- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Global Inverted Yield Curve Signaling Potential Recession

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

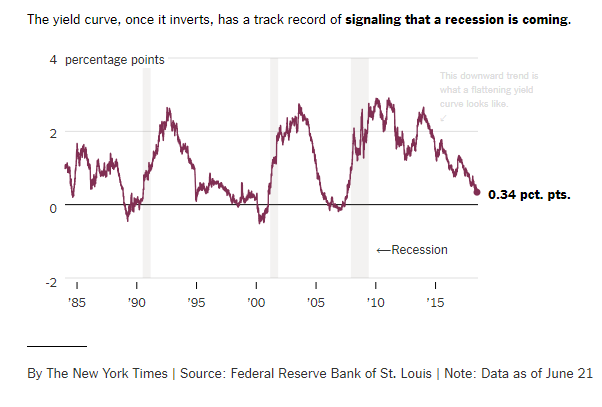

This past week saw the yield curve between ten year and two year U.S. Treasuries shrink to a mere 34 basis points. It is now at the lowest and most dangerous level going all the way back to 2007. It is not coincidental that this was immediately before the outbreak of the Global Financial Crisis. Even more worrisome news was that there has been an actual inversion of the global yield curve for the first time since before the crisis broke out in 2007.

This is a good reason for you to think about protecting your retirement accounts with IRA-approved precious metals. Historically speaking, inverted yield curves are warnings about impending financial troubles ahead. It is one of the numerous reasons for why gold makes sense in an IRA. Now is a good time for you to start researching gold IRA rules and regulations while the yellow metal prices are still reasonable.

Inverted Yield Curves Are Widely Respected and Feared

The inverted yield curve is a serious predictive force on economic pullbacks. Consider what the various mainstream media and analysts have to say about its powers for predicting U.S. (and global) recessions. The Financial Times warns on inverted yield curves that they are:

“Coco Chanel's proverbial ‘little black dress' of economic indicators. The slope made up of bond yields of various maturities has a record of predicting recessions that would make even the savviest econometrician turn pea-green with envy. It is not perfect, but the curve has become flat and inverted — when short-term bond yields are actually higher than long-term ones — ahead of most economic downturns in most major countries since the Second World War.”

Besides the stern warnings from Europe's leading financial newspaper, you have the New York Times calling out:

“Curve inversions have correctly signaled all nine recessions since 1955 and had only one false positive, in the mid-1960's when an inversion was followed by an economic slowdown but not an official recession.”

Why Do Yield Curves Matter?

Yield curves are important in economics for a reason. Investors generally insist on receiving a larger rate of return when they lock up their money for a longer amount of time. This is why the yield curves on longer-term bonds should have an upward slope. It makes sense that the return rate for an only two year bond would be lower than the ten year bond's return.

When the economy is expanding, investors expect inflation to rise. This is why they insist on still greater yields for tying up their money in longer-term bonds. When the yield curve is sloping sharply higher, this signifies that the investors' hopes for the future are positive.

Similarly in recessionary periods, inflation would likely decrease. This causes the longer-term yields to drop. In a period leading up to recession, this difference between the longer-term and shorter-term yields will flatten out and finally turn inverted.

National Yield Curves Are A Mixed Bag Right Now

This brings you back to the status of yield curves around the world and in the United States. The global average yield for from seven to ten year bonds in the most inclusive government bond index managed by JP Morgan has just fallen beneath the one to three years' maturing dates' average yield. This means that the average global yield curve has turned inverted.

This is not to say that all yield curves in the major economies are negative yet. Those of the United States, Germany, Japan, and France are still positive for now. Yet there is no dismissing the inversion of the average worldwide yield curve as simply a random one-off indicator. As the Financial Times astutely points out:

“The shape of the curve matters so much because it is the overall judgment of thousands and thousands of well-informed investors round the world, and the collective signal they are sending is that the outlook is far from rosy.”

In other words, the collective opinion of savvy and smart-money investors from throughout the globe is collectively sending warning signals for the world economy.

U.S. Yield Curve Flattening Is Worrisome

U.S. yield curves have a long and storied tradition of predicting recessions as New York Fed President John Williams reminded us all earlier in the year:

“An inverted yield curve ‘is a powerful signal of recessions' that have occurred historically' when the Fed is in a tightening cycle, and markets lose confidence in the economic outlook.”

Citigroup analysts have also warned about the consequences of inverted yield curves in a recent report put together by lead analyst Jabaz Mathai and company, with:

“The historical relationship between the curve and implied recession probabilities is highly non-linear: implied probabilities grow very fast when the curve moves into inverted territory.”

Meanwhile the U.S. yield curve may not yet be inverted, but it is flattening fast. This is troublesome. The chart below shows you how close this curve is to becoming negative or inverted:

No one can discount the United States' flattening yield cure. The outcome of the American economy also has major effects on the world economy. The Financial Times goes so far as to speculate that a few more interest rate increases by the Fed will force the U.S.' yield curve to invert. This would only worsen the global inverted average in a vicious downward spiral.

The track record of the inverted yield cure is hard to argue with. Every single recession over the past fifty years has been predicted by (and preceded by) such an inverted yield curve. It should give you pause for thought concerning the future direction of the economy, the markets, and the impact that this will have on your own retirement portfolio.

Is The Fed to Blame for the Steeply Flattening Yield Curve?

The most interesting twist on the yield curve story could be that the Federal Reserve is a key player in the problem. They are boosting the shorter-term interest rates (on purpose) through their monetary tightening policies. The natural result of this is that it causes the yield curve spread to flatten out.

This means that the Fed normalizing interest rates plays a part in crushing the economy. It also reveals a disturbing connection between periods of interest rate tightening by the Fed, flattening out of yield curves, and the beginning of recessions.

Other bigger factors are also at work. The markets are having withdrawal symptoms from having their easy money fixes pulled back on them. The economic boom we have been in was fueled by this easy money. Now that the monetary policy is tightening back up, the bubbles it created have begun to deflate (if not to burst outright). It means that the whole rosy economic picture economic and news pundits trumpet about can quickly deteriorate.

Gold Is Your Retirement Portfolio's Best Line of Defense

As a last warning, it is important to keep in mind how quickly these yield curves can completely flatten out and turn inverted. From 2005-2006, the yield curve between five and thirty year Treasuries flattened an incredible 30 basis points (down to zero) in a mere six months. The curve between the two year and ten year Treasuries dropped from 40 points down to zero in approximately the same time span.

Should this historical trend from the Global Financial Crisis' onset be repeated, then by the conclusion of 2018 the yield curve will have flattened out completely. This is why you need to include IRA-approved gold in your portfolio. It's time to learn what is involved with a Gold IRA rollover now.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81