- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

“Great Lockdown” Economic Crisis Could Be Worse Than the Great Depression

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 17th June 2020, 01:47 pm

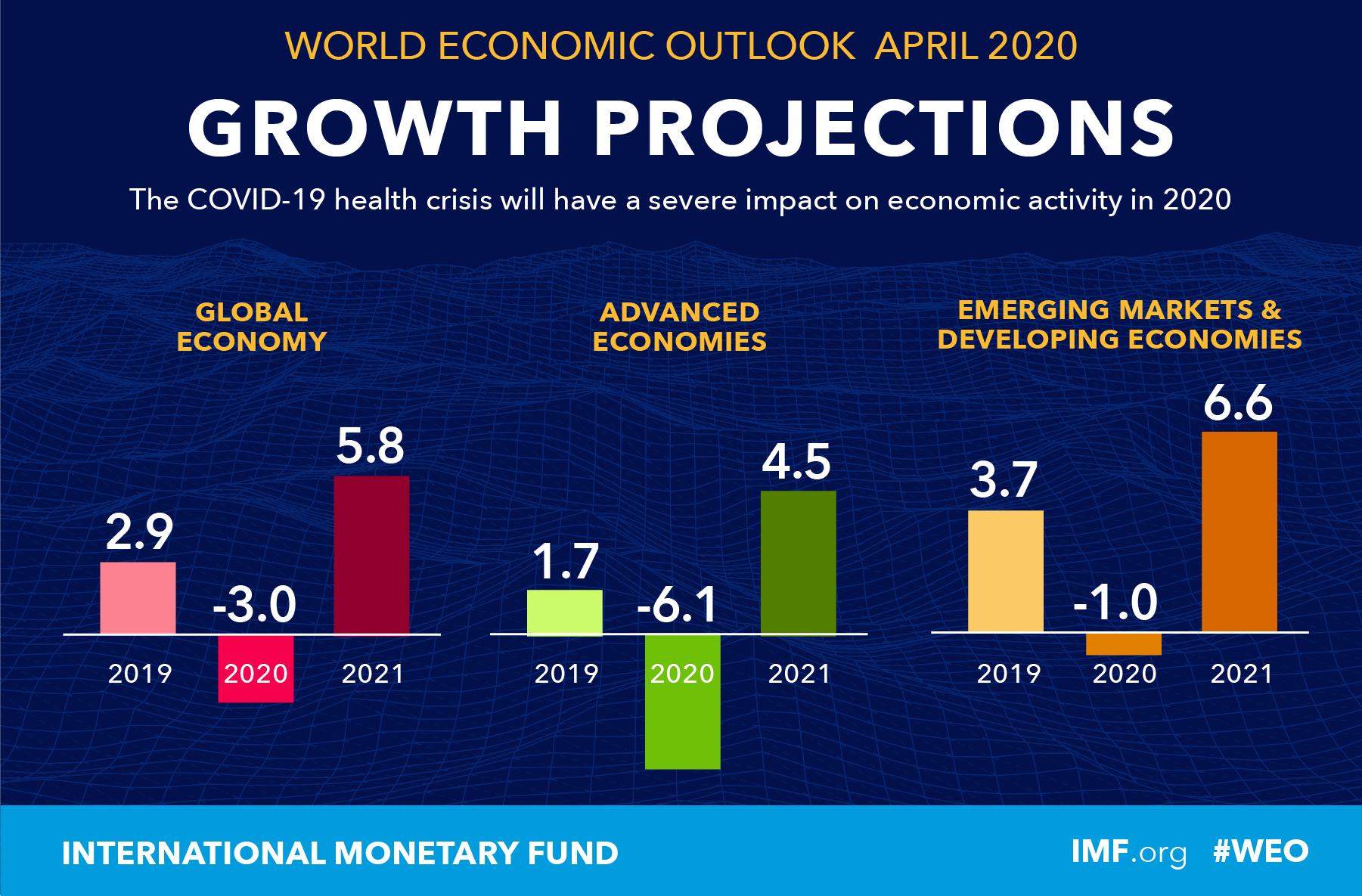

This past week, the IMF cleverly coined a new phrase for the present economic collapse going on around the world in the current “Great Lockdown” economic crisis. Back when the European economic heavyweights were entering their first few weeks of the forced national lockdowns in March, the International Monetary Fund stated that the world economy would undergo the most terrible financial crisis and shock dating back nearly a hundred years to the 1930's Great Depression era. They were forecasting a devastating global GDP contraction of three percent for 2020 at that time.

Even with major economies reopening slowly nowadays, the IMF has updated its forecast to a more grim reality. They have declared that the international economic decline could be substantially worse than their prior forecast, pushing the world into a more painful depression than that of even the Great Depression. The chief economist of the IMF stated on Tuesday that the world economy will now contract by more than their original April estimate of three percent.

Great Lockdown Experiment Wrecks the Entire World Economy

The IMF Chief Economist Gita Gopinath explained how desperate the economic scenario is for the entire world since the coronavirus lockdown with:

“For the first time since the Great Depression, both advanced and emerging market economies will be in recession in 2020. The forthcoming June World Economic Outlook Update is likely to show negative growth rates even worse than previously estimated. The current crisis is unlike anything the world has seen before.”

