- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

French Election Heats Up As China Blasts U.S.-Led Uncertainty and Deutsche Bank Flounders

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 25th December 2020, 06:44 am

This past week saw the French presidential contest heat to a boiling point as the conservative Francois Fillon's candidacy buckled under the mounting corruption scandal and probe into a questionable diversion of public funds while he was in government. Populist/nationalist candidate Marine Le Pen stands to gain the most from his departure if he bows out of the race. She reiterated her promise to withdraw from the Euro if she wins the runoff May 7th.

Meanwhile, back in the continuing saga between sparring superpowers the United States and China, the Chinese unleashed their latest verbal salvo in an interview where the Chinese Vice Finance Minister accused the United States of being the main causes of uncertainty and instability in the world. This was courtesy of President Trump's new trade policies and the potential Fed interest rate increases in the offing.

In the still troubled world of banking, Deutsche Bank at its London HQ office announced massive restructuring changes and capital raises that will throw numerous employees overboard as it desperately seeks to right the struggling largest bank in Germany and biggest lender on the continent. Precious metals like IRA-approved platinum, gold, and silver are what you need to protect your retirement assets in times like these.

French Election Contest Seizes the Attention of the World As Euro and EU Future Hang in Balance

This last week saw the problems of conservative French presidential contender Francois Fillon worsen as a steady stream of his own campaign management and elected officials from the party began to distance themselves from him and even disown his campaign. Police were searching his house last Thursday.

Over 60 politicians within his venerable conservative Republican alliance stated they can not support his candidacy because it is soon to be charged with embezzlement of public funds. Among the people leaving his campaign were Gilles Boyer his campaign treasurer and Bruno Le Maire his senior adviser. Twenty politicians within the party also penned an open letter encouraging him to withdraw as candidate of the party in the election. Fillon currently ranks third in the Ifop French public opinion polls behind both independent campaign Macron and Nationalist Front leader Le Pen. He will likely be eliminated in the primary round of voting set for April 23rd.

Yet despite this, Fillon still refuses to go. He held a make or break campaign rally before the Eiffel Tower this weekend which drew between 35,000 and 40,000 determined supporters. Ifop ran a poll which the organization released on Sunday ahead of his rally showing that 71 percent of the French people wish for Fillon to withdraw from the race. Other polls Ifop has conducted shows Fillon trailing fairly badly at 21 percent to Macron's 24 percent, to Le Pen's leading 26 percent.

The conundrum for France is that if Fillon does not step down, the conservative alliance and glorious party of Nicholas Sarkozy will most likely be eliminated from the Presidential race altogether on April 23. Alternatively, if he is replaced by most likely successor Alain Juppe, his more conservative followers will move into the camp of Marine Le Pen the far right populist candidate who is determined to withdraw France from the euro (and even European Union altogether), per Deputy Chief Executive Bruno Jeanbart of Opinionway polling company.

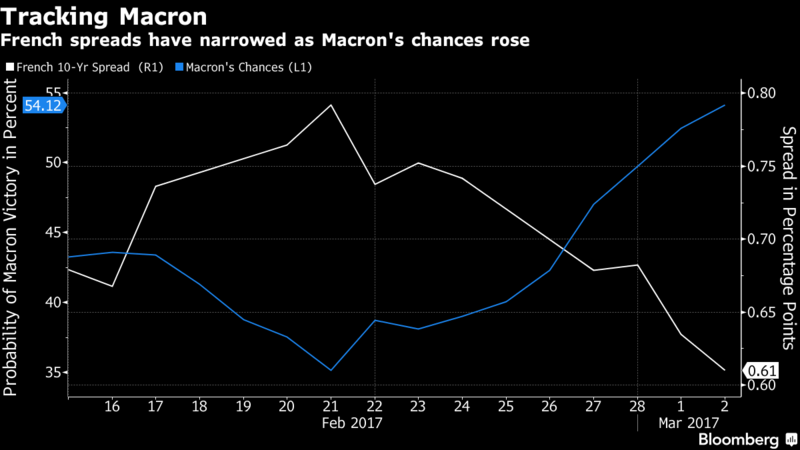

While the Ifop polls still show Macron defeating Le Pen by 61 percent to 39 percent, other computer-driven prediction models are showing a decisive win for Marine Le Pen on May 7th. Polls which predicted the Brexit results and U.S. election results more confidently than the Ifop Presidential runoff polls have been proven completely wrong over the last year too. The chart below shows that the greatest hope of investors lies in a Macron presidential victory:

Emmanuel Macron has stepped up his efforts to try to appear as the only alternative in France to the end of the French participation in the euro as Le Pen stated in her speech in Paris this past week that”the question is not if we'll leave the euro, but when and how.”

Yet Macron himself recently admitted that Le Pen's Nationalist Front is standing at the gates of power and could win the presidency. Marine Le Pen continued at her recent speech to affirm her previous pledges to withdraw her country from the euro as she assured supporters that her form of economic nationalism is in fact the next piece in the bigger populist puzzle that is shaking and sweeping across the globe. She warned that France has been:

“pillaged by the neo-liberal global economic order. Look at the jobs that Donald Trump has brought back to America. From Donald Trump in the U.S. to Xi Jinping in China to Theresa May in Britain, economic patriotism is on the March. The European Union is [the] last one left to still believe in the illusion of a borderless world. The euro is a corpse that still moves. It's not a question of if we'll leave the euro but when.”

If this sounds suspiciously like the agenda that helped President Donald Trump to get elected in the U.S., it is. Le Pen further promised to firmly recover control of the French Central Bank under her government, to force the public sector to purchase goods made in France, and to nationalize French toll roads.

She will erect a 35 percent tax on imports of French company products which they produce overseas in an effort to bring the industry and jobs back to France, as Trump has said. She pledged to make multinational companies pay a larger amount of their taxes in France. “My job isn't to create jobs in China,” Le Pen reminded her audience. Her reminder is a wake up call of the global instability that threatens your retirement portfolio.

China Calls US Main Source of Uncertainty In the World Because of Trump Trade Policies and Federal Reserve Rate Hikes

Top Chinese official and Vice Finance Minister Zhu Guangyao has upped the ante in the war of words between the Trump administration and the Chinese with his latest comments. Zhu stated flatly that he considers questions surrounding the United States as among the biggest drivers of economic doubt around the world:

“Internationally, I think the big challenge is uncertainty. So I see some uncertainty first is the Trump administration economic policy, that is, what will happen and what impact to the U.S. economy and the global economy. Second uncertainty certainly is the Federal Reserve: How they will make the decision for interest rates. And the most challenging situation is anti-trade and some (cases happening) with geopolitical risk.”

Zhu maintained that it is “unreasonable” to point the finger at China regarding increasing anti-trade and protectionism gripping both the United States and different places in Europe. Yet despite this tough talk, China is beginning to move towards a more accommodative policy with the Trump administration regarding accusations of currency manipulation.

China has signalled that it could change its exchange rates policies on the yuan because of increasing pressure from President Trump's threats of beginning a trade war with China and because of imminent interest rate increases from the U.S. Federal Reserve. This is the first time their annual government report has put in a requirement ensuring the stable global status for their yuan is among its biggest tasks. At the same time, they have dropped their line about “keeping a stable yuan at a reasonable and balanced level,” which their last three years of reports included.

This new phrasing appears to indicate that Beijing is going to be more permissive of market-based exchange rate moves in the yuan versus the dollar. It would mean that they lower the amount of foreign exchange market intervention they pursue in 2017, as Premier Li Keqiang read from the government work report to the National People's Congress Sunday:

“The renminbi exchange rate will be further liberalised, and the currency's stable position in the global monetary system will be maintained.”

This is happening against a backdrop of China pulling back from their previously substantial efforts to make the yuan one of the world's most important international currencies. Swift, the payments processor, Thursday revealed that the total value of yuan international payments settlements plunged a sharp 29.5 percent for 2016 even as the international payments yuan share declined to 1.68 percent, down .63 percentage points, by 2016 year's end.

Deutsche Bank Throwing Staff Overboard In a Desperate Bid to Salvage the Bank

This past week, the CEO of Deutsche Bank John Cryan admitted that his 17 month-long effort to salvage Germany's largest bank had failed. Late Sunday afternoon, the biggest lender on the continent approved his latest measures to try to fix the bank. These included a concrete plan for raising around $8.5 billion via a sale of stock shares. Other plans revealed included abandoning prior goals to sell their consumer banking division and instead selling part of their valuable asset managment business.

Most critically for the staff of Deutsche Bank, they will now integrate their subsidiary Postbank inside their commercial and private clients division. The CEO admitted that this will “inevitably” cost still more job cuts and create a “difficult” period in his statement from their London office headquarters:

“There will be a difficult integration process in Germany, but it's only in Germany that this applies.”

The bank has still not revealed details on how many more people will be eliminated from the bank, as their last branch-closing and staff-reducing programs have not yet played out. The company had already decided to slash their global operations from four down to only three divisions back in October 2015. They call this a “slight reorganization.” This makes their 20 billion euros in additional capital the bank has raised since the onset of the financial crisis less significant to them than to investors like yourself.

Yet Cryan has himself admitted that their counterparty financial institutions and clients are still worried that the capital base of Deutsche Bank is not sufficient with his conclusion, “We feel confident we've done the right thing.” As critically important European banks continue to struggle, be sure to do the right thing for your retirement assets by hedging them with gold and precious metals against all the craziness in the world today. Gold makes sense in an IRA.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81