- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Gold Outshines The Stock Market; Set To Be One of The Best Performers in 2016

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Gold price has had a bumpy ride down to its most recent lows in December last year. Many factors came into play that took away the lure of the shiny metal. Stock markets have had a particularly strong performance in terms of both dividends and growth. The US dollar has kept appreciating against most major currencies, especially Gold producing countries. As the US dollar rises in price Gold producers can afford to sell Gold at a cheaper price in US dollar terms as they will still receive their asking price in the local currency.

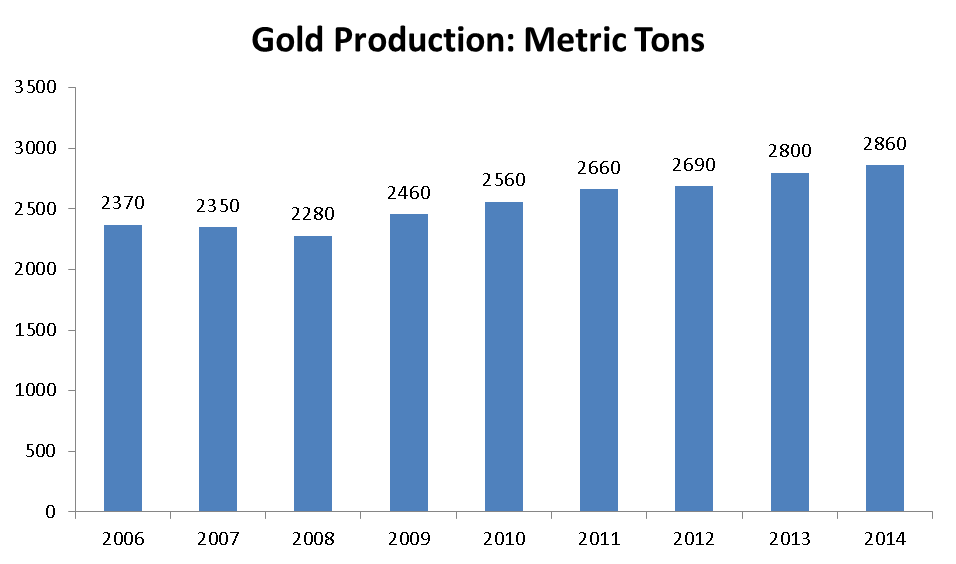

Deflationary pressure has been felt across most commodities, and that includes Gold. Supply has also been on the rise, producers increased supply dramatically over the past 7 years. The chart below shows how annual production has been on the rise steadily since 2009.

What might be changing for 2016

The above narrative is set to see some major changes as we move forward into 2016. Stock markets look like they are set for a major correction. The economy is not as expansive as first thought and a meltdown in China looks to be cooking. There are many voices challenging the official Chinese government data as to how bad the economic contraction really is. Some forecasts see GDP growth as low as 3% compared to the official 6.8%. Add to this weak global outlook the Federal Reserve hiking interest rates and stocks begin to look extremely less attractive.

The Federal Reserve has added a decent dosage of nitroglycerine to the fire by starting its cycle of higher interest rates. However higher interest rates alone do not necessarily mean doom for the stock market. Future income streams are diminished as the net present value of those streams will be lower when interest rates are higher. But if future income streams are considered to outpace the increase in interest rates stock markets may still go up. In theory higher interest rate environments happen when economies are booming. Demand for goods and services are at their highest pushing corporate revenues higher also and more than cancelling the negative effect of higher rates.

The Fed may have got the timing wrong

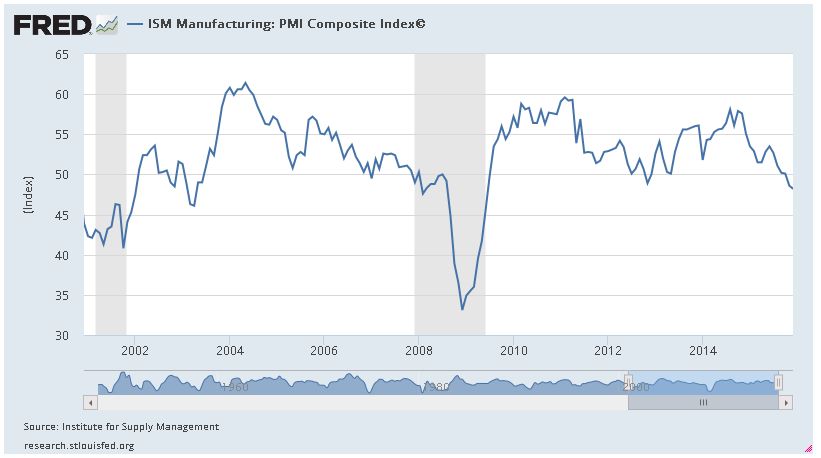

The problem with this latest hike in interest rates is that it may be happening when the economy is not at its strongest. Latest data for the ISM Manufacturing Purchasing Manager (PMI) Index, was released at 48.2 the previous reading was 48.6 ISM PMI levels below 50 indicate a contracting economy, while levels above 50 indicate an expanding economy.

The chart below shows how this indicator has been on a steady decline over the past 16 months, since it peaked out at 58.1 in August 2014. We can also see it’s reaching levels that are getting close to those seen in 2008.

Interest rates have been historically low for over 6 years and corporates and the markets have been able to reap some incredible benefits. But the environment may have been falsified, corporate net present value revenues look much better with interest rates at 0.25% instead of 5.90%. That was the average Fed Fund rate for the period from 1971 to 2016.

Gold sees better performance than general markets

Looking at performance from the start of the year the S&P 500 index has sunk by 6.50%, which is also its worst start to the year on record. Globally things have not been any better with major stock markets having their worst start since the Great Depression. Fueled by a slowdown in China and uncertainty over the reliability of official data, it seems likely that there is more room for increases of volatility in the stock market.

Gold on the other hand has had a great start to the year, and has already gained over 5%. Higher interest rates had been cause of concern but the market still considers Gold as a safe haven. Therefore despite the rate hike, the initial rout in the stock market still sent Gold higher. Silver has also performed well since the start of the year, with a 5% increase. Other precious metals like Platinum and palladium haven’t fared so well, both are down by 1% and 11% respectively.

There are various analysts that see a reduction in Gold supply over the next year, and that seems likely as lower prices have been biting into the profitability of extraction operations. But the largest factor going into 2016 will be the flight of capital from risky assets as most major stock markets make large corrections in price.

Worthy of note that if you had bought the S&P 500 in September 2007 at the previous market high before the 2008 crisis, you would now be up by just over 20%, that’s a decent reward for baring the pain during the crisis.

However if during the same time you had bought Gold at that month’s high you would now be up by almost 40% That includes the large drop in price Gold has seen over the last 4 years.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.67

Platinum: $931.67

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68