- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Central Bank Gold Buying On Track for Highest Since 1971

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 8th November 2019, 10:47 am

The news this week revealed that September set new records for both central bank and ETF gold buying. Central banks continued their gold buying spree as they diversified their currency reserves out of American dollars in a big way. For only the month of September, global central banks acquired an additional net 47.5 tons worth of gold, pushing their reserves to the highest level in over 45 years (to the second highest total on record), per the latest data from the World Gold Council. It was also significant that no gold sales from central banks were announced in the month of September.

Turkey and Russia Lead the Way for Central Banks Hungry for Gold Reserves

It was not only the usual central bank suspects buying gold during the month of September. Turkey led the pack for September when it boosted its gold reserves by a total of 22.9 tons for the month. This followed its impressive increase in August of Turkish reserves that grew by 41.8 tons.

Russia held its place as the top gold buyer of 2019 with another strong month's acquisition of the yellow metal. They have been in the approximately 10 tons each month region all year. For September, the Russian central bank increased its reserves by 11.4 tons.

The country's choice has been well rewarded as gold prices have increased significantly over the year. By September, the Russian Central Bank's gold reserves had leapfrogged past $100 billion, in part due to roaring gold prices. These most recent purchases mean that Russia has grown its total gold holdings by more than 120 tons in 2019 alone so far.

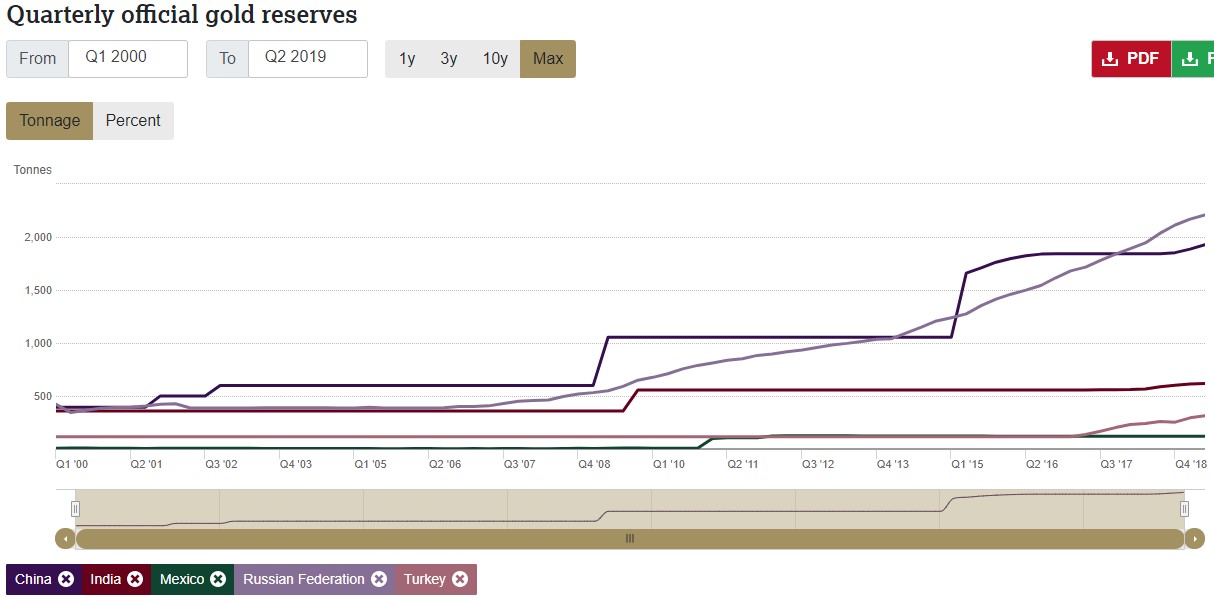

China also increased its gold holdings for the month of September by 5.9 tons. This represented their 10th consecutive month in gold acquisitions from the People's Bank of China. It was only late in 2018 that the central bank in China restarted its gold purchases officially, but they have managed to add more than 100 tons of the precious metal in those months. This chart below shows how the central bank gold buying trend (over the last two decades) has been higher:

Even gold selling Uzbekistan returned to the precious metals buying column in September. They had sold gold holdings down for the prior three consecutive months (liquidating almost 25 tons in July and August alone) before coming back with a respectable 6.5 ton purchase for September. The Central Bank Governor Mamarizo Nurmuratov stated earlier in 2019 that he would buy Chinese and American sovereign debt so that he could diversify the country's $26 billion of international reserves away from only gold as the country emerges from its longstanding economic isolation. Apparently he rethought the amount of the gold diversification the country needed in September.

