- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Gold may be near bottom for three reasons

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 25th December 2020, 06:42 am

Research shows extreme level of overbought

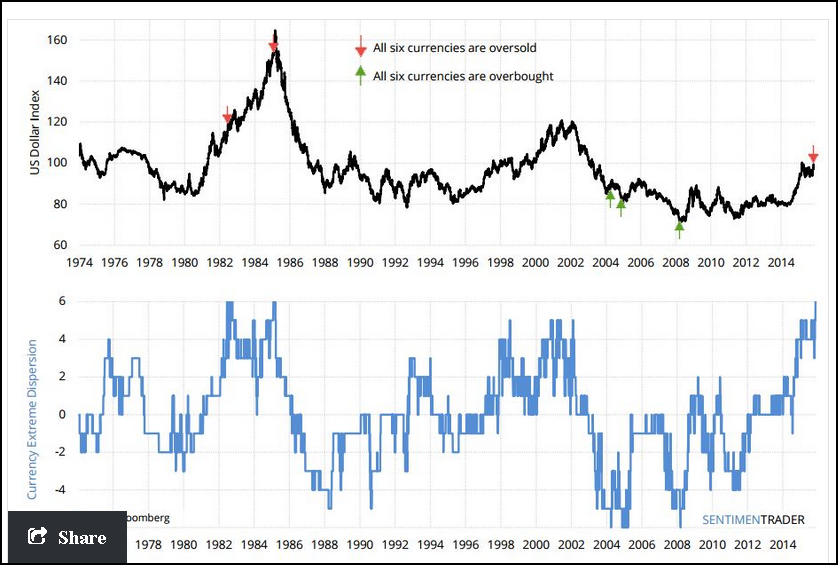

Sundial Capital Research has put together a report that shows the US dollar has not been this overbought for 30 years. It uses the Z-Score to compare the different currencies in the basket that makes up the US Dollar Index (DXY). The Z-Score is a method in statistics to compare two different sets of data on a like for like basis. When a market reaches overbought levels there usually is a contrarian reaction. The more extreme the level of overbought or oversold the bigger the reaction will be in the opposite direction. A bit like when you stretch an elastic, the more you stretch that elastic the harder it will whip back in the other direction.

What the data means

The report shows that the US Dollar is again above 6 on the Currency Extreme Dispersion statistic. This level was last seen in 1985. The next 6 years that followed showed a steady decline for the Greenback. Looking at the chart below for the Dollar Index and the dispersion statistic we can see that extremely low readings of the dispersion statistic, meaning extreme levels of oversold, have led to US Dollar rallies. If you look at the extremely high levels of this statistic, meaning extremely high levels of overbought, you will see they are followed by US Dollar declines.

Gold producers view

A higher US Dollar allows for Gold exporting countries to accept lower prices for Gold which is quoted in US Dollars. If USDCAD goes from 1.3000 to 1.4000 a Canadian Gold producer will now receive 10 Canadian cents more for the Gold it produces, if there is no change in the price of the commodity. A declining US Dollar then means that Gold producers will receive less in their local currency and will begin demanding higher Gold prices. A declining US Dollar will put a lot of upward pressure on Gold Price.

The market has over done it, again H4

It looks like we could be seeing a short term correction in the Greenback due to being so overbought, the market has already priced in an interest rate hike for December, but as usual the market has also probably over done it. This would be the explanation as to why the US Dollar is overbought; great expectations of how far the currency can go on the back of a new cycle of higher interest rates. Now if the December Federal Reserve meeting does produce an interest rate hike, a lot will depend on the speech that follows by Fed Chairwoman Yellen. If the message becomes dovish again and the rhetoric is more of let’s see as we go, we can be almost sure the US Dollar will begin being sold to much lower levels. It will take a very strong economy for the Fed to talk about a second hike coming soon after the one that may happen in December. If there is no hike in interest rates then the US dollar will reverse its trend also and begin going south. It looks very much like a case of, as the old saying goes, buy on rumor sell on fact.

