- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Destabilizing Iran’s Impact on Oil Reminds Why You Need Gold in Your Portfolio

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last week you saw the most serious protests in nearly a decade break out in Iran. These were widespread across the Islamic country. Most interestingly, they took place in towns and with working class young people that are traditionally pro-regime. Around 20 individuals died so far. The victims were not only protesters but a few policemen as well. This is a situation that bears close watching in one of the largest oil producing countries in the world.

Difficult to predict geopolitical events that destabilize the price of oil and threaten the world economy and financial markets are one of the key reasons that you need to hedge your portfolio. Gold protects against market turbulence. This is why you need gold in your IRA today. Nowadays you are even allowed to store IRA-approved gold offshore. You should consider the top 5 offshore storage locations for your gold IRA.

Iranian Government is in a Dangerous Position

The Iranian government is finding itself in a dangerous position thanks to these country-wide protests that do not have any apparent leaders to arrest. On the one hand, if they allow the protests to continue raging unchecked, they run the risk of emboldening the protesters. This could cause the protests to spread and eventually even for chaos to rule on the streets throughout Iran. The regime might even lose control of the country over them if they are allowed to go on for too long.

If they instead crack down hard on the protests, Iran runs the risk of arousing another round of sanctions from President Trump and the United States. These sanctions would be for humanitarian violations. The U.S. President has already been threatening as much in just the last few days. The irony is that both scenarios would likely lead to higher oil prices, since the amount of oil that Iran exported would likely be reduced, possibly significantly.

You know the hard line fundamentalist regime in Tehran is desperate when they start to talk about promising to hear out the protesters' demands. The Islamic Republic News Agency official media cited Labor and Social Affairs Minister Ali Rabei as stating:

“We are all responsible when it comes to recent events. The government and authorities will listen to people's demands and will make every effort to materialize them.”

On the surface it sounds like the regime is giving in to protesters in an effort to diffuse the street protests, but meanwhile the government is taking the offensive. It is putting its own people on the street to protest in support of the government in what they refer to as spontaneous counter rallies.

Potential is for Protests Spreading to Saudi Arabia

Another real danger to the region (and oil prices) comes from neighboring countries. Saudi Arabia in particular is vulnerable to the possibility of this protest movement spreading across the borders. It has a few elements in common with Iran that make the key swing oil producing kingdom a likely sympathetic breeding ground.

Like Iran, Saudi Arabia boasts a younger population. Neither of the two countries had a “Spring Revolution” as did other Middle Eastern countries like Egypt and Tunisia either. A Saudi Arabian protest movement that threatened the oil exporting friendly regime would also be bullish for oil prices.

Possibility Exists for Hostilities Between Iran and Saudi Arabia

As unlikely as it might at first sound, the protests could even lead to an open conflict between Iran and Saudi Arabia. The reason for this is that the regime in Tehran holds its so-called enemies responsible for the outbreak of Iranian protests. Iran did not specifically name any names, but their number one regional enemy and rival is Saudi Arabia.

Their mutual diplomatic ties have been increasingly worsening since two years ago. At that time, the Saudis moved forward on their pledge to execute an important dissident cleric Nimr al-Nimr. He was a Shiite Muslim like the Iranian population.

Such open armed conflict between the two nations could seem to benefit a number of regional and global parties unfortunately. Saudi Arabia in particular is one of those that stands to gain from higher oil prices on several fronts. Greek-based transportation and oil expert Theo Matsopoulos expanded on this idea with:

“Saudi Arabia has based its economy on revenues from oil. The program Vision 2030 inspired by Bin Salman is calculated at 261 billion USD, in order to change and transform KSA's economy – which is currently in a recession – from oil dependent to a more open western economy. The financing of this project could derive from the privatization of ARAMCO, which needs as higher as possible oil price.”

U.S. and Russia In Favor of Higher Oil Prices Also

Two of the world's great superpowers also have an incentive to see increased oil prices these days. The United States has already tipped its hand with the Trump administration increasing its calls for new sanctions on Iran. This also reinforces President Trump's argument for abandoning the 2015 nuclear agreement with the Islamic Republic.

The U.S. would gain as jobs were created again in the oil shale industry and domestic energy production increased apace. A potential conflict between Saudi Arabia and Iran could also mean more weapons orders, as Theo Matsopoulos explained:

“The higher prices that could result from the disruption of oil supply, would benefit US shale gas exporters. And the war could bring new orders to the American weapons industry from the replenishment of ammo and new aircraft to artillery.”

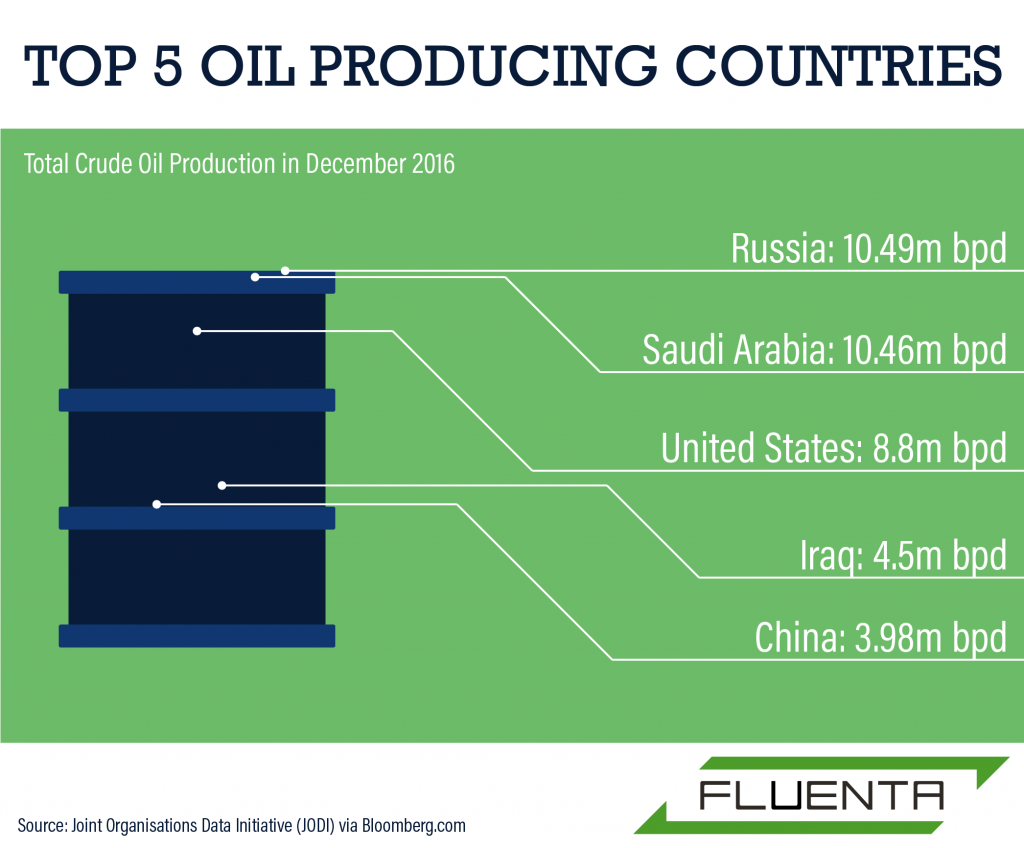

Russia also stands to benefit from higher oil prices the spreading of a crisis from Iran to Saudi Arabia could bring to the energy commodity. As among the world's largest oil producers, they may have the most to gain as the graphic below shows:

Their economy has been teetering on recession since oil prices plunged several years ago. Now they need an increase in oil prices so that they are able to balance their government budget. This currently amounts to a full 3.4 percent of their entire GDP.

Oil Could Skyrocket Higher in Consequence

Oil has been trading relatively flat at around $60 per barrel lately. This could quickly change as some of this perfect storm (started by Iranian protests) surrounding oil production and exports occurs. History has shown that such crises can push oil up to $100 and even more per barrel. This rapid escalation was certainly the case when such protests led to the Iranian Revolution originally in 1979. Given the volatility of the energy markets, there is nothing to prevent it from happening again.

Higher oil prices may be good for a few countries that are large producers of it. It is not good for you personally or for your retirement portfolio though. Unstable and rising oil prices have caused economic recessions several times in the past. They have the capacity to take away the steam holding stocks and bond prices up.

This is why you need to be able to rely on the world's historically proven safe haven asset to protect your retirement accounts. Gold outperforms in times of market crisis and rising oil prices. Gold and other IRA-approved metals will help to offset losses in other assets vulnerable to oil price shocks. Now would be a good time to learn more about Gold IRA rules and regulations as well as what is involved with a Gold IRA rollover.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81