- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Coordinated Global Central Bank Action Fails to Stem Market Crisis

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Monday of this past week saw both stock market indices and oil benchmark prices deteriorate into a free fall. This worst stock market plunge since the Black Monday crash of 1987 happened even as global central banks around the world engaged in more interest rate cuts as well as launching new stimulus programs. They all failed to restore investor and market confidence. Some analysts worried that the American Federal Reserve had already run up against the confines of its ability to ward off a recession with the economic devastation wrought by the spreading coronavirus pandemic.

Markets in Disarray As Central Banks Slash Rates

It was this past Sunday that the United States' Federal Reserve slashed its interest rates practically to zero while also unveiling a new $700 billion stimulus package, as the BBC reported. This was only part of the larger coordinated international actions the Fed pursued with its counterparts in Japan, the euro zone, the United Kingdom, Switzerland, and Canada.

The cut was the second emergency rate reduction by the Federal Reserve in under two weeks. More impressive still was the enormous program of asset buying that equaled one which the Fed enacted in the height of the Global Financial Crisis over ten years ago back in 2008. Japan similarly announced that it would expand its program of bond buying. The People's Bank of China injected huge amounts of money into its own financial markets to try to calm fears about liquidity. Even New Zealand's central bank cut its interest rates to all time lows in an effort to ease the pain from the economic blow.

International coordination centered on a joint action between the U.S. Federal Reserve, Bank of Japan, Bank of England, European Central Bank, Swiss National Bank, and Bank of Canada. The Federal Reserve worked in tandem with these important global central banks to diffuse rapidly rising worldwide “dollar funding pressures” per Fed Chairman Jerome Powell. Their coordinated action was designed to provide greater liquidity through the existing arrangements for U.S. dollar liquidity swap lines.

As the Bank of Canada stated on its website, the major central banks of the world arranged to reduce the pricing on their existing U.S. dollar liquidity swap lines by 25 basis points. This brought the revised rate amount down to the dollar OIS Overnight Index Swap rate plus 25 basis points. In another effort to boost the efficacy of these swap lines to provide greater dollar liquidity, the international central banks with such dollar liquidity operations also announced that they would start providing these U.S. dollars every week (in their jurisdictions) with a new 84 day maturity. This will be offered next to the one week maturity options presently available.

Massive Coordination of Central Banks Around the World Leaves Markets Unimpressed

Global central bankers had hoped such dramatic measures would have a noticeable impact on calming worldwide stock market indices, but they were quickly disappointed. Traders did not show any signs of being impressed as the virus continuing to spread globally. Markets were quickly fearful again as the Chief Tedros Adhanom Ghebreyesus of the World Health Organization declared that it was not possible to forecast when the coronavirus would reach a global peak. G7 leaders held a videoconference to discuss the growing crisis on Monday even as the IMF Head Kristalina Georgieva called on world governments to coordinate their efforts to deliver enormous spending like in the Global Financial Crisis to try to save the global economy from coronavirus pandemic-induced massive damage.

Markets cratered around the world. Right after the opening bell rang in New York on Wall Street, the Dow plunged almost 10 percent and saw trading temporarily halted as circuit breakers kicked in. By the time the trading day had finished, the Dow Jones Industrial Average had fallen an eye watering 12.9 percent. The drop had only accelerated after U.S. President Donald Trump announced that the American economy “may be” hurtling towards recession.

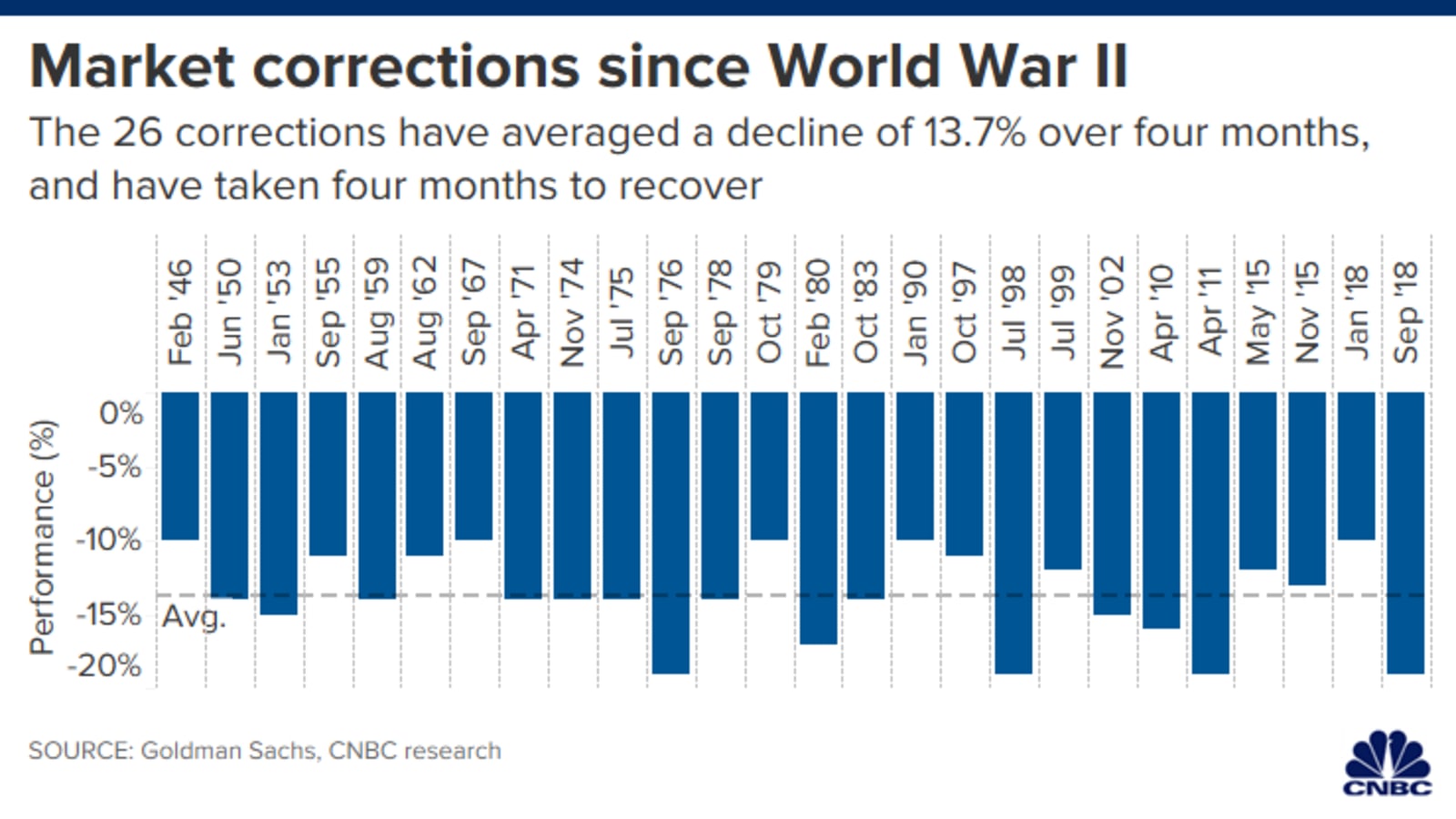

It represented the largest percentage drop dating back to 1987. The S&P 500 also crashed 11.9 percent as the Nasdaq cratered 12.3 percent. Each of the three major U.S. stock indices had declined over 25 percent from their highs just a month before at this point. This chart below shows the declines of the previous market corrections dating back to World War II:

All other major international stock markets plummeted as well in the wake of the announced coordination to reduce the coronavirus impacts. Afternoon trading across the Atlantic Ocean saw the Paris stock market down 10.7 percent, Madrid off 11.3 percent, Milan down 10.9 percent, Frankfurt fall 9.5 percent, and London drop 7.9 percent.

In Asia, Australia's markets led the Asia Pacific region declines as Sydney cratered 9.7 percent in its all time worst drop ever recorded. The Philippines market plunged around eight percent, Indian and Thai markets fell over five percent apiece, and Singapore, Hong Kong, Taiwan, and Indonesia each dropped over four percent. China's Shanghai index tanked 3.4 percent after dismal Chinese industrial production data was released. It followed the prior week's news release showing exports from China had completely collapsed.

Manufacturing Activity Plunging Around the U.S. and World

The central bank moves had failed to stem stock market collapses by the end of the trading day Monday. Analyst Michael Hewson of CMC Markets explained that:

“While these (central bank) moves may go some way to easing any potential blockages in the plumbing of the financial markets, they won't adequately compensate for the upcoming economic shocks that are about to come our way.”

The extent of the economic crisis unfolding became more real when Chinese industrial production data for January and February declined by 13.5 percent in its first such contraction for approximately 30 years. New York state's manufacturing activity also declined to its worst level dating back to 2009, per the monthly industry survey of the New York Federal Reserve Bank.

Analysts Worry that the Federal Reserve is Running on Empty

The major retreat early in the week came on the heels of last week's volatile declines that witnessed a number of stock markets around the world endure their greatest losses for decades or for all time in certain cases. Some analysts said that the reason had to do with fears that the Federal Reserve might be running out of options for additional action. Kerry Craig of JP Morgan Asset Management warned that Sunday's move:

“raises the question of whether the Fed has anything left in the tank should the spread of the virus not be contained. Our view is that the drag on the services sector from the social distancing policies and shock from the fall of the oil price on the energy sector will be enough to tip the U.S. into recession, but not necessarily a long one.”

Failure of Coordinated Global Central Bank Action Argues for Portfolio Diversification

Unfortunately the news of the continuing carnage in stock markets around the world this week (in response to a perceived failure among investors of global central banks' policy coordination) is far from good. It reminds observers that gold makes sense in an IRA. Seldom have the arguments for retirement portfolio diversification been stronger. One way that you can do this is by acquiring IRA-approved gold, historically recognized as the ultimate safe haven asset for thousands of years now. It is a good idea to learn more about Gold IRA rules and regulations as well as the Top Gold IRA companies before considering any action.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81