- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Consumer Debt Rises Threatening U.S. Economy Again

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 20th June 2019, 07:24 pm

Another unfortunate financial milestone has just been reached with regards to American consumer debt, and it has some economists increasingly worried. For the month of April, the most recent Federal Reserve Consumer Credit Report revealed that U.S. residents borrowed cash at the quickest rate for five months. This has increased the total amount of debt that American consumers owe to a staggering almost $4.07 trillion.

American Consumer Borrowing Continues to Grow Unchecked

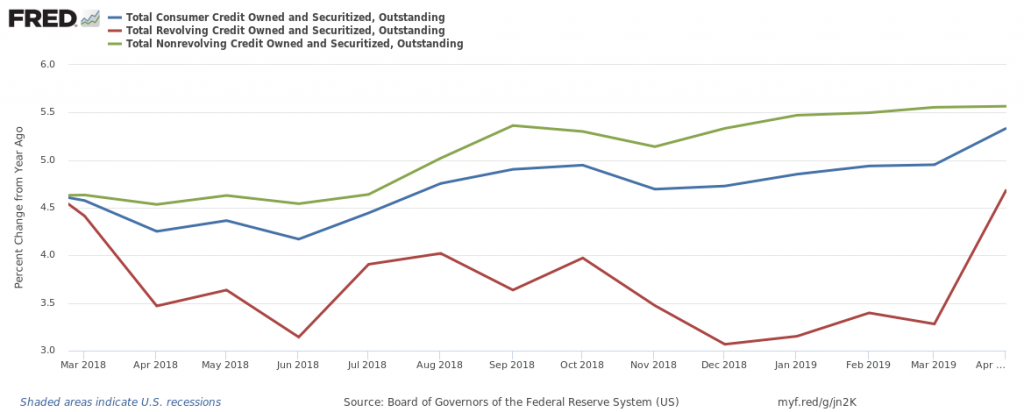

Americans latest borrowing foray has caused consumer credit to expand by an astonishing $17.5 billion. This represented a yearly growth rate of 5.2 percent. It brought American total private debt up to an incredible almost $4.07 trillion. This total takes into consideration student loans, credit card debt, and car loans, but does not even include housing and mortgage debt. These are dangerous new all-time highs in consumer debt that do not show any signs of abating soon. This chart below shows how steeply and dangerously the consumer credit expanded in America for April:

Yet the already incredible totals did not stop Americans from running up their credit cards yet again during the month of April. The revolving portion of outstanding total credit increased by $7 billion. This was good for a 7.9 percent expansion. It also represented the biggest such rise since November.

How can this continue to go on indefinitely? The mainstream media attempt to explain it away by claiming that Americans simply are more than comfortable with taking on debt. The available statistics however do not prove this anywhere. The odds are equally high that the U.S. consumers run up their balances on credit cards simply because they can not afford to cover all of their bills.

Credit Card Delinquencies Are At Great Recession Level Highs

Last month, the data emerged showing that charge offs on subprime credit cards are at levels almost as high as during the Global Financial Crisis and the Great Recession. The Fed and its monthly consumer credit data conveniently leave out this important information from its monthly consumer credit report. Clearly it shows that borrowers with lower income are struggling to keep up and not fall impossibly behind on their mounting bills.

You should remember too that all forms of non revolving credit were up last month despite the increasing debt servicing levels that come with the higher debt. Non revolving credit (including student loans and car loans) actually expanded by 4.2 percent to grow by another $19.5 billion. The federal government's lending (generally student loans) increased by nearly a billion more, taking into consideration seasonal adjustments.

If the Economy Is Booming, Why Are Americans Barely Making Ends Meet?

These debt statistics beg a serious question: when Americans are working at a near record low unemployment level and they are earning greater amounts of money (while still reaping the advantages of President Trump's tax cuts), then why do they find it increasingly necessary to run up their credit cards and other non revolving credit? The simple answer is because they can not make ends meet at today's incomes versus expenses and costs. Eventually these credit cards will be permanently maxed out. What will happen to the U.S. economy and markets at that point?

Remember too that Americans must repay this mountain of debt at some point eventually. If too many of them default and credit card companies are forced to charge the debts off, then the financial system will find itself in great trouble once again. It is not only credit card companies that will be left holding the bill this next time either. Car loan delinquencies have roared up to the greatest amount dating back to 2011 at the end of the last crisis. They are nearly at highs only encountered in the middle of the Great Recession and Global Financial Crisis right now.

Why is this so especially important? Among other reasons, it is because all of this is having an impact on the Federal Reserve's economic and monetary policy, though they do not want to admit this publicly too much. It is cheap and easy credit and money that the central bank relies on to maintain the bubbles in the U.S. economy. The Fed will be forced to slash interest rates and restart the Quantitative Easing programs before long in