- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Current Depression Four Times More Severe than Global Financial Crisis Per Goldman Sachs

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 23rd April 2020, 09:29 am

The economic hits just kept on coming this past week. Goldman Sachs, the much-admired and widely followed Wall Street analyst, announced their belief that the worldwide economic toll from the current crisis will prove to be four times more severe than was the Global Financial Crisis. They revealed forecasts for second quarter GDP dropping around 35 percent even as unemployment rates could reach 15 percent. If their assessment of the current economic collapse is correct, it would represent a crisis worse than the Great Depression.

Goldman Sachs Sees Far Deeper Economic Crisis Than Other Analysts

To be sure, not all of the Wall Street economists foresee such a devastating setback as Goldman Sachs analysts do. Goldman is calling for the highest and worst unemployment levels dating back to the Second World War. Yet as the majority of the planet's developing countries are now under a state of almost complete shutdown in an effort to halt the spread of the coronavirus, Goldman Sachs anticipates a Q2 GDP drop of 11 percent versus last year same time, with a 35 percent decline from the prior quarter (on an annualized basis).

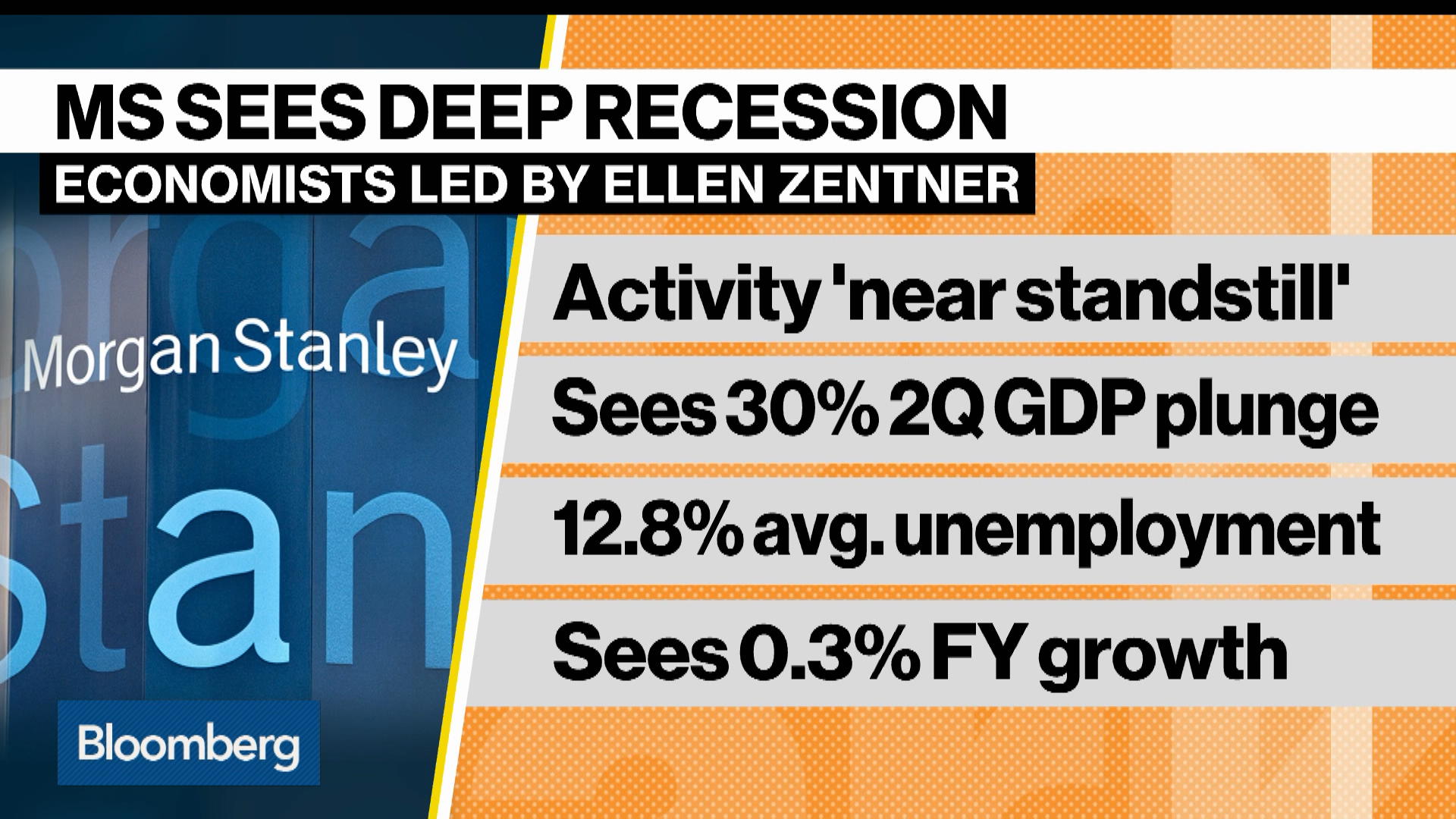

Goldman also declared that their assessment of a 15 percent unemployment rate in the United States, “understates the severity of the situation,” with many workers having given up seeking employment until the economy fully reopens. They are not entirely alone in this investment banking assessment either. The graphic below shows rival firm Morgan Stanley’s official position on the future economic data during the crisis:

Analyst Optimism Misplaced According to Citi's Second Wave Virus Theory

After falling as much as over one-third from the January/February highs, stocks have rebounded hard from their lows. It makes little sense, but Wall Street believes that the virus itself has peaked and that the damage will not be as severe as some analysts have predicted. According to Goldman's Chief Economist Jan Hatzius:

“The initial improvement [in outlook] was mostly policy driven, but the greater optimism of the past week seems to be at least partly related to the virus itself. The number of new active cases looks to be peaking globally, projections of cumulative fatalities and peak healthcare usage are coming down, and even actual new hospitalizations in hard hit New York City have fallen sharply.”

Yet even the more optimistic analysis will not dare to assign a date to when the American economy will be able to successfully restart from the devastating social distancing practices which have shuttered all non-essential industries in the nation. According to Hatzius, there will not be a full return to the prior “business as usual” until a proven vaccine is widely available on the market. Still, Hatzius believes that:

“It might be possible to bring back at least part of the lost output with a sharp increase in testing as well as more limited changes to business practices that lower the risk of infection.”

Hatzius was particularly referring to the car manufacturing industry, construction, and other manufacturing businesses. He feels that these could quickly ramp up from their present abysmal 25 percent output to upwards of 70 percent capacity for May.

This is encouraging optimism, but other analysts do not see such a rosy outcome anytime soon. The Chief Investment Officer David Bailin of Citi Private Bank simultaneously warned that the worst is likely far from over for American and global economies and their stock markets. Bailin warned that:

“In the event that we have a very significant second wave of disease in the United States that cause a further shutdown of the economy… that clearly is not priced into the market. The other thing that may not be priced into the market is the fact that this virus may take another 18 to 24 months to really cycle through the globe, and ultimately have a vaccine. In the second quarter, we expect earnings to literally fall by 40 percent or more across the board.”

Wall Street may have opened the champagne way too early.

No One Can Say With Certainty How Deep and Painful the Depression Will Be

As the global pandemic could possibly drag on for much longer, Bailin reasonably has come up with “significantly” lowered expectations and forecasts for the upcoming corporate earnings versus the majority of other analysts. He referred to how hard the coronavirus shutdowns impacted business for March should “hint” at how the future following quarters will look. He added that:

“In the second quarter we expect earnings to literally fall by 40 percent or more across the board, and we don't expect earnings in the United States to get back to their first quarter levels for nine quarters for now.”

Leading Economist and Analyst Mohamed El-Erian Similarly Gloomy With Economic Forecasts

Another of the most highly respected and followed long-time economists Mohamed El-Erian has shared his gloomy thoughts for the U.S. economy in coming months. He expects a double digit percentage drop in economic activity for the whole year 2020 thanks to the effects of the pandemic. The Chief Economic Advisor of Allianz El-Erian warned on Squawk Box that:

“I think we may be at minus 10 percent to minus 14 percent growth for the U.S. This is a big hit. I'm a little bit more worried than what the consensus of economists out there is right now.”

El-Erian explained his darker outlook versus most of his economist colleagues this way. This particular economic downturn is distinctly different from prior ones like the 2002 Internet Dot-com collapse and the Global Financial Crisis of 2009. Traditional reference frameworks are not applicable this time around. He added that:

“The benefits you would expect normally, lower oil prices means more dollars in consumers' pockets, even that doesn't work in this economy. So I'm a little bit more worried than what the consensus of economists out there is right now. There is tremendous uncertainty in any economic forecast now. I hope I'm wrong.”

El-Erian is widely revered for his longtime association with investment and bond king powerhouse PIMCO. He shared his thoughts even as the results of the CNBC Rapid Update survey were released during the program. The pan-Wall Street forecasts average for the prior week anticipated a roughly four percent decline in American GDP for 2020.

Other respected bodies are more negative than this though. Just last week, the International Monetary Fund argued that the United States' economy could contract by 5.9 percent for the entire year. The IMF also shared their feeling that the globe will now “very likely” undergo its most severe economic collapse dating back to the Great Depression.

Can the U.S. Bounce Back in H2 of 2020?

Hatzius of Goldman Sachs is hopeful that with industries brought back online in May that economic growth should recover at an “unprecedented” level in the United States. His forecasts for Q3 growth are plus 19 percent from the Q2 plunge. He sees a further 12 percent increase in the last quarter of 2020 too. According to a research note that Hatzius penned recently:

“Such is the strange world of recovering form a pandemic shock. At the broadest level, [policy makers] need to focus on providing all-out support, especially in countries with significant amounts of fiscal and monetary space. Governments need to replace as much as possible of the private sector income hit, in order to limit the downward pressure on after-tax income and therefore on spending.”

Sadly the economic news and major analyst predictions for the present economic devastation continue to be shocking. This is why Gold makes sense in an IRA. The historically proven IRA-approved precious metals are on a tear precisely because there is no longer any viable economic or financial certainty remaining in the world. Now is the time to study Gold IRA Rules and Regulations as well as the Top Gold IRA companies before you take any further action.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81