- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Fed Buying Treasuries Again as US Manufacturing Sector Data Declines

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 3rd September 2019, 08:33 pm

This past week saw two key pieces of news released in the U.S. On the one hand, the Federal Reserve has purchased a substantial amount of Treasuries for its first time in nearly five years. In the last two weeks alone, the Fed bought up $14 billion in American government bonds.

They did this just ahead of the new U.S. manufacturing data that showed contraction in the sector. The ISM manufacturing PMI dropped to 49.1 percent in August. Any data under 50 equates to shrinking in the sector. It represented the worst results in over three years.

Has The Fed Opened Its First Round of QE4?

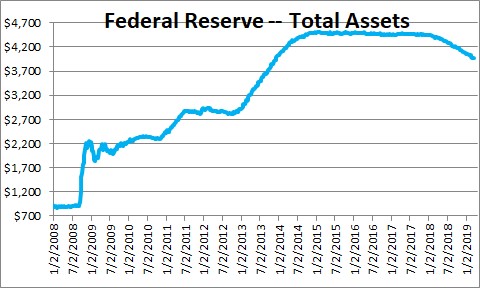

Until the second half of August purchases, the Federal Reserve had not not bought any significant quantity of Treasuries since October of 2014. This had been just shy of five years ago (at 250 weeks). Since concluding its last Quantitative Easing 3 program in 2014, the Fed had maintained a stable Treasuries holdings of approximately $2.6 trillion worth all the way to late in 2017. Their total assets were around $4.5 trillion at the peak.

At that point, they started their reduction of the Fed balance sheet. In 2018 and the majority of 2019, the Fed was selling off Treasuries as part of their balance shrinking project to return their holdings towards more historically normal (and according to many critics more acceptable) levels. They tapered and then ended this process through the summer. The chart below shows the last over ten years tally of the Fed's balance sheet:

Yet with August's substantial purchase, the Fed seems to have begun buying Treasuries again. No one is sure for how long they will do this as they have not yet provided definitive guidance. It is significant that the Federal Reserve also cut the interest rates in July for their first time in over a decade. Some economists like Peter Schiff of Euro Pacific Capital Management were already warning then that the interest rate cut would lead to a fourth program of quantitative easing. He called this the first cut on the road to zero interest rates.

In its defense, the Fed has been giving clues as to their intentions as far back as the spring. It was at this point that they tipped their hand on a new effort to monetize the skyrocketing U.S. debt once more. By April, the Treasury Department had reduced its estimate for Q3 2019 borrowing ahead of their anticipation that the Fed would raise their holdings of Treasuries. The Treasury Department referred to this in a statement in April. They said that their lower borrowing estimate resulted from changes to the “fiscal activity.”

Fiscal Activity Means The Fed Is Supporting the Treasury Department Again

It is important to understand what the Treasury means by “fiscal activity.” Reuters interviewed an undisclosed Treasury official on the subject. The official stated that:

“The fiscal change related to the Fed's plans to stabilize its massive portfolio of bonds relative to the size of the U.S. economy.”

Events in 2019 have supported this as Reuters reported. Back in February of this year, Jerome Powell the Fed chairman confirmed their intentions to end the balance sheet reduction program this year. Powell had stated that they will keep the balance sheet in the range of from 16 percent to 17 percent of the country's GDP. It redefines the Federal Reserve balance sheet to a new normal of from $3.2 trillion to $3.4 trillion. Their holdings of U.S. Treasuries comprise a major component of this total balance sheet.

Treasuries will continue to grow in importance on their balance sheet as the Fed continues to sell off its MBS (mortgage-backed securities). The Fed has intimated that it will keep the MBS rolling off and buying Treasuries with the proceeds indefinitely. It means that the American central bank is moving away from mortgage-backed securities assets and further into U.S. government bonds.

It is no accident that this is happening. The U.S. Treasury is in dire need of real aid to finance the enormous federal government deficits as the monthly Treasury statements reveal. For the 2019 fiscal year, the deficit has already exceeded the entire fiscal year 2018 shortfall. Econimica explained the apparent Fed about face in policy with:

“Since March 2019, when the Fed rolled out its plan, the Fed has ended its Treasury runoff sooner than they had communicated, cut rates as they said they would not, and is buying mid- and long-duration bonds while aggressively rolling off/selling off notes and bills… again opposite to what they previously communicated.”

There is a reason why the Fed has shifted its policy so dramatically.

U.S. Manufacturing Data Contraction Explains Fed Actions

The Fed's actions of the last two weeks can be better understood by looking at recent U.S. manufacturing data. The Institute for Supply Management showed that the manufacturing sector declined in August. For the month of August, the U.S. manufacturing Purchasing Managers' Index dropped to 49.1 percent. It was the first decline dating back to 2016 as well as the lowest result in over three years.

Chairman Timothy Fiore of the ISM Manufacturing Business Survey Committee declared in his statement that:

“Respondents expressed slightly more concern about U.S.-China trade turbulence, but trade remains the most significant issue, indicated by the strong contraction in new export orders. Many respondents continued to note global trade softness as a reason for sluggish activity.”

The expanded trade war against China has taken its toll on the American manufacturing sector that had been such a significant winner for the Trump administration. Just this Sunday, new tariffs began being assessed on $112 billion in Chinese goods. These are targeting household supplies and grocery items.

Manufacturing Data Reading Ends Three Year Economic Expansion

The contraction in August is important because it marked the end of 35 months of expansion. During this time frame, the PMI averaged 56.5 percent, per the ISM. This ISM data similarly revealed that employment and production measures contracted in August for their first time in nearly three years. In the ISM category of new export orders, the reading dropped to its worst since April of 2009. It was the second consecutive monthly decline.

The ISM data has also been corroborated by a new data release this week from IHS Markit on Monday. The data showed that American manufacturing PMI declined to 50.3 for August, the worst reading going back to September of 2009. It just managed to hold on to expansionary territory. Chief Business Economist Chris Williamson of IHS Markit stated that:

“The August PMI indicates that U.S. manufacturers are enduring a torrid summer. Output and order book indices are both among the lowest seen for a decade, indicating that manufacturing is likely to have again acted as a significant drag on the economy in the third quarter, dampening GDP growth.”

This week's news unfortunately shows declining economic activity and the Federal Reserve trying to get back in front of it by printing more money and putting it to work helping the U.S. Treasury finance its unsustainable debt. Their major new Treasuries purchases are another reason why gold makes sense in an IRA. It is easy to include IRA-approved gold in your retirement portfolio. You can review the Gold IRA rules and regulations and consider top Gold IRA companies and bullion dealers to learn more about it.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.67

Platinum: $931.67

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68