- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Former Treasury Secretary Warns Potentially Negative Interest Rates Coming for U.S.

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

This past week saw a warning from the former Treasury Secretary under President Bill Clinton. Larry Summers shared that the United States only lies one bad recession away from returning to zero percent interest rates or even lower into negative interest rates. His comments came out as a new survey showed that tens of millions of Americans are worse off than before the Great Recession that ended a decade ago.

Former Treasury Secretary Larry Summers Talks Dangers of Zero Interest Rates

The former Treasury Secretary Larry Summers knows something about the negative impacts of zero percent interest rates. He was a chief economic adviser to President Barrack Obama the only time in modern U.S. history when the administration found itself forced to embark on such a policy. Summers sounded the alarm about where we are today and where we appear to be headed with:

“It's a very different world when everyone's stuck at zero interest rates. We'll have to think about stabilization policy. Institutions are going to have to think about their investment policy in a very different world when we have a black hole, zero interest rate world. I fear that's what we're headed into. We're one recession away from a situation of that kind.”

Summers, currently an economics professor at Harvard University, pointed out the example of Japan's economy that has suffered from literally decades of economic stagnation. The Bank of Japan (the country's central bank) began its experiment with negative interest rates back in 2016. This was approximately two years after the European Central Bank dabbled with it.

Summers expects that the Federal Reserve-set interest rates have little chance of remaining above zero. He anticipates they will reach zero or dip into negative interest rate territory unless there is an substantial change in the United States. The former Treasury Secretary puts the odds of recession occurring this next year at somewhere below 50 percent. He warned that these chances will increase significantly in the coming few years.

Markets and U.S. President Trump Expecting More Rate Cuts

The Federal Reserve has already cut interest rates by a quarter percentage point two times in 2019 so far amid signs of a downturn in the global economy that has weighed on U.S. economic growth. Markets anticipate there will be another interest rate cut at least before 2020 begins. Yet Chairman of the Federal Reserve Jerome Powell has warned about markets getting ahead of themselves.

President Donald Trump is also aggressively in favor of more rate cuts for the U.S. economy. He has consistently criticized the Federal Reserve for not cutting the costs to borrow more starkly. President Trump tweeted on the subject:

“The Federal Reserve should get our interest rates down to zero, or less, and we should then start to refinance our debt. Interest costs could be brought way down, while at the same time substantially lengthening the term. The USA should always be paying the lowest rate. No inflation! It is only the naïveté of Jerome Powell and the Federal Reserve that doesn't allow us to do what other countries are already doing. A once in a lifetime opportunity that we are missing because of ‘Boneheads'.”

Clearly Powell and the Federal Reserve remain under pressure to move interest rates towards zero percent and below.

Powell Appears to Deny Talk of Negative Interest Rates

Last week the Fed released its minutes from their September meeting. These revealed that at least a few of the policymakers showed concerns about markets anticipating more rate cuts than the Federal Reserve is set on providing. During the September 17th-18th Federal Open Market Committee meeting, they cut the interest rates by a quarter point down to a targeted range of from 1.75 percent to two percent. The cut back in July turned out to be the first interest rate reduction in over ten years.

So far, Chairman Powell has been resisting talk of a move towards negative interest rates. After September's FOMC meeting, he told reporters:

“I do not think we'd be looking at using negative rates. I just don't think those will be at the top of our list.”

Yet the chairman admitted that the Fed did consider the idea of using negative interest rates in the midst of the financial crisis, though they decided against it at the time. Instead, they opted for massive quantitative easing in the form of enormous asset purchases.

The Federal Reserve came incredibly close to negative interest rates back in December of 2008. At that point, they cut the target interest rate to from 0 percent to .25 percent. Central bankers around the world cut their interest rates an incredible 10 times in years 2007 and 2008 as they were attempting to stimulate economies mired in the depths of the Global Financial Crisis.

Yet Powell's stance today is directly opposed to a great number of central bankers around the globe. Over $17 trillion in government bonds is already trading for negative yields. The Fed will have an opportunity to review its approach before long. They meet again at the conclusion of October.

Many Americans Still Worse Off than Before Great Recession

The discussion on cutting interest rates became more personal to many Americans this past week as a survey released by personal finance company Bankrate.com showed that a huge number of consumers' finances still have not recovered from the impacts of the recession that ended a decade ago. Senior Economic Analyst Mark Hamrick at Bankrate.com explained that:

“There are still tens of millions who are struggling to even get back to where they were before the economy took a turn for the worse.”

The survey revealed that over half of American adults during the Great Recession claimed that they suffered from at least some kind of negative financial impact. Another half of those (over a quarter of American adults) say that they are now worse off than before the crisis began. As another example, AARP discovered that over half of American households possess no emergency savings at all.

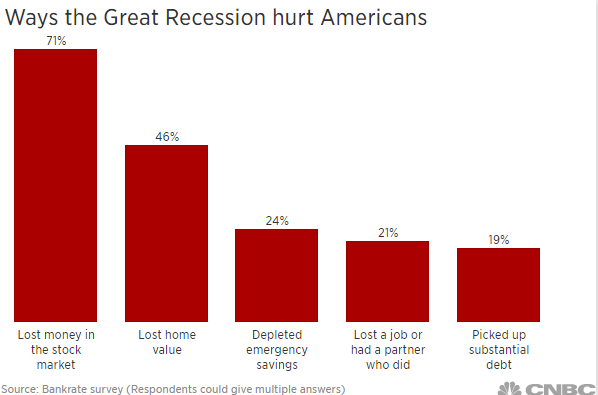

Only 46 percent of adults during the Great Recession have experienced paycheck growth since before the recession started. Over a third who lost their job in the recession (or their partner lost a job) claim that their pay is now less than before the recession began. This chart below reveals the ways that the recession harmed Americans more specifically:

Slowing Economic Growth and Lower Interest Rates Encourage Record ETF Gold Holdings

Amid the declining interest rates and slowing global growth, Exchange Traded Fund gold holdings achieved new record highs for the month of September. The most current data from the World Gold Council showed that global gold-backed ETFs increased their gold assets by 75.2 tons in the past month. This jump saw total gold holdings reach 2,808 tons to pass the last record set at the all time high price of gold in 2012.

For the year, worldwide ETF gold holdings have increased by 13.4 percent (368 tons) with every region of the world experiencing gold inflows for September. North American funds led the gold holdings growth, with a 51 percent increase to holdings for the year so far. Meanwhile central banks added another 57.3 tons of net golf for August.

The concerns this week about interest rates headed towards zero percent or lower in the U.S. are a reason for why gold makes since in an IRA. One way you can increase your retirement investment diversification is with IRA-approved gold. You can look into Gold IRA rules and regulations as well as Top Gold IRA companies to learn more.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81