The same can be said for the price of Gold, its price is also well over sold on standard Stochastic levels used in Technical Analysis. Price has dropped sharply since the probability of a rate hike has been back on track. Yet if the Fed does raise rates in December it is all factored into the price of Gold already and the next direction is mostly up again. Yet if the Fed fails to raise rates then Gold will begin to seem more appealing again and price is most likely to rise also.

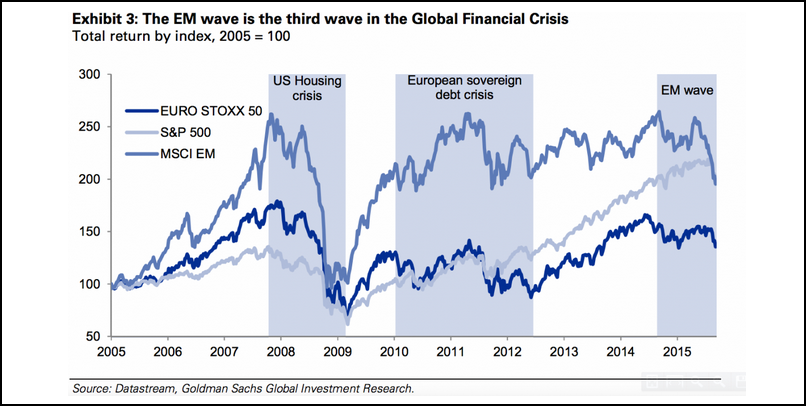

Stock market correction

Goldman Sachs issued a report in October with a narrative that gives rise to a third wave of correction in the stock market since the beginning of the crisis in 2008. This time the factors are the new regime for interest rates in the US and a slowdown in Emerging Market economies. The higher interest rates in the US will make investments in riskier Emerging Market countries less attractive. This will cause capital outflow and reduce economic growth. The declining economic growth in Emerging markets is now of global importance, as countries like China or Brazil contribute a much higher percentage to world GDP. China has come a long way over the past 25 years and is now the world’s second largest economy, in 1990 it ranked 11th and accounted for 3.88% of world GDP in 2011 that number had increased to 14.35% with a prediction for 2016 of 18.04%.

The idea of an interest rate hike from the Fed coupled with weakened economic conditions in emerging countries and a not so strong domestic economy has already shown what it can do.

In August weak economic data coming out of China and the possibility of a rate hike in the US sent the S&P 500 from 2072.75 on August 20th to 1860.75 in the space of three days. The stock market has recovered since then but has failed to go past its previous high of 2125.75 from July 20th.

It has recently begun a new downward trend again on the possibility of a higher interest rate regime.

If the correction in stocks follows the same pattern as other corrections investors will inevitably turn towards the shiny yellow metal as it is a safe haven for the preservation of wealth in a time of crisis.

Increase in demand for Gold

There has been an increase in demand for Gold during the last quarter which has coincided with the consistent decline in price. Demand increased on a global basis by 8% reaching a 2 year high at 1,120 tonnes. As price keeps falling it seems predictable that demand will continue to pick up and supply will begin to diminish as miners see their margins fade. Demand has also increased from central banks that bought a total of 175 tonnes in the last quarter. China alone has increased its Gold reserves from an average of 778.28 tonnes from 2000 to 2015 to a whopping 1708.50 tonnes for September 2015. This increase has been sharp and recent, as of the quarter ending March 2015 the Chinese central bank held 1054.09 tonnes by the quarter ending June 2015 the central bank held 1658.42 tonnes, that’s an increase of 36.44%. This could be a move by the central bank to bring its Gold reserves in-line with the size of its economy given the reserves of other major economies. The USA has 8,133 tonnes of Gold reserves and Germany has 3,381 tonnes.

source: tradingeconomics.com

These three factors are combining simultaneously to create a different picture to the one we have been used to over the past years. The factors exerting upward price pressure on the shiny yellow commodity have not been greater for a long time.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.67

Platinum: $931.67

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68