Gold Demand Broke All-Time Highs in 2023: More to Come in 2024?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 13th February 2024, 02:47 pm

In 2023, the demand for gold surged to unprecedented levels, driven by persistent geopolitical tensions and economic uncertainties that drove capital flight into safe-haven assets.

According to the World Gold Council, total gold demand reached 4,899 tons, surpassing the previous year's figure—and the previous single-year all-time high—of 4,741 tons. This surge in demand, of about +3.4% year-over-year, was fueled by various factors, including geopolitical conflicts such as the Russia-Ukraine war and the Israel-Hamas conflict, as well as economic weaknesses in China.

One of the key drivers of the surge in gold demand was the increased purchases by central banks, with total purchases exceeding 1,000 tons for two consecutive years. This trend, which has been ongoing since 2019, underscores the role of gold as a safe-haven asset during times of uncertainty. Central banks, including the People's Bank of China, significantly boosted their gold reserves, signaling confidence in the precious metal's value as a store of wealth.

Individual investors also contributed to the spike in gold demand, with retail purchases increasing alongside central bank acquisitions. As geopolitical tensions escalated and economic risks persisted, investors sought refuge in gold to protect their portfolios from market volatility and inflationary pressures.

Table of Contents

Rising Gold Pricing Matches Gold Demand

The rise in gold demand in 2023 resulted in record-high prices, with gold reaching an all-time high of $2,100 an ounce in December and netting a year-over-year return of +15%. This price appreciation reflects the increased demand for gold as a safe-haven asset and inflation hedge.

Looking ahead to 2024, the outlook for gold investors remains positive but nuanced. While gold purchases may not reach the same levels as in 2023, factors such as inflation and geopolitical uncertainties are expected to continue supporting demand. However, a potential decrease in inflation could moderate demand, highlighting the complex interplay of economic factors that influence gold prices.

| Category | 2022 | 2023 | Annual y/y % change | Q4'22 | Q4'23 | Quarterly y/y % change |

|---|---|---|---|---|---|---|

| Gold Supply | ||||||

| Mine production | 3,624.8 | 3,644.4 | 1% | 946.7 | 930.8 | -2% |

| Net producer hedging | -13.1 | 17.0 | N/A | -13.6 | -22.3 | N/A |

| Recycled gold | 1,140.1 | 1,237.3 | 9% | 290.7 | 312.9 | 8% |

| Total Supply | 4,751.9 | 4,898.8 | 3% | 1,223.8 | 1,221.4 | 0% |

| Gold Demand | ||||||

| Jewellery | Includes fabrication, consumption, inventory | |||||

| Technology | 308.7 | 297.8 | -4% | 72.1 | 80.6 | 12% |

| Investment | 1,113.0 | 945.1 | -15% | 247.4 | 258.3 | 4% |

| Central banks & other institutions | 1,081.9 | 1,037.4 | -4% | 382.1 | 229.4 | -40% |

| Total Demand | 4,699.0 | 4,448.4 | -5% | 1,303.4 | 1,149.8 | -12% |

| OTC and other | 52.8 | 450.4 | 753% | -79.7 | 71.5 | N/A |

| LBMA Gold Price (US$/oz) | 1800.09 | 1940.54 | 8% | 1,725.9 | 1,971.5 | 14% |

The chart above illustrates the strong supply and demand-side growth seen in 2023 relative to the year prior. Of particular note is the exceptionally strong over-the-counter (OTC) demand growth for gold on an annual basis (+753%), in addition to strong Q4 quarterly gains in technology-related gold demand growth (+12%).

Another Demand-Driven Market for Gold in 2024?

In 2023, central bank goldbuying exceeded expectations. Last year, central banks continued to be net-buyers of gold and, notably, Turkey’s pivot from heavy selling in early 2023 suggests that, in general, buying campaigns are more durable than originally suspected. Analysts expect yet another strong year of goldbuying from central banks, which, as it has for the past two years, provided strong price support for the yellow metal despite rising supply.

