- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Goldman Warns on Zero Earnings Growth for U.S. Corporations

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 6th March 2020, 11:21 am

These past two weeks have seen historic drops in the stock markets both in the U.S. and around the world. Goldman Sachs slashed its earnings estimates for 2020 on U.S. companies to only $165 per share. Their revised forecast predicted a zero percent growth rate in U.S. corporate earnings for the year with earnings contraction for the first half of this year. Meanwhile the coronavirus continued to spread, causing companies to give earnings warnings and the Fed to engage in an unexpected emergency interest rate cut.

Coronavirus to Keep Earnings Stagnant for the Year

Per Goldman Sachs' warning last week, the coronavirus impact on American companies will cause earnings growth to become stagnant for 2020. The mainline Wall Street investment bank cut its earnings on this year from the prior $174 forecast to only $165 per share. It represented a dramatic shift from other investment banks who were still anticipating earnings to rise by seven percent for the year.

U.S. Chief Equity Strategist David Kostin of Goldman warned clients in his note last Thursday that:

“U.S. companies will generate no earnings growth in 2020. We have updated our earnings model to incorporate the likelihood that the virus becomes widespread. Our reduced profit forecasts reflect the severe decline in Chinese economic activity in 1Q, lower end demand for U.S. exporters, disruption to the supply chain for many U.S. firms, a slowdown in U.S. economic activity, and elevated business uncertainty.”

As a highly respected investment bank Goldman Sachs' warning turned up the fear factor for already jittery investors.

U.S. Equities See Correction Territory In Matter of Days

The last week of February saw American stocks plunge. Fears of the coronavirus slowing global economic growth finally began to sink in to panicking investors. Last week saw the Dow Jones drop over eight percent while the S&P 500 tanked nearly nine percent and the Nasdaq declined around three percent.

By last Thursday, the S&P 500, Dow, and Nasdaq had all closed officially in correction territory and were off over 10 percent from their 52 week highs set only a few weeks ago. Once the U.S. Centers for Disease Control confirmed the very first American coronavirus case with an origin that was unknown in Northern California, fear in the markets super spiked. The Dow crashed almost 1,200 points Thursday, February 27th. This was the highest one day drop in the index's history, even while it was not its largest single day percentage decline. It only took the Nasdaq and S&P 500 indices six days to go from record highs to correction territory by that last Thursday of February.

When the dust settled on Friday, February 28th, the Dow and S&P 500 had dropped another 1.39 percent and .8 percent. The markets finished the last week of February with the Dow down 12.36 percent (over 14 percent off the recent record highs) and the S&P 500 down 11.5 percent (over 12.75 percent from its all time high), per CNBC. It marked their worst week since the Global Financial Crisis.

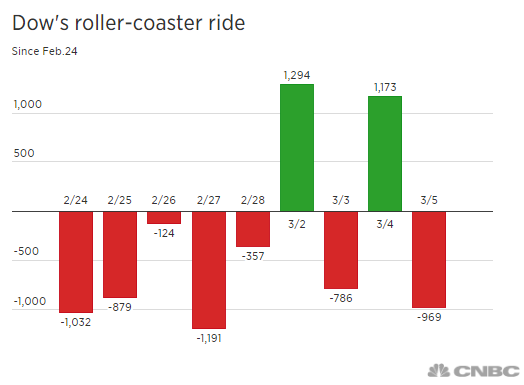

This past first week of March saw continued wild rides for the markets in the U.S. The Dow Jones Industrial Average experienced 1,000 point or greater swings two times in only three days as the chart below shows. Despite the several days rallying back, U.S. stocks remained in correction territory by yesterday's close.

Investors had continued to hope that earnings might rapidly recover once the coronavirus faded. Goldman's recent note to clients has severely damaged that sentiment. The investment bank now anticipates that the S&P 500 firms will see earnings declines for 1H of 2020.

Global Stock Indices Also Hammered Hard

Stocks indices around the world have similarly plunged into correction over the last two weeks as the coronavirus cases beyond China continued to rapidly spread to Italy and around the world. CNBC also reported that the MSCI World Index and MSCI ACWI benchmark global equity indices had fallen the last week of February by over nine percent. This represented their worst performing week going back to the Global Financial Crisis of 2008. The Stoxx 600 in Europe dropped by 3.6 percent to finish Thursday, February 27 in correction before dropping another four percent last Friday.

By the afternoon of Friday, February 28, seven different important Asia-Pacific stock indices had reached correction territory. These included the China Shanghai composite, the Japanese Nikkei 225, the Hong Kong Hang Seng, the Australian S&P ASX 200, the South Korean Kopsi, the Thai SET composite, and the Singapore Straits Times.

Major Companies Are Warning on Earnings Misses

Individual companies have been sounding alarms on upcoming earnings misses. Major firms including Apple, United Airlines, and Nike have issued warnings that they will miss their revenue guidance and earnings because of the impact of the coronavirus on their supply chains. This has hit chipmaker stocks particularly with massive percentages of their revenues stemming from China. Microsoft also cautioned on Wednesday that it will miss its quarter's revenue guidance for the business segment that handles Windows as a result of the virus.

Goldman's Kostin had a starker warning concerning the potential financial harm the coronavirus may do. He warned that:

“A more severe pandemic could lead to a more prolonged disruption and a U.S. recession. In this case S&P 500 earnings would fall by 13 percent in 2020.”

Goldman is more hopeful on 2021, expecting corporate earnings growth to rise six percent for next year to reach $175 per share.

Fed Unexpectedly Slashes Interest Rates by Half a Point

The coronavirus infection statistics only continued to worsen this week. The Federal Reserve took a dramatic action on Tuesday by lowering the U.S. benchmark interest rates by half a point in an unexpected emergency move. They claimed that the coronavirus spread, “poses evolving risks to economic activity.” This was the first such emergency interest rate cut dating back to the Global Financial Crisis.

Yet even this action to combat the slowing economy did not put a brake on the stock market coronavirus related fears and declines. The markets remain nervous that significant exporters (such as China) will not be able to get their manufacturing components to American companies and this will impact growth around the world.

Yesterday the markets continued their drop with the DJIA down as much as 1,000 points at one point in the day. The S&P 500 declined 3.3 percent. Today's Dow Jones futures were down around 241 points at time of publication, implying that the markets would decline by 277 points on the open. Similarly, the futures for S&P 500 and Nasdaq 100 futures were showing significant declines at the other two major American indices. It happened as the most recent figures from the WHO (World Health Organization) revealed that there were more than 95,270 cases of coronavirus around the world and more than 3,280 dead from it.

Bond King Calls Fed's Emergency Interest Rate Cut Panic

Meanwhile, yesterday saw “Bond King” CEO Jeffrey Gunlach of DoubleLine Capital indicate that he believed the Federal Reserve had panicked in slashing interest rates. He forecast that U.S. short term interest rates are going towards zero percent now, with:

“If we look at history, once the Fed does a panic, intermeeting rate cut, particularly when it's 50 basis points… they typically cut pretty quickly again. I'm in the camp that the Fed is going to cut rates again, perhaps even in two weeks” at their scheduled meeting. “We will see short rates headed toward zero. When I say panicked, it doesn't mean it's not justified. Sometimes panic is justified. Business activity is likely to contract. I received multiple emails today of clients that were planning on visits to DoubleLine saying they're canceling them.”

Unfortunately the news this week regarding earnings forecasts and stock market declines is not good. It does help explain why gold makes sense in an IRA. One way that you can diversify your investment and retirement portfolios is by adding some IRA-approved precious metals. If you want to learn about Gold IRA rules and regulations and Top Gold IRA companies you can read more.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81