attractiveness to investing in UK stocks is that the Pound could recover the 20% it lost recently in the near future. Hedging would protect the portfolio if Sterling slides further, but not allow gaining in profits from a strengthening Pound.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.67

Platinum: $931.67

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68