A number of other central banks were also net buyers of gold for the month. Greece, the Eurozone, Malta, and Mexico each bought .1 ton of the yellow metal. The Kyrgyz Republic purchased .4 tons, while Kazakhstan bought .2 tons. The World Gold Council revealed that an impressive dozen central banks have boosted their total gold reserves by minimally a ton in the first eight months of this year. This data from the World Gold Council comes from the International Monetary Fund-submitted information.

Central Bank Gold Buying Reaches Second Highest on Record, Highest in over 45 Years

For the year already, central banks have set new records in their gold reserves buying. They have collectively purchased an astonishing 547.5 tons of gold net for 2019 so far. This is in itself a full 12 percent year over year increase and represents the trend of 2018 continuing. In 2018, the global central banks purchased 651.5 tons of gold. This was high enough to break the previous gold buying records all the way back to 1971 when the dollar suspended gold into dollar convertibility. The year 2018 is now the second largest (of all time) annual gold purchase total from central banks.

Central Banks Are Minimizing Exposure to the U.S. Dollar in a Significant Way

What does it all mean? Why are central banks so eager to trade in their dollars for gold bullion in 2018 and 2019? The move represents a concerted effort to reduce exposure to the American dollar. This is especially the case from U.S. rivals like China and Russia.

Economist Peter Schiff of Euro Pacific Capital Management has discussed this surge in central bank gold buying strength. Although he concedes that the United States abandoned the gold standard completely back in 1971, he sees the world returning to it in the future. Schiff warned that:

“The days where the dollar is the reserve currency are numbered and we're going back to basics. You know, everything old is new again. Gold was money in the past, and it will be money again in the future, and central banks that are smart enough to read that writing on the wall are increasing their gold reserves now.”

Long time Senator Ron Paul has also highlighted this important concept in a Liberty Report recent episode. He stated that international central banks have become increasingly attracted to sound money such as gold and are parting ways with the Federal Reserve manipulated U.S. dollars.

Gold Demand Rises Three Percent as Gold Backed ETFs Achieve Record Holdings in the Third Quarter

Central banks are not the only major international players buying gold these days. For the third quarter ending September 30th, total gold demand rose by three percent and reached an impressive 1,107.9 tons, per the World Gold Council published report Gold Demand Trends Q3 2019. Inflows into the yellow metal from ETF's around the world were strong enough to overcome weaker demand in jewelry, coin, and gold bar markets so that the total demand rose significantly. While gold mining output declined marginally, a rise in gold recycling helped to cause a minor gain in gold supply.

For Q3, the gold backed ETFs absorbed 258 tons of the yellow metal. This brought total ETF holdings to their record high during the month when they reached 2,808 tons. This surpassed the 2012 prior record as gold prices were at all time highs of over $1,700 per ounce. The World Gold Council attributed the strong ETF retail gold buying to:

“Accommodating monetary policies, along with safe haven and momentum buying, drove demand.”

With the previously noted powerful central bank gold buying of 156.2 tons for the third quarter, gold demand looks set to continue strong. Even though it was a decrease of year over year versus the third quarter record breaking 2018 totals, these purchases still put central banking gold buying at 12 percent above 2018's record setting numbers.

Gold Prices Reach All Time Highs in Many Currencies

It is also worth noting that gold prices as measured in many global currencies have recently hit all-time highs. The sustained support of approximately $1,500 per ounce represented a strong five percent rise for the third quarter gold prices. India is one nation where gold has recently set all-time record high gold prices in the local currency. The country makes up a major component of worldwide gold jewelry sales.

You can follow the example of savvy central bank gold buyers and consider acquiring some IRA-approved gold bullion for your own retirement accounts. With all of the economic and political uncertainty in the world these days, gold makes sense in an IRA. One way you can acquire gold gradually is through buying gold in monthly installments. It is a good idea to consider the top gold IRA companies before you purchase.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.67

Platinum: $931.67

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68