- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Does the ECB Possess the Will and Means to Save Italy and the Euro?

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last week saw a reluctant Italian President Mattarella finally accept the political reality on the ground in appointing the populist parties' desired Prime Minister candidate Giuseppe Conte as the first political novice to rule the country since the end of World War II. Italian bond markets have reacted very negatively to this inevitable turn of events in the third largest economy of the Euro Zone (and original founding member of the European Union). Toxic debt ridden Italian banks are already straining to compensate for the radically higher interest rates and bond prices wracking the country over just the last week.

This is the latest geopolitical reminder for why you need to include at least some IRA-approved precious metals in your retirement portfolio. Gold makes sense in an IRA because it has a thousands of years' long track record of safeguarding the value of money and wealth. You should start reviewing Gold IRA allocation strategies now.

Italian Populists Triumph and Take Power in Italy – Here's What They Want

Newly sworn in in Italian Prime Minister Conte just wants a little respect. He has what at least sounds like noble goals for his new anti-EU ministerial cabinet and populist-powered agenda:

“We will work intensely to realize the political goals of our agreement, and we will work with determination to improve the lives of all Italians.”

The problem is that his new coalition, which heavily features anti-immigrant populists, the far-right, and demagogues, has the potential to at least damage the entire European Union project, if not to blow it to pieces outright. A few weeks ago, the true wishes of the victorious populists appeared in the press in the form of this leaked document.

It more than casually suggested that the fledgling government was contemplating a future exit from the single currency and the Euro Zone. Another threat was that it could demand the European Central Bank void around 250 billion euros of Italian public debt as well as lessen the tough economic sanction against Russia. Everyone wondered what a populist government in Western Europe would like, and now they know.

Italy Has the Potential to Be the Next and Far Worse Greece

It is not at all an exaggeration to declare around a decade following the long-lasting Greek sovereign debt crisis (which scared markets badly) that Italy is in line to become the latest and far-worse next weak link in the Euro Zone's proverbial chain. Italy's fiscal position is so bad today that it is raising fears concerning the future of the single currency and the financial system of Europe itself all over again. This is the so-called “existential threat” to Europe that Hungarian born billionaire George Soros warned about only a few weeks ago.

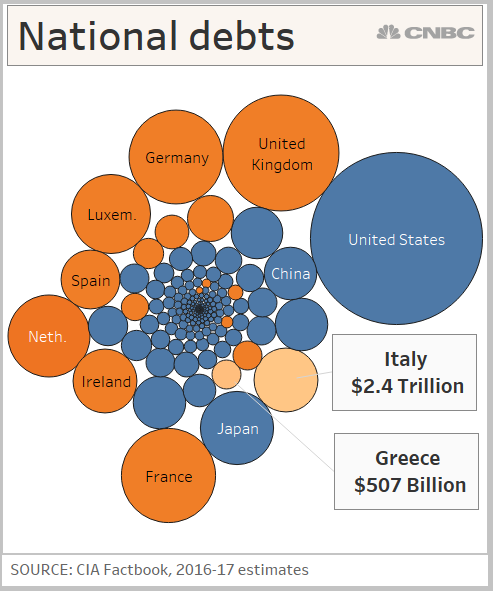

The real problem is that the numbers in the case of Italy are far worse than they were with (economically tiny by comparison) Greece, as this graphic below clearly shows:

Resident Fellow Desmond Lachman of the American Enterprise Institute recently warned in his blog post:

“Italy's economy is 10 times larger than that of Greece, whose debt crisis shook the euro area's foundations. The single currency is unlikely to survive in its present form if Italy were forced to exit that monetary arrangement.”

There are serious reason to be concerned, all the more so after the first populist government in Western Europe emerged in Rome just this last week. The economy of Italy has struggled badly since the Global Financial Crisis and Great Recession era a decade ago. Its bank and national debt loads rival Greece's untenable fiscal position in debt to GDP levels. Greece had to drastically cut its own expenditures on public services and fell into a devastating recession as a result of the painful austerity measures imposed by its trifecta of intergovernmental creditors over the last decade.

