- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Midland Trust IRA Review: Illinois’ Best IRA Provider?

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Midland IRA Review

- Phone : +1 239 333 1032

- URL :

- Global Rating

- Good

User Rating

- 0 No reviews yet!

Review Summary :

Midland IRA is a custodian for thousands of different precious metals IRAs. Besides this, they offer a constant and continuously refreshed array of educational materials for IRA accounts. Their educational and record keeping services benefit both novices and professionals. The firm delivers options of flat rate yearly fees as well as sliding scale fees.

Pros:

- The educational materials offered give this company a client-centric appeal.

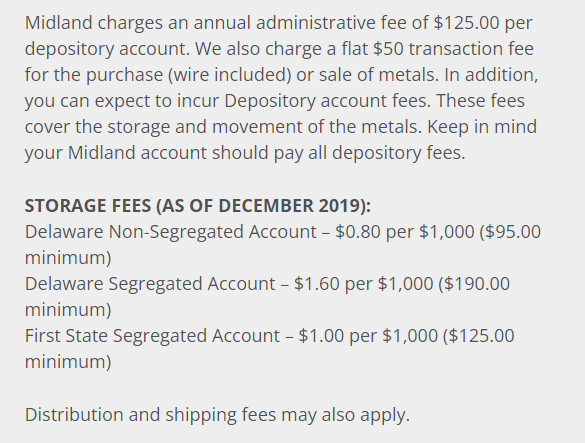

- They provide both sliding scale and flat fee yearly charge options. Low minimum storage fee starting at $95.

- Their focus is on both novice and professional level investors.

- Offers top-tier storage facility and segregated holdings option.

Cons:

- They do not offer as many investment classes and choices as some larger rivals.

- High transaction fee of $50 per purchase or sale in bullion.

Quick Facts about Midland IRA Review

Company Headquarters:Chicago, Illinois

Reviewed By:Wesley Crowder

Published On:February 10, 2023

Have you purchased products from Midland IRA Review? Leave a review!

Midland IRA (www.midlandira.com/) is a Chicago-based IRA administrator and custodian that specializes in helping their clients invest in alternative assets like precious metals within self-directed retirement accounts. The company acts as the qualified trustee (custodian) of thousands of precious metals IRAs. They also provide recordkeeping services and a continual supply of educational material for IRA professionals and investors.

Table of Contents

About the Management

Midland IRA is an employee owned company. In January 2022 the company reshuffled the top management. Brandon Hall took the role of President, he is a co-founder and employee of the company having joined in 2004. Dave Owens, previously President and CEO since the founding of the company in 2002, remains as CEO. Dave Owens is also a board member of the Sinabel Captiva Community Bank, Florida, since 2004. From 1997 to January 2022, Dave Owens also had a leading role for 1031 Tax Free Strategies, LLC, as the company Principal.

Another leading figure is the Chief Technology Officer (CTO), Joe Stolz, who joined Midland IRA in 2015 as a business systems manager. In 2020 he became the CTO, and in 2021 also took on the role of executive vice president. You can see more profiles of the top management team and sales staff on Midland IRA's Meet Our Team page.

Midland IRA Prices and Products

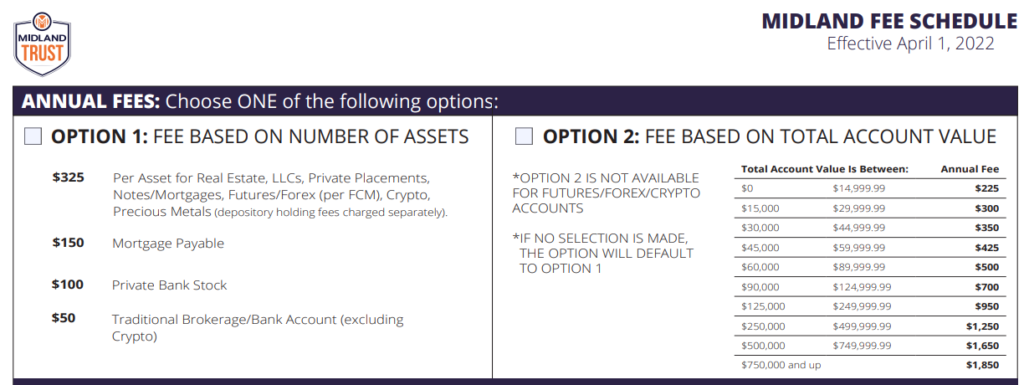

Midland IRA specializes in a broad range of alternative investments within self-directed IRAs, including precious metals. They act solely as the qualified trustee/custodian of the account and do not provide any bullion or other precious metals products. Below is a screenshot of their fee schedule for a precious metals IRA with Midland IRA:

Note that in the above screenshot you'll see two options for annual fee payment. Most investors choose the first option, which gives them flat-rate annual fee, as opposed to the second option, which gives them a sliding scale fee that could become more expensive in the long-term.

Note that if you want to invest in crypto, forex, or futures you must use option 1. Option 2 may look more expensive, however, it depends on which assets you intend to hold, how many types, and account size. For example, if you hold real estate and gold, and your account value is less than $90,000, with option 2 you will pay $500. However with option 1 you will pay $325 X 2, or $650.

