- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Current conditions & Gold’s Value Looking Forward

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 26th October 2015, 04:52 pm

Economic Conditions

Gold has been in a consistent decline for the past 3 years, where price has fallen from levels around $1770 in September 2012 to current levels below $1200. This came about mostly due to the sharp rise in Stocks and Bonds, traditional assets were performing well and there were few reasons to seek refuge in Gold. The S&P 500 has gone from 1407.40 in September 2012 to an all time high of 2137.10 in May of this year. To add to the pressure for Gold price interest rates fell to historically low levels for various years. The key Fed Fund rate was lowered to 0.25% at the onset of the 2008 crisis and has remained there since. What this unseen level of interest rates did is create an exponential effect on Stock growth, as corporations benefited from access to cheap finance for their operations. This low interest rate scenario, which has been the fuel for the economic growth over the past 6 years, could be about to come to an end.

source: tradingeconomics.com

The debate is still open as to the timing for the first in a series of rate hikes which will take us through 2016 and beyond. The real concern is that interest rate hikes may happen too early, given the current subdued economic data. This would certainly turn around the bull trend in stocks as corporations would be hit the worst in a higher interest rate scenario if the economy is not performing well enough to sustain the higher interest rate levels. The economy may not necessarily suffer as much as Stocks, looking at the chart below for Annual GDP Growth and comparing to the one for Fed Fund rates above, we can see that during many periods in the past 45 years the economy has shown similar levels of growth with much higher interest rates.

source: tradingeconomics.com

However expectation for price growth will be diminished in a higher interest rate environment, expectations for price growth are measured by the Price/earnings ratio. This ratio tells you how many more times than earnings the market is willing to pay for a stock. Currently this ratio is at 26.22, but it would be highly unlikely that the Stock market would deem these levels as feasible as we enter into a tightening monetary policy.

The strength of the US Dollar will also begin to take its toll as exports will become expensive for countries importing American goods. Exports make up around 13% of GDP that is not one of the largest sectors but large enough to impact overall GDP. The Euro has fallen from just under 1.4000 in May 2014 to current levels below 1.1100 on the back of better GDP growth but also mostly on the back of expectations for higher interest rates in the US. It is therefore quite feasible to forecast an even higher US Dollar against most major currencies, further dampening exports.

Expectations for Gold Price

Some analysts have reduced their price expectations for Gold going into 2016, although they still remain slightly higher than current levels. The main concern is the likelihood of a restrictive monetary policy and a stronger US Dollar in a higher interest rate scenario. Higher interest rates means that investors will be more attracted to assets that have a yield as they will now be higher, moving some of their holdings out of Gold which has no coupons. A strong US Dollar will allow commodity exporting countries to offer lower prices for their commodities in Dollar terms as they will receive a larger amount in their domestic currency. There have been reports of a decline in demand for Gold coming form a reduction in demand of the Jewellery sector, which has helped demand drop by 12% on a yearly basis in the second quarter of 2015.

Higher interest rates however could also see the Stock market take a beating as a new regime of tightening monetary policy comes into place. As Stock price declines Gold should benefit, despite the higher yield in bonds, as it is a safe haven asset and is often held in the attempt to protect wealth from adverse market conditions. The graph below shows the curves for Gold price and the Supply line since 2008. As we can see since 2013 the two curves have begun to diverge with supply decreasing as producers are being squeezed by falling prices. The supply line has fallen much faster than price, Gold Price Index has fallen from just below 180 to 120, whereas the Supply Index has gone from just under 180 to 60. Supply has fallen by approximately twice as much as price over the same period. There may not be much more room for price to fall given that it would seem that supply has adjusted in a much bigger way with a more severe reaction to falling prices.

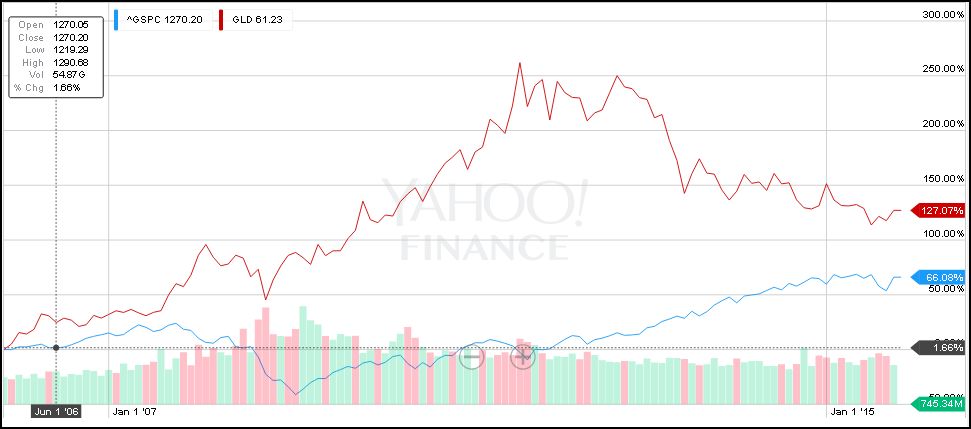

Looking at a comparison chart for Gold and Stocks, the chart below shows Gold SPDR (GLD) compared to S&P 500 index.

We can see that over the past 10 years Gold has performed considerably better than the S&P 500. Over this period Gold has increased by 127.07% compared to an increase of 66.08% for Stocks. Gold also never under-performed compared to S&P 500 for the whole 10 years. Price discovery for any asset is always tricky and there is no crystal ball but holding a percentage of Gold within a well diversified portfolio would certainly seem to make sense.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.67

Platinum: $931.67

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68