- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

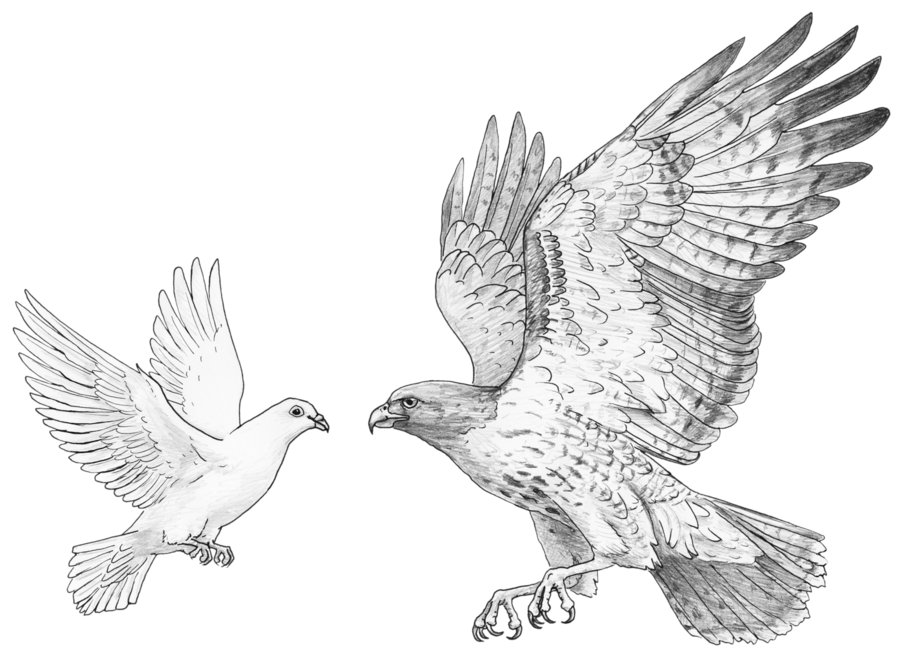

Fed Chair Yellen Has a Change of Heart and the Dove Takes Down the Hawk!

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 5th February 2016, 08:59 pm

The Federal Reserve has been getting us used to some sharp changes of heart from one meeting to the next. With talk taking a hawkish stance at one FOMC meeting being taken down by dovish talk as soon as the next. We saw this happen last year after the markets fell due to a rout of the Chinese stock market. The Fed then raised concerns as to whether the economy would be able to maintain its course and doubts as to whether an interest rate rise would be appropriately timed.

The dovish hawk or the hawkish dove

This bird talk can create a lot of confusion especially when the two nouns Hawk & Dove are mixed with their adjectives, Dovish & Hawkish. This can only add to the confusion in times of uncertainty and I feel that maybe even central bankers are not immune to this possibility.

A Hawk is someone who feels that the economy is going to overheat and cause inflation to rise; therefore the need to raise interest rates. Of course every central banker knows they need to be preemptive to have the greatest effect. A Dove is someone who feels that interest rates should go down to boost a contracting economy.

So with this in mind in December the stance from Yellen was Hawkish as the Fed had decided that the economy was still on course for expansion, despite the market debacle. This would cause jobs to increase and inflation to begin to raise its ugly head as demand for goods and services could only increase.

So we got what most in the market had been expecting, an interest rate rise of ¼ percent, the first rise in several years. However a month later the talk from Yellen’s last statement leaves some wondering if she is becoming more dovish again. Recent market turmoil at the beginning of the month and continued declines in crude oil prices mean that inflationary pressure might not be so strong.

It now looks like further interest rate increases may be on hold, with some analysts talking of the possibility that the Fed may need to lower rates back down again.

What has changed since December?

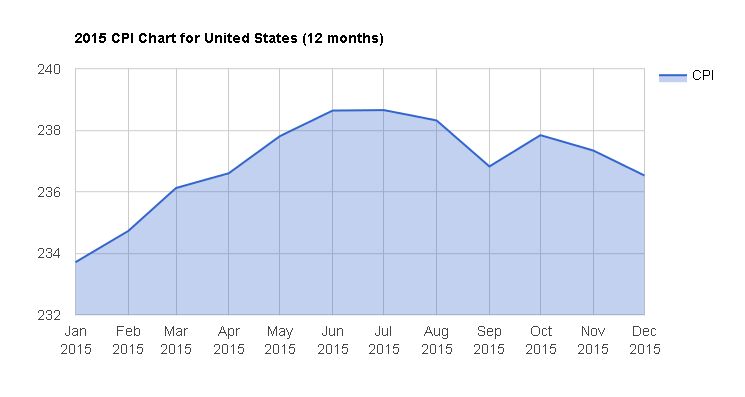

In terms of inflation there hasn’t been much of a change, the last 4 months of YoY inflation figures have been negative. And the most recent figure for monthly inflation was 0.7%, from the chart below you can see that the Consumer Price Index, a gauge for inflation, has been on the decline for several months.

Source cpiinflationcalculator.com

Source cpiinflationcalculator.com

One of the Fed’s main metrics is a 2% target inflation, forecasts are currently at 1.7% for this year, just slightly short. In fact in their last statement they still hold the 2% inflation rate as a target and state that they expect economic conditions will only improve at a pace that will warrant slower increases of interest rates.

Given the recent slowdown in China and other major economies coupled with a not so strong GDP growth they may be right. The Annual GDP Growth rate was down again at 1.8% in January, that made it three straight quarters in a row of declines.

source: tradingeconomics.com

Other weak economic data that is cause for concern is the Institute of Supply Managers Manufacturing PMI, which is well below 50. Latest data is at 48.2, readings lower than 50 indicate a contraction in economic activity. This data has been under 50 since October last year.

What hasn’t changed is strong job growth the latest data for Non-Farm Payrolls was a much higher than expected 292k additional jobs. That was much higher than the expected 200k and higher than an upwardly revised December data of 252k.

What to expect next

The latest Non-Farm Payroll data wasn’t enough to stop Yellen from expressing a more Dovish view and caution going forward, with a wait and see approach. The next Federal Open Market Committee meeting is scheduled for March 16th, so before that date there will be another 2 releases of Non-Farm Payrolls and plenty of other economic data in between. It will be a helter-skelter ride of predictions as to whether the Fed will raise rates at the next meeting or not, as we hear the Hawks and the Doves battle it out.

It’s hard to predict economic data but it does seem likely this interest rate rise has been precipitated. However Yellen knows that the economy cannot become complacent with very low interest rates. If there were an economic slowdown now the Fed would have no choice but implement negative interest rates. Although it wouldn’t be the first time for a developed country to do this it would still be unchartered territory for the Fed.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,385.11

Gold: $2,385.11

Silver: $27.83

Silver: $27.83

Platinum: $938.54

Platinum: $938.54

Palladium: $884.45

Palladium: $884.45

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81