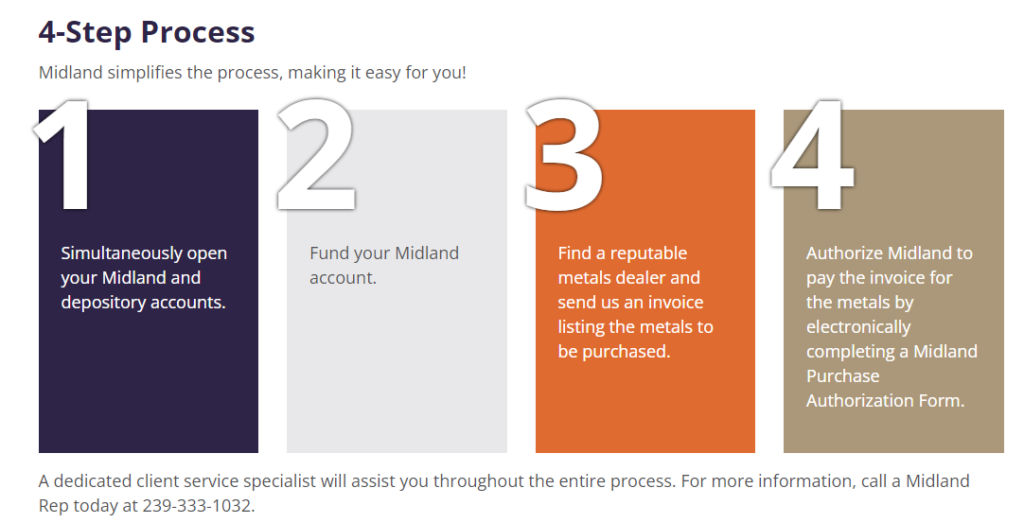

Midland IRA have a streamlined process for you to buy gold, silver, platinum, and palladium for your Self-Directed IRA. They out line the 4-step process as shown in the image below.

The storage fee schedule for Midland IRA is in line with the industry standard. Although their transaction fees are slightly higher than average at $50 for each purchase or sale of precious metals. However, they do offer top a security location for storage at the Delaware Facility, and a segregated holding option.

Midland IRA Ratings & Complaints

- Better Business Bureau: ⭐⭐⭐⭐, A+ (Details)

- BBB: ⭐⭐⭐⭐ out of 2 reviews

- BBB: 0 open complaints

- Business Consumer Alliance: N/A

- Trustpilot: N/A

Midland IRA Contact Details

- Address: 135 South LaSalle Street, Suite 2150, Chicago, IL 60603

- Toll-Free Phone: 877.944.5472

- Local Phone: 312.235.0300

- Fax: 312.235.0302

- Email: mail@midlandira.com

- Website: www.midlandira.com/

Always Review the Competition Before You Buy

Investing in precious metals within a retirement account isn't a process that you should rush into or downplay in importance. Most experts recommend an allocation of about 5%-15% of your retirement investments towards precious metals. This portion of your portfolio may seem like a minority. But it could wind up holding majority importance in the event of another recession or global financial crisis.

A self-directed IRA gives you the freedom to invest some of your retirement savings in a variety of alternative instruments, including precious metals. However, not all self-directed IRAs are the same. So, setting up an account and purchasing IRA-eligible bullion is not always as straightforward as it might seem.

To avoid the hassle and expense of paying unnecessary fees and enduring a complicated setup and administration process. We suggest you thoroughly compare the top precious metals companies and IRA custodians before making a buying decision. Fortunately, we've made it easy for anyone to conduct their own research from our Top 10 Gold IRA Companies of 2024 and Top 10 IRA Custodians of 2024 lists.

Contact Us if You Own or Represent Midland IRA

If you're an owner, representative, or associate of The Entrust Group and you've found any of the details in this review to be erroneous, misleading, or outdated, please do contact us with your concerns. With the intent of providing the most accurate reviews on an ongoing basis, we will gladly revise or remove any content that is outdated or incorrect.

How We Rank IRA Custodians

While building this year's list of the top 10 IRA custodians, we considered numerous different companies before narrowing down the candidates presented in the finalized custodian comparison table. We've made it easy for anyone to conduct their own research regarding the history, features, reputations, and fees of the leading precious metals IRA custodians. We researched and ranked each company thoroughly based on the following factors:

- preferred/partnered depositories and storage options

- whether storage fees are included in the annual charge – some companies require you to pay storage fees in addition to annual administration/renewal fees

- setup charges and account startup cost

- fee structure – sliding scale annual fees vs. flat-rate annual fees

- company reputation and industry presence

Why Broad Financial is Ranked #1 IRA Custodian of 2024

Broad Financial partners with bullion dealers, brokers, and investment firms to bring retirement investors cost-effective, streamlined access to precious metals IRAs. While you can set up an account with Broad Financial directly as an individual, there are numerous benefits associated with opening your account through one of our top-rated gold IRA providers, Augusta Precious Metals.

Information Kit

If you'd like to learn more about the advantages of opening a Broad Financial precious metals IRA through Augusta, see our full review of Augusta Precious Metals. You can also access Augusta's highly informative investor education kit that teaches you everything you need to know about investing in a gold IRA. Simply fill out the form below. Even if you don't plan on investing any funds right now. We strongly recommend you consider the content presented in their FREE information kit before making an investment decision in the precious metals industry.

Next Step

You may have found Midland IRA a perfect match or you may still want to compare other companies before making a final decision. You can check out or reviews of another 9 top trusts on our list here. Then, you may need an IRA company that specializes in bullion. You can read the review on one of our top three IRA precious metal companies, Augusta Precious Metals.

Midland IRA Review

- Phone : +1 239 333 1032

- URL :

- Global Rating

- Good

User Rating

- 0 No reviews yet!

Review Summary :

Midland IRA is a custodian for thousands of different precious metals IRAs. Besides this, they offer a constant and continuously refreshed array of educational materials for IRA accounts. Their educational and record keeping services benefit both novices and professionals. The firm delivers options of flat rate yearly fees as well as sliding scale fees.

Have you purchased products from Midland IRA Review? Leave a review!

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.67

Platinum: $931.67

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68