Disney Among Latest Major Companies Laying Off Workers in U.S.

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

This past week the news emerged that Disney was forced to let go of 28,000 employees throughout its division of parks, experiences, and consumer products. The extended closures at their theme parks in California coupled with reduced attendance at the theme parks that are open have dramatically impacted the iconic company's finances. Disney joins a growing list of other historic national and international companies that have laid off employees across America this past month.

Disney Theme Parks Continuing Closure Massively Impacts Company Finances

The Disney Head of Parks Josh D'Amaro sent out the bad news memo to Disney employees on Tuesday. He explained a few “difficult decisions” that the historic company had to take after the coronavirus pandemic devastated their business. This included ending the temporary furlough of thousands of workers for the company. Approximately 67 percent of the 28,000 let go employees worked as part timers per D'Amaro's statement Tuesday. Disney would not offer a layoff breakdown for the various theme park locations.

Some of the company theme parks did open back up with restricted attendance capacity. These included the Disney parks in Florida, Paris, Japan, Shanghai, and Hong Kong. The company's enormous (and original) Disneyland theme park and its California Adventure are still closed in Anaheim, California. D'Amaro explained the company's choice in the memo released to company employees (obtained by CNBC):

“As you can imagine, a decision of this magnitude is not easy. For the last several months, our management team has worked tirelessly to avoid having to separate anyone from the company. We've cut expenses, suspended capital projects, furloughed our cast members while still paying benefits, and modified our operations to run as efficiently as possible, however, we simply cannot responsibly stay fully staffed while operating at such a limited capacity.”

This parks, experiences, and consumer products division of the Disney company is crucial to the firm's all around business operations. In 2019 it amounted to 37 percent of the Disney total revenue of $69.6 billion.

Disney Can't Stop Bleeding Out Money

Disney has continued to bleed out money since the beginning of the pandemic. They had exposure in Asia because of their Japan and China theme parks that made their financial position even worse. For the Q2, Disney reported a corporate loss of $1 billion in its operating income thanks to the closures of various parks, cruise lines, and hotels. The situation worsened in the third quarter with the firm announcing a sharper loss amounting to $3.5 billion. The park shutdowns for August alone have cost Disney $3.5 billion.

D'Amaro has not been idle in this time. His team has worked tirelessly to impress the state legislators of California that the theme parks need guidelines to reopen. Just the past week, Disney offered an update to the media that CNBC reported to showcase their success in reopening both the Florida parks and their international locations in Paris, Japan, and Shanghai.

This update went to great lengths to present the company's improved safety measures it has already enacted. Policies in place at Disney Theme Parks include widely offered sanitation stations, a requirement to wear masks, paying without cash, and advance online meal ordering with mobile delivery. According to D'Amaro, Disney's troubles from Covid-19 have only been:

“exacerbated in California by the State's unwillingness to lift restrictions that would allow Disneyland to reopen.”

The California Governor Gavin Newsom detailed his four level framework to reopen the state back in the end of August to make restrictions less burdensome for the businesses operating in the state. This was based on how widely coronavirus was spreading on a case by case county basis. Unfortunately for Disney, their primary county of operations is Orange County in the “substantial” tier level. According to this threat level, all theme parks have to stay closed per the website of California. Orange County boasts a county positivity rate of 3.1 percent which is less than the state's average of 3.4 percent.

Yet the county does report approximately 4.4 new coronavirus cases for every 100,000 individuals on a daily basis, and this keeps it from proceeding with additional openings. The governor told reporters back in a press conference near the end of August that the officials in the state were working “actively” with the various theme parks around California including Disneyland.

Many Other Major Companies Announce Layoffs in September

Disney is far from alone in its corporate woes that are leading to mass layoffs. Many other corporate icons have followed suit in the past month. On September 22nd, Ralph Lauren announced it was slashing its worldwide employment base by 15 percent in order to save the iconic retailer a yearly $180 million. Carnival the famous cruise line enacted its second round of personnel cutbacks on September 21st as it cut down significantly on the size of its fleet.

Even Technology, Banks, and Defense Contractors Are Laying Off Substantial Numbers

Even companies once thought to be more immune to the ravages of the virus are now finding themselves with little choice but to lay off employees. Victims have been claimed in technology, banking, and defense. Dell the computer maker announced September 14th it will begin to cut an unknown quantity of positions to slash costs.

Citigroup the banking giant is also feeling the squeeze. They are letting go approximately one percent of their entire worldwide staff as they announced September 14th. This came despite their previous pledge to not layoff any additional staff in the midst of the ongoing pandemic.

Aerospace and defense behemoth Raytheon Technologies would have been considered immune to a pandemic a year ago. On September 17th it revealed that it is cutting 15,000 jobs from its global staff too. Likely other defense contractors based in the U.S. will find themselves making similar tough choices in coming months.

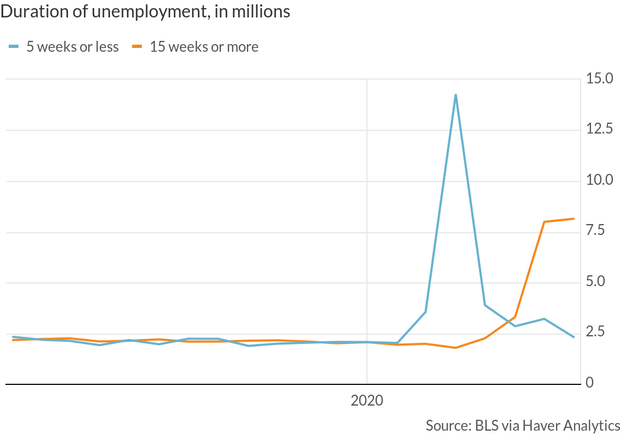

Unfortunately the news from this past week continues to point to grim economic fallout from layoffs in the U.S. and around the world. It is a reason that Gold makes sense in an IRA. One way to achieve diversification of your retirement and investment accounts is through precious metals. You can learn more by reading about Top 5 Gold IRA coins for investors and Gold IRA rules and regulations. More information is also available on the Top Gold IRA companies.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,332.82

Gold: $3,332.82

Silver: $36.10

Silver: $36.10

Platinum: $1,361.29

Platinum: $1,361.29

Palladium: $1,115.65

Palladium: $1,115.65

Bitcoin: $105,607.89

Bitcoin: $105,607.89

Ethereum: $2,404.72

Ethereum: $2,404.72