Keep in mind that this global pandemic began as a health emergency crisis that quickly morphed into a full-blown manmade economic crisis of epic proportions. It was the social distancing that governments imposed along with travel restrictions that pushed the collective world economies over the cliff. The IMF chart from their April 2020 update below says it all:

Even though a number of leading world economies have started ending their lockdowns, it has proven to be more challenging than initially expected. In certain cases, the re-booting procedures have taken far long than expected. On top of this and making matters considerably worse, a number of re-opening countries are wrestling with an increased second round of coronavirus cases.

For example, there are already over eight million infections that afflicted people around the globe in nearly every country and territory and on all six inhabited continents. The leading five nations that have suffered form the highest number of infections are the U.S., Brazil, Russia, India, and Great Britain, per the data out of Johns Hopkins University.

V-Shaped Economic Recovery Looking Increasingly Unlikely Now

Investors and some economists had optimistically touted a hoped-for so-called V-shaped recovery that they expected would ensue after the virus faded and the lockdowns ended. Unfortunately, this has not at all proven to be the case so far. The IMF has observed that the global service sector has suffered a far greater amount of damage than manufacturing did during the crisis. This is a significant change from past crises in which the dearth in investment available crushed the manufacturing sector the most. Because of this, IMF Economist Gopinath stated that:

“It is possible that with pent-up consumer demand there will be a quicker rebound, unlike after previous crises.”

On the other hand, she warned that this view can not be taken for granted. It is highly possible that consumer spending behaviour will change as a result of consumers being lastingly scarred by the crisis. Simply put, they may decide to save a larger amount of their disposable income and spend considerably less for the foreseeable future.

Stock Markets Are Divorced from Economic Reality on the Ground, But This Could Quickly Change

Meanwhile as the world economy went into a veritable freefall, stock markets the world over have attained new highs even as the global economy is still grappling with the effects of the pandemic. The S&P 500 is a case in point. It has recovered the majority of its prior losses since the crisis first erupted. Bond markets which had gone into a tailspin have also calmed down, thanks to massive central banking firepower and coordinated interventions. Gopinath added that:

“With few exceptions, the rise in sovereign spreads and the depreciation of emerging market currencies are smaller than what we saw during the Global Financial Crisis. This is notable considering the larger scale of the shock to emerging markets during the Great Lockdown.”

Because of this, the economist from the IMF has warned that if economic and/or health conditions around the world again deteriorate, you should anticipate what she called “sharp corrections” in global markets.

Legendary Economist El-Erian Warns About Zombie Markets

Mohamed El-Erian is the now-legendary Chief Economic Advisor for Allianz. He has recently warned that you now have to not only be wary of zombie companies, but also zombie markets with asset prices turning detached from underlying fundamentals and becoming severely and hopelessly distorted. El-Erian declared that:

“I think we've got to be careful about zombie markets. We're not there yet, but we're starting to get close.”

These so-called zombie companies keep operating by borrowing cash despite the fact that they can not pay down their debts with any reasonable expectations. Thanks to all-time low interest rates, there have been a rising quantity of these kinds of zombie firms in the last decade. El-Erian expounded with:

“They eat away at the dynamism of an economy, they misallocate resources and they eat away at productivity. So you may be keeping them alive today, but it comes at a cost.”

El-Erian explained that zombie markets could occur as central banks such as the Federal Reserve prop up asset prices and in the process destroy the markets' innate abilities to efficiently allocate capital.

“Zombie markets are markets that are completely mispriced, they're completely distorted. Why? Because there is a policy view that you need to subsidize everything in markets for now.”

In the past, the Fed has undertaken a number of unprecedented steps that included promising to purchase corporate debt and limitless quantities of Treasuries in order to ensure that the financial system remains a smoothly functioning machine while the crisis is ongoing. This past Monday, the central bank insisted that it will now increase its buying in the credit markets into the category of individual corporate bonds.

This has all combined to boost stricken stock prices from far lower levels seen back in March. Since the Fed's interventions began in earnest, the S&P 500 has roared back up almost 40 percent from March 23rd, the date that the Fed announced it would begin to purchase corporate bonds.

According to El-Erian, the actions of the Federal Reserve have led to a so-called win-win mentality in the financial markets. A huge number of traders now believe that the central bank will keep purchasing assets even to include stocks so that it can stave off a full-blown financial crisis. El-Erian warned that:

“The mentality of the market is if they're willing to do high yield, they're willing to do equities, because after all, the last thing the Fed wants is a financial crisis to make the economy worse. The market feels very strongly that it basically is holding the Fed hostage.”

Unfortunately the prognosis from the IMF and economist Mohamad El-Erian quite correctly points out that this present manmade economic crisis is likely to surpass the Great Depression for hardship and universality. This is a real reason why gold makes sense in an IRA. Now is the time to consider seriously acquiring some safe haven IRA-approved gold for your retirement portfolio. You can learn more about getting gold in your corner by reading about the Top Five Gold Coins for Investors and the Top Gold IRA Companies.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,385.11

Gold: $2,385.11

Silver: $27.83

Silver: $27.83

Platinum: $938.54

Platinum: $938.54

Palladium: $884.45

Palladium: $884.45

Bitcoin: $67,337.49

Bitcoin: $67,337.49

Ethereum: $3,245.06

Ethereum: $3,245.06