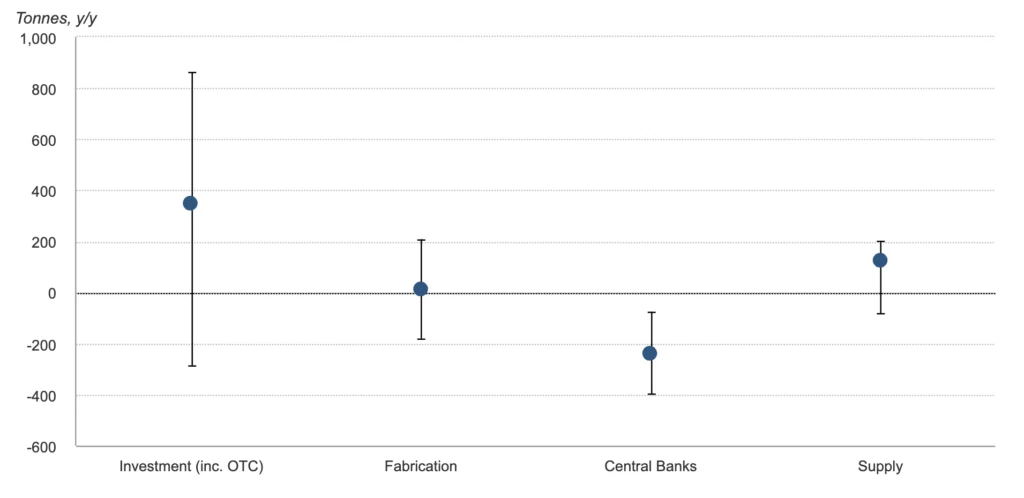

Figure 1: Expected change in annual gold demand and supply, 2024 vs. 2023 (Source: World Gold Council)

In Figure 1, pictured above, we see a diverse range of push and pull factors influencing projected global gold demand in the year ahead. While OTC demand is expected to grow considerably, driving gold prices higher, central bank demand is expected to decline by a lesser margin, and manufacturing-related demand is expected to stagnate.

The consensus viewpoint among gold market analysts for 2024 is that a soft economic landing in the US will yield “neutral to mildly positive” effects for gold, caused primarily by:

- Lower but still elevated long-term interest rates: neutral to positive for gold

- A flat US dollar: neutral to positive for gold

- Below trend economic growth: mildly negative for gold

- Lower inflation: mildly negative for gold

- Elevated geopolitical risks: positive for gold

Additionally, recession risks are a positive signal for gold. This remains a possibility for the year given that the World Bank forecasts slower global growth in 2024 (+2.4%) and highlights various systemic risks that could threaten the integrity of international markets—primarily, an economic slowdown or recessionary activity in mainland China.

Supply-Side Gold Developments for 2024

On the whole, global mining output for gold is expected to continue to its upward trajectory in 2024, matching the year-over-year pace seen between 2022 and 2023 (+3.0%).

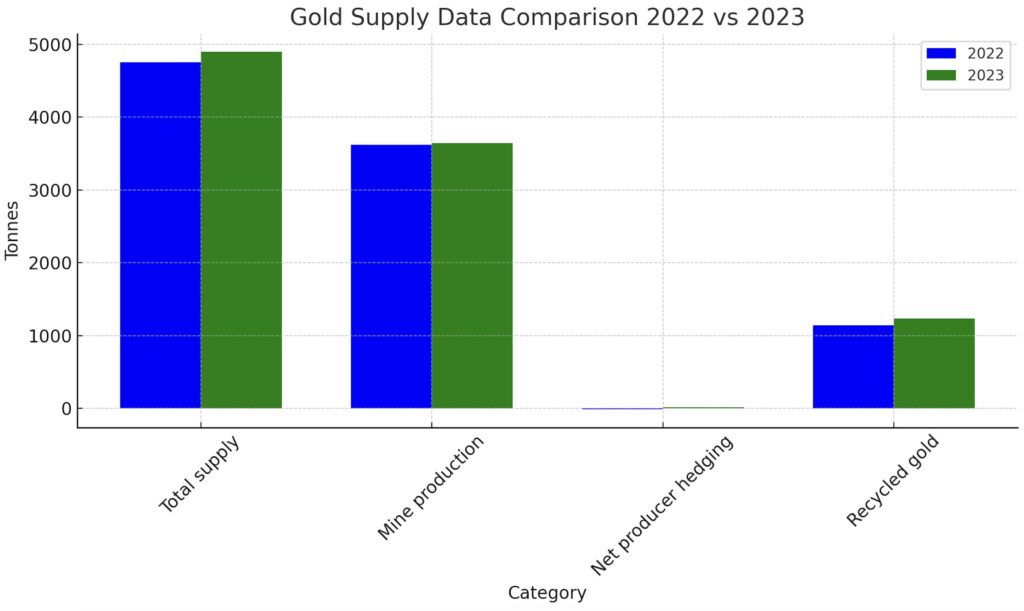

Figure 2: Global gold supply in tonnes, 2022 vs. 2023 (Source: World Gold Council)

Several new global mining and exploration projects are expected to slightly elevate gold's production supply from 2023. A variety of new mine start-ups in South Africa, Russia, Mali, Brazi, Burkina Faso, and Australia have led analysts to forecast higher gold ore output in 2024, while geopolitical and logistical disruptions may offset some or most of these supply influxes. Similarly, increasing rates of gold recycling in China will also contribute to downward supply pressure on the yellow metal.

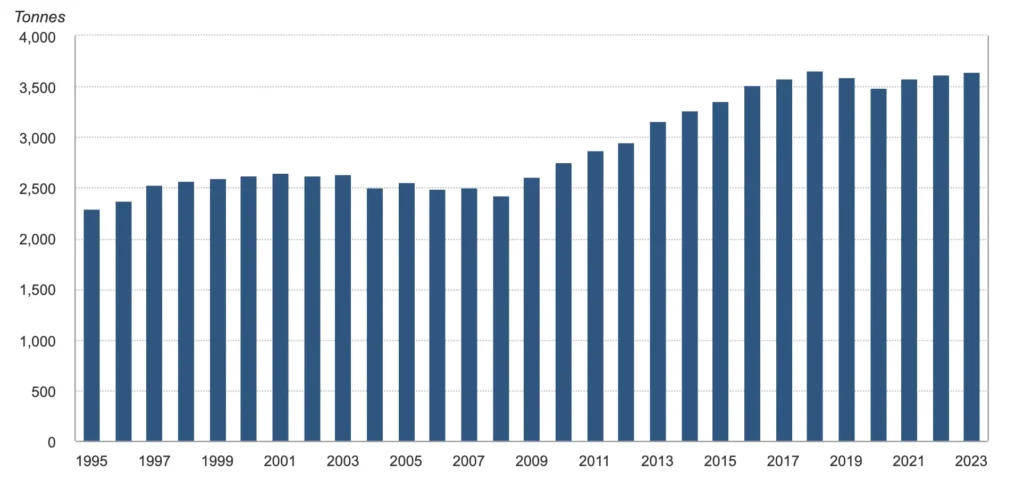

Figure 3: Actual annual gold mine production in tonnes (Source: World Gold Council)

Although 2023's gold supply levels fell short of 2018's all-time high, mine output has been trended up since 2009 and this trendline is expected to continue in the year ahead. Due to these market dynamics, Bank of America analysts have maintained their price target of $2,200 per ounce for gold bullion by December 2024.

Another Bullish Year for Gold Ahead?

The record-high demand for gold in 2023 underscores its enduring appeal as a safe-haven asset and investment diversifier. For investors, particularly those considering gold and silver investments within self-directed IRAs, understanding the dynamics driving gold demand and its implications for future market trends is crucial for making informed investment decisions.

If current trends persist, we could see another record year for gold prices. However, much depends on central bank and consumer demand levels for the yellow metal, in addition to political and logistical uncertainties in geostrategic conflict zones.

Whether decreased inflation and an easing monetary policy environment will offset these bullish factors remains an open question. As the World Gold Council pointed out in their Q4 2023 report, the “tense geopolitical and political environment, alongside possible rate cuts in Q2, should help the cause” of driving OTC demand for the yellow metal. In the meantime, all eyes on the Fed and the unfolding developments in the Middle East.

Interested in investing in gold on a tax-advantaged basis? Consider speaking to your financial advisor about opening a tax-deferred gold IRA. To start your investment journey, browse our list of the best self-directed gold IRA companies today.

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as financial advice. Investing in precious metals, including gold and silver, carries inherent risks, and individuals should consult with a qualified financial advisor or investment professional before making any investment decision.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,329.45

Gold: $3,329.45

Silver: $36.82

Silver: $36.82

Platinum: $1,388.07

Platinum: $1,388.07

Palladium: $1,153.30

Palladium: $1,153.30

Bitcoin: $109,622.77

Bitcoin: $109,622.77

Ethereum: $2,590.46

Ethereum: $2,590.46