December 2021 Newsletter: Black Friday for Alternative Assets, Steep Discounts on Gold, Silver, and Bitcoin Amid Generational Inflation

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 3rd December 2021, 02:13 pm

Black Friday sales have stuck around a little longer this year.

Right now, it’s a buyer’s market for alternative investors. As we roll into December, gold, silver, and Bitcoin are all currently priced at a discount.

Gold is trading at $1,783 an ounce, down from $1,867 on November 21st (-4.5%).

Silver is trading at $22.39 an ounce, down from $25.40 on November 12th (-11.5%).

Bitcoin is down the most on the month (-8.67%), trading at $56,500 per token after starting the month over $63,000 and breaking an all-time high of $67,582 on November 8th.

It's only a matter of time until we see Bitcoin once again hit new all-time highs.

If you take advantage of Bitcoin’s recent drop, you might set yourself up for a generous Christmas present later on. After all, Bitcoin has historically performed well in the days following Christmas (+2.57% average gain between December 26th and 29th)

Not only is it a good idea to capitalize on the dip, but taking a position in alternatives right now might help fortify your portfolio in the inflationary period ahead.

Fed Chair: “Transient” Inflation is No More

The consumer price index is currently at its highest point since 1990 (6.2%), and Fed Chairman Jerome Powell finally said it himself: inflation can no longer be called “transient”.

By all indications, we’re in this for the long haul, and any prudent investor would be wise to prepare their portfolio for a slow and prolonged period of inflation. Because when the Fed finally hikes interest rates, the end result likely won't be pretty for the stock market.

Consider that over 600 of America’s biggest publicly-traded companies are “zombie firms”—that is, unprofitable companies unable to service their debt without borrowing at low cost. They include Macy's, Marriot International, Exxon Mobil, and all our top airlines such as Delta, United, Southwest, and American. They share $2.6 trillion in debt obligations between them.

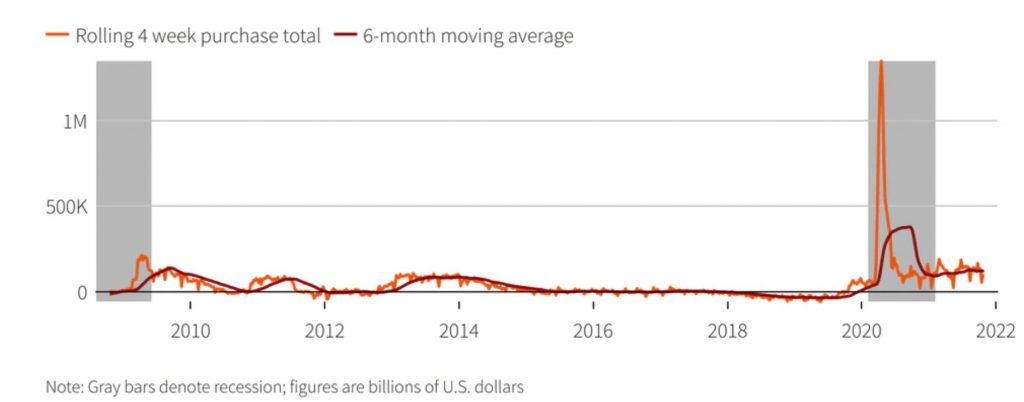

To combat inflation, the Fed is already grinding their bond-buying operation to a halt. Sooner than later, once the quantitative easing program is finished, we're going to have to increase the cost of borrowing. When that day comes, what will happen to the zombie firms that our economy depends on?

The Fed's bond-buying program is slowing to a halt. (Source: Reuters)

We can’t endure another round of government bailouts if we're serious about strengthening the U.S. dollar. That also means we can't afford to keep borrowing costs near-zero for much longer.

The good news is that the best available tools for protecting wealth amid inflation and stock market uncertainty are currently priced at a discount. To protect your portfolio, inquire about opening a tax-advantaged precious metals IRA or a self-directed Bitcoin IRA today.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,348.95

Gold: $3,348.95

Silver: $38.17

Silver: $38.17

Platinum: $1,443.60

Platinum: $1,443.60

Palladium: $1,294.77

Palladium: $1,294.77

Bitcoin: $118,036.85

Bitcoin: $118,036.85

Ethereum: $3,549.24

Ethereum: $3,549.24