- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Provident Trust Group Review: Are They Still Worth Trusting With Your IRA?

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Provident Trust Group

- Phone : (888) 662-0869

- URL :

- Global Rating

- Very Good

User Rating

- 0 No reviews yet!

Review Summary :

Provident Trust Group proves to be among the most popular IRA custodians. They boast of over $6 billion of assets in custody with over 34,000 clients throughout all 50 of the states. They can provide services including trustee, agent, co-trustee, custodian, and successor trustee to their IRA clients. However, the company does have steep annual fees of $295. In addition, these fees don't include precious metals storage which is something to take into account when selecting an IRA custodian.

Pros:

- Their clientele base of 34,000 covers all 50 states

- Services include trustee, agent, co-trustee, custodian, and successor trustee for their IRA clients

- They offer a significant range of investment choices for their clients

Cons:

- The annual $295 administration fee is among the highest in the industry of the best administrators

- These fees do not include precious metals storage

Quick Facts about Provident Trust Group

Year Founded:2008

Company Headquarters:Las Vegas, Nevada

Reviewed By:Wesley Crowder

Have you purchased products from Provident Trust Group? Leave a review!

Provident Trust Group (PTG) (www.trustprovident.com) is one of North America's most popular IRA custodians, with more than $6 billion worth of assets in custody and more than 34,000 clients across all 50 states. Founded in 2008, the company is based in Las Vegas, Nevada, and is led by a team of qualified financial professionals and tax attorneys. PTG is able to serve as the agent, trustee, co-trustee, successor trustee, or custodian of an IRA account.

Table of Contents

Provident Trust Group Management

Until 2018, the CEO of Provident Trust Group was Theresa Fette, a nationally recognized specialist in business planning, taxation, trusts, and alternative assets. In 2012, Fortune Magazine rated Theresa Fette as one of the most powerful women entrepreneurs.

However, since Fette left Provident Trust Group, the company has not been forthright about its current leadership team.

Provident Trust Group Prices and Products

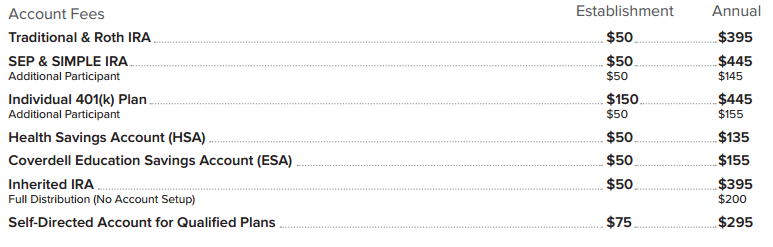

Provident Trust Group offers a variety of custodial and administrative services to individuals, advisors, and institutions. The following is a screenshot of Provident Trust Group's official fee schedule:

The only number that gold IRA investors should pay attention to in the screenshot above is the bottom figure – the annual cost of a self-directed IRA, as this is the type of account you'd be using. It is important to note that the cost of storage is not included within the $295 annual cost mentioned above – according to the ‘Depository Information' section on their Direction of Investment form for precious metals, which states that they use Delaware Depository and that clients are responsible for paying a storage fee each year. Note that this policy differs in contrast to the policy of some custodians who cover the cost of storage within a flat-rate annual charge. The majority of the custodians on this year's top 10 list include the cost of storage within their respective annual fees.

Provident Trust Group Ratings & Complaints

- Better Business Bureau: ⭐⭐️, C – Not Accredited (Details)

- BBB: 14 complaints closed in last 3 years (Details)

- Business Consumer Alliance: Rating B (Details)

- Yelp: ⭐⭐️ Based on 35 Reviews (Details)

- Trustpilot: No Profile

- Facebook: 1.1K followers

Provident Trust Group Contact Details

- Address: 8880 W. Sunset, Ste 250, Las Vegas, NV 89148

- Toll-Free Phone: (888) 855-9856

- Local Phone: (702) 434-0023

- Email: info@TrustProvident.com

- Website: www.trustprovident.com

Consider All Options Before Investing

At first glance, investing in a precious metals IRA may seem like a simple and straightforward process. While most major custodians and bullion dealers are in fact reputable enough to honor their own fee policies and guidelines, that doesn't mean that all of their fees and policies will be the same. The safest and most cost-effective investment is always ideal, which is why anyone interested in an IRA should begin their research by comparing the reputations, policies, and annual fees of the top precious metals IRA custodians before making an informed investment decision.

Although signing up with a custodian directly may appear to be the best way to “cut out the middleman,” this is not always this case. Some bullion dealers and Gold IRA companies will offer to waive the setup, storage, and admin fees for your IRA if you open the account through them with their partnered custodian(s). These companies can also sell you IRA-eligible gold products and have them shipped and delivered directly to an approved depository to be held in the custody of your preferred custodian.

The point is – it can be worthwhile to set up your precious metals IRA through a bullion dealer that will help you conveniently open and stock the account with the appropriate coins and bars, while also waiving some of the custodian fees that you would have been charged if you had signed up with the custodian directly instead. With that said, you should continue your research by comparing the top bullion dealers/Gold IRA companies, as these are the companies that the individual investor deals with to set up, and buy gold for, a Gold IRA.

Contact Us if You Own or Represent Provident Trust Group

If you're an owner, representative, or associate of Provident Trust Group and you've found any of the details in this review to be outdated, inaccurate or misleading, please do contact us with your concerns. We strive to provide the most useful and accurate review on an ongoing basis. As such, we'll honor any revision or removal requests that are in line with that goal.

Why Broad Financial is Ranked #1 IRA Custodian of 2024

While building this year's list of the top 10 IRA custodians, we considered a total of 37 different companies before narrowing down the candidates presented in the finalized custodian comparison table. We've made it easy for anyone to conduct their own research regarding the history, features, reputations, and fees of the leading precious metals IRA custodians. Each company has been thoroughly researched and ranked based on the following factors:

- preferred/partnered depositories and storage options

- whether storage fees are included in the annual charge – some companies require you to pay storage fees in addition to annual administration/renewal fees

- setup charges and account startup cost

- fee structure – sliding scale annual feesvs. flat-rate annual fees

- company reputation and industry presence

In addition to excelling in the above aspects, Broad Financial also ranked as the #1 custodian this year because of their compatibility with Augusta Precious Metals, a top-rated company on 2024's list of the top Gold IRA companies. Broad Financial partners with bullion dealers, brokers, and investment firms to bring retirement investors cost-effective, streamlined access to precious metals IRAs.

If you'd like to learn more about the advantages of opening a Broad Financial precious metals IRA through Augusta, check out our full review of Augusta Precious Metals.

Provident Trust Group

- Phone : (888) 662-0869

- URL :

- Global Rating

- Very Good

User Rating

- 0 No reviews yet!

Review Summary :

Provident Trust Group proves to be among the most popular IRA custodians. They boast of over $6 billion of assets in custody with over 34,000 clients throughout all 50 of the states. They can provide services including trustee, agent, co-trustee, custodian, and successor trustee to their IRA clients. However, the company does have steep annual fees of $295. In addition, these fees don't include precious metals storage which is something to take into account when selecting an IRA custodian.

Have you purchased products from Provident Trust Group? Leave a review!

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81