While Italy has been attempting to resolve its own debt problems, their debt crisis has so far proven impossible for a number of Italian governments to properly address and solve effectively. The central bank of Italy warned last Tuesday that the country stood a mere “few short steps” away from watching investor confidence in the country and its bonds evaporate.

The financial market selloff from last week shook the nerves of even the most ironclad investors. Now analysts are speculating on what the damage to the rest of the Euro Zone and even entire 27 remaining member states of the European Union will be if Italy withdraws from the block. Many have claimed that such a “QuItaly” departure has the very real potential to fatally impact the economic and political union of more than 25 years time in the wake of the still ongoing and horribly messy Brexit.

Investors Speculating How ECB Will Save Italy and the Euro Zone from Breakup

Investors have taken to speculating anew on what the European Central Bank will now do in order to stave off the rapid surge in Italy's debt yields. These have already moved up so aggressively that they are causing severe distress for Italian banks now. It has once again raised the ugly specter of a Euro area breakup.

In order to support the Italian system, the amount of funds needed to backstop it would amount to an eye-watering trillions of euros. The IMF only has 500 billion euros to throw at the problem. Even taking into account the European Stability Mechanism's 400 billion euros, this would still leave the rescue fund woefully short of a good 1.5 to 2 trillion euros in rescue funding necessary to stave off a mass Italian banking collapse and government default.

It helps to explain why the Italian bond market experienced its worse selloff in an astonishing 26 years over the last week. European and global investors have not taken their expectant eyes off of the ECB since the carnage paused over the past weekend. Saxo Bank Head of Foreign Exchange Strategy John Hardy warned:

“If this continues for another couple of sessions, I think you will have to see some official (European) response. It becomes a ‘whatever it takes' kind of moment.”

It is really hard to imagine the ECB simply standing idly by and watching as Rome financially burns to the ground and so kicks off another existential crisis for all of the Euro Zone. The ECB's paltry 30 billion euros per month of quantitative easing in Italian debt purchases seems a joke today compared to the rapidly growing magnitude of the fiscal problem in Italy. The national government has to refinance upwards of 200 billion euros in debt every year.

What may be holding the ECB back is fierce popular and political resistance in Germany to propping up Italy. One EU monetary official opined anonymously that:

“It raises a lot of issues again, but if we get into a situation where Italy starts slipping into a crisis this is potentially a very big deal. The size of the problem is bigger than anything we have had to deal with.”

Besides this, receiving such help from the ECB and IMF would come with many restrictive chains attached to it. The ECB rules on deploying this OMT weapon revolve around a dreaded European Financial Stability Facility and European Stability Mechanism program. This would involve a macroeconomic adjustment program.

Undoubtedly this would be unacceptable to the brand new populist government in Italy that has campaigned so successfully and resonantly against European meddling in Italian affairs. Their base is convinced that Rome has long ago lost its financial independence to the out of touch bureaucrats in Brussels. Retiring Vice President of the ECB Victor Constancio warned in his interview to Spiegel magazine last week that:

“Italy knows the rules. They might want to read them again.”

This means that we are once again heading to a potentially globe shaking Euro Zone game of chicken in which each side holds on tight hoping the other will blink and swerve at the last minute. The real question nowadays is: does Italy really want this kind of help? Its other choice would be to affect a Quitaly from either the Euro Zone or even the entire European Union potentially (if enough carnage and bad blood results).

Remember too that the ECB governing council must approve such a bailout before it can be extended, as Francesco Papadia the former Head of Market Operations for the ECB reminded:

“Without that reassurance on Italy's future in the euro, the ECB would be trying to save ‘a country that doesn't want to be saved'. I would find it very difficult for the Governing Council to approve that.”

This is the latest pressing reason for why your retirement portfolio is urgently screaming for IRA-approved gold. You can now buy gold in monthly installments and vault it in respected top offshore storage locations which the IRS now approves as well. Do something while you still have the luxury of time.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,385.11

Gold: $2,385.11

Silver: $27.83

Silver: $27.83

Platinum: $938.54

Platinum: $938.54

Palladium: $884.45

Palladium: $884.45

Bitcoin: $67,337.49

Bitcoin: $67,337.49

Ethereum: $3,245.06

Ethereum: $3,245.06