- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Fed Makes Hawkish Statements Again: How to Take Advantage of Higher Interest Rates

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

The latest comments by Federal Reserve Chair Ms. Yellen have given the US dollar a boost and spooked the Bond market. Yellen made a speech at Harvard on Friday morning, and the market read her statements as being conclusive to more hikes during 2016. It would also seem more likely that an interest rate hike may happen as soon as the next Federal Open Market Committee meeting. An announcement on monetary policy is scheduled for June 15, at 2:00 pm.

Bond markets rout

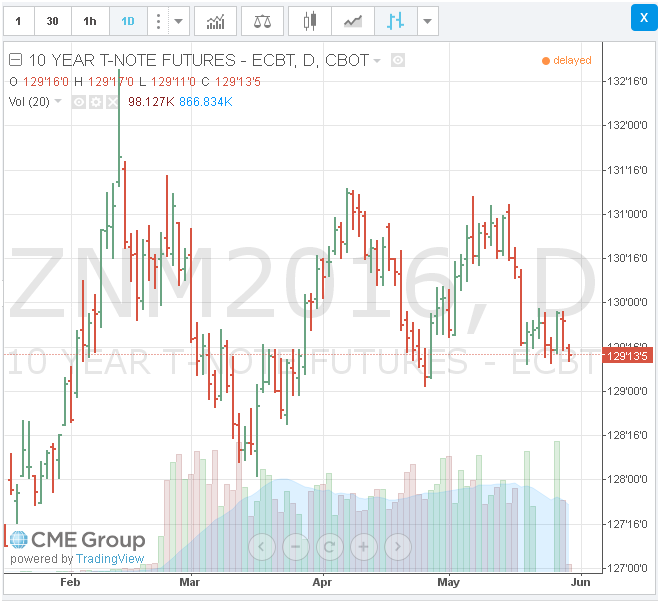

Whether or not the timing is right for the next FOMC meeting, the bond market seems to think it is highly likely. The Treasury bond market didn’t really get a chance to react to the speech by Yellen, as that market closed early on Friday due to Memorial weekend. However, the Futures market for Treasuries had plenty of time as it is open 24 hours and was trading on Monday 30.

The June Futures contract for the 10 year Treasury Note closed on Friday at 129.291/2 to open at 129.16. That’s a drop of 131/2/32s or approximately 0.42%. The price of Treasuries has been acting like a helter-skelter over the past months. The market has been subject to price swinging higher and lower depending on comments from the Federal Reserve or unexpectedly higher or lower economic data releases.

Directors from other Federal Reserve Banks had previously made statements as to the suitability of an interest rate hike as early as this June. These high-level officials from the Fed, however, have no vote on the Federal board that decides on monetary policy. Given that the hawkish take on rates is coming from the Chair itself, it is now beginning to seem more likely that not only there will be more interest rate hikes, but that the first one may come as early as the next meeting.

Intrinsic danger of bonds

A typical 2 asset portfolio is often considered to be made of 60% stocks and 40% bonds. More recently investors are also more likely to include other assets within their typical portfolio. These securities range from precious metals to Real Estate.

The average investor is becoming more sophisticated, and therefore the average portfolio will also include securities not so commonly held in the past. Investors hold Treasury Notes because of their low inherent risk. Given their high trustworthiness they also have a low yield in the current low-interest rate environment. That may be fine for as long as interest rates remain low as they have done for the past 7 years.

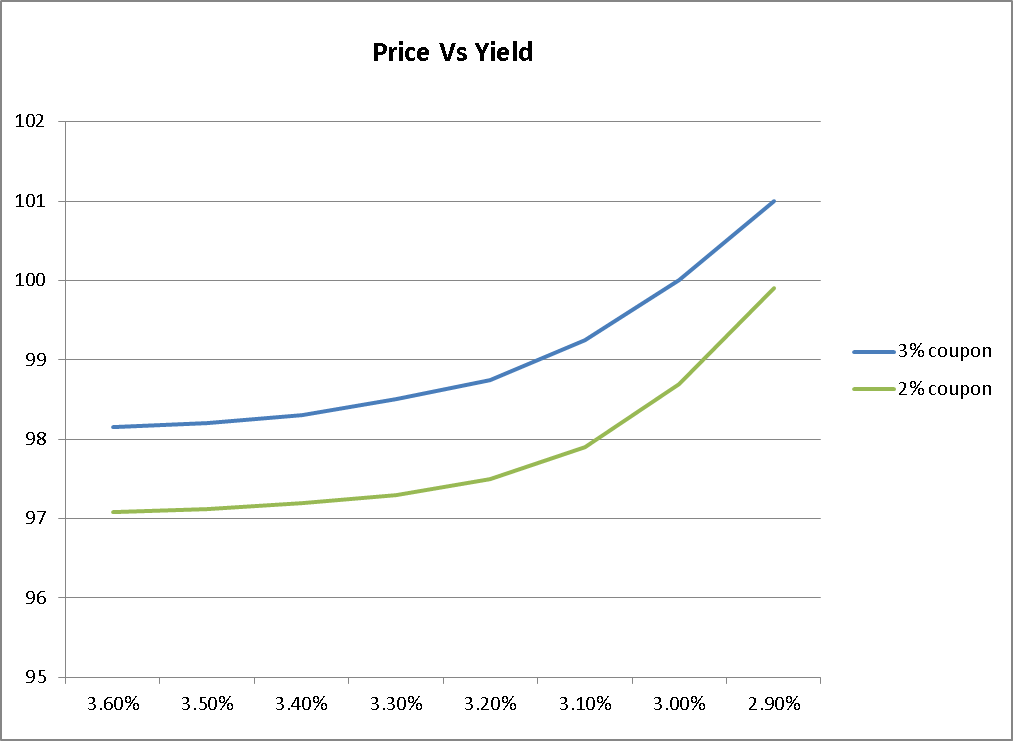

The problem with holding bonds arises when interest rates begin to rise again. From the Fed’s comments, it looks like we are definitely heading into a cycle of higher interest rates, whether we like it or not. Of course holding a 10 year Treasury Note until maturity will presume no loss, you will receive your cash back and considering the coupons you received your investment will have given you a well-defined return.

But if interest rates begin to rise during the holding period of your bonds, you will be missing out on earning a higher interest rate when compared to newly issued securities. Not only that but if you were to sell the bonds before maturity, you would lose money, as the market would want to pay less to buy a bond with a lower coupon. Paying less for bond compensates the buyer so that they can receive the same return as the newer higher coupon bonds.

Interest rate hikes can be your friend

There is a way investors use to protect against higher interest rate risk, and that is buying bonds that are linked to a variable interest rate. This indexation means that as interest rates increase so too will the bond’s coupon. The coupons on these bonds are reset at regular intervals. There are two types issued by the US Treasury TIPS (Treasury Inflation Protected Securities) and FRNs (Floating Rate Notes).

There are two main distinctions; the first is the duration of the bond, or the time until maturity. TIPS are issued for maturities that are of 5, 10 and 30 years. Whereas FRNs are issued for 2 years only, you can buy & sell previously issued FRNs or TIPS; you’re not obligated to hold them until maturity. Both can be bought in multiples of $100.

Secondly, but maybe most importantly, is the indexation of the coupon. TIPS are linked to inflation as quoted by the Consumer Price Index. This can be helpful when inflation increases are outpacing interest rate hikes. With FRNs, the coupon is reset on a weekly basis using the yield on the 13 week Treasury-Bill plus a Spread. This system can be particularly useful when interest rate hikes are likely to outpace inflation.

The spread on the FRN is calculated at the issue of the Note and stays the same until the bond matures. What will change is the coupon. Given the Fed’s stance on interest rates and the relative stability of inflation, FRNs seem a good way to gain some exposure to the upside of further interest rate hikes as we move through 2016 and enter 2017.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.67

Platinum: $931.67

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68