- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

From U.S. Treasuries to Hong Kong, Chinese Threaten Markets

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 30th August 2019, 04:03 pm

This past week there were two important news stories regarding Chinese activities that are threatening U.S. treasuries and markets. Data released from the U.S. Treasury Department in the last week showed that China dumped U.S. Treasuries in May yet again. This has forced down their total holdings to the smallest amount in two years.

At the same time, yesterday the Chinese defense ministry gave an indication that they could deploy the People's Liberation Army in the streets of Hong Kong if the continuing protests do not stop in the partially autonomous financial center city. The news from China is a significant warning to you to take measures to protect and diversify your investment and retirement portfolios.

Chinese Continue Dumping U.S. Treasuries in Ominous Sign for U.S. Government Finances

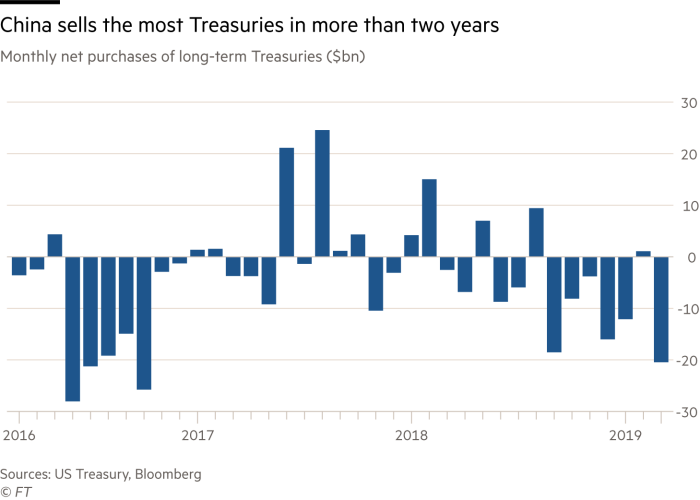

The news from the Treasury Department was that China has again divested its U.S. Treasuries debt for the third month in a row. This time they sold off $2.8 billion more of the government debt instruments for May. In April, the Chinese had sold off $7.5 billion of American bonds. This followed the March action in which the Chinese sold off $10 billion worth of American Treasuries. The March period was the largest such selloff by Beijing in almost two and a half years. For just the past three months, China has liquidated a significant $20.3 billion of its total American government debt holdings.

March's sell off renewed a trend of China dumping its Treasuries that was a theme of 2018. In the past 12 months, Beijing has cut back an incredible $72.9 billion in American Treasury holdings. This has caused the country's total holdings of U.S. Treasuries to fall from the record (back in February of 2016) of $1.25 trillion to today's $1.110 trillion. This chart below shows the worrying trend:

Rising U.S. Deficits Make China The Critical Treasuries Buyer

The Chinese dumping U.S. Treasuries is a critical story not getting as much media attention as it should. China is still the largest creditor to the United States. It only takes a longer pause in Beijing's bond buying to create problems for the American government. Washington is actually looking for more buyers for billions more in Treasuries to help pay for massively rising deficits.

For the fiscal year of 2019 already, the federal government has already racked up an eye watering $747.1 billion budget deficit. Observing analysts comment that this total will most likely exceed one trillion when the fiscal year ends. In order to pay for these deficits, the government must sell these bonds. Should the largest buyer of Treasuries keep emerging as a net seller, this will cause substantial difficulties for the American Treasury Department in a matter of months.

Understanding the Chinese Nuclear Option with Treasuries

Some analysts have worried that Beijing could take the Treasury crisis to a whole new level. They refer to this as the aptly called Treasury “nuclear option” that the Chinese might use in their ongoing trade war conflict with the U.S. Under such a scenario, China could actively and massively sell its Treasury holdings.

The result would be that U.S. government borrowing costs would rise significantly and the dollar's value would likely plunge. While China can not deploy more tariffs than U.S. President Trump in this economic conflict (as America imports a great many more Chinese products), they do have major leverage in the remaining $1.11 trillion of U.S. government debt.

The majority of analysts downplay the likelihood of China using such a tactic. It would harm their economy as well. Yet consider that China's state controlled newspaper the Global Times made some insightful comments on the issue just last month. One of their editors put substance behind the potential when he wrote:

“Many Chinese scholars are discussing the possibility of dumping U.S. Treasuries and how to do it specifically.”

Beijing Actively Seeking Alternatives to U.S. Assets and Payment Systems

All the while the Chinese are selling off their U.S. Treasury holdings, they are replacing these with gold. For the month of June, the Chinese increased their gold reserves for the seventh consecutive month. It gives the Chinese government the means to pursue their “determined diversification” from U.S. dollar assets and currency. At the same time, they chip away at the reserve currency status of the dollar in the process.

Another alternative to the dollar that the Chinese are looking to pursue involves dollar-less payment systems. They have increasingly expressed their needs to see global alternative payments systems that do not use the dollar. Last month, one of the Chinese state owned papers published an op-ed piece. In this they appealed to the global community of nations to seek out one or more alternatives to the international dollar system. The article warned that:

“capricious actions” taken by the U.S. government could eventually “ruin the future of the dollar itself.”

Chinese Defense Ministry Threatens Military Intervention in Hong Kong

The Chinese have also been threatening Hong Kong this past week. The long-time British colony became a part of China back on July 1st in 1997 under a framework called, “one country, two systems.” The global financial center was guaranteed it would maintain a large amount of control over its internal affairs for 50 years minimally.

This has now been called into question as political tensions in Hong Kong have boiled over in the last two months. At issue is the extradition bill that would permit people arrested in the city to be extradited to mainland China for their trial. Now the citizens of Hong Kong are worried that they are watching their critical civil rights trickle away under the rule of Beijing.

Some residents have urged calls for gaining independence in the territory. This week, when the Chinese Defense Ministry was queried on how it would respond to this idea, Defense Ministry Spokesman Wu Qian issued troubling comments for the financial enclave. The Financial Times reported his reference to the Hong Kong Garrison Law's “clear provisions” in Section 3, Article 14 during a news conference. Meanwhile, according to The New York Times, Wu stated that the:

“Behavior of some radical demonstrators… is absolutely intolerable… the behavior of some radical protests challenges the central government's authority, touching on the bottom line principle of ‘one country, two systems'. That absolutely can not be tolerated.”

In this Garrison Law article Wu referred to, the Hong Kong government can request help from the garrisoned Chinese military troops who are stationed there “in the maintenance of public order.” Wu went so far as to suggest that this military troop deployment can happen if the government asks for it.

Geopolitical Developments With China Are Significant

The U.S. Treasury debt system that China supports is a critical component of American government finance. China threatening to militarily occupy Hong Kong, one of the largest financial and trading centers in the world, is also news markets can not ignore forever. These are reasons why gold makes sense in an IRA. One tool for diversification is IRA-approved gold through a gold IRA rollover. A good way to investigate which gold companies are reputable is by reading more about the top gold IRA companies and bullion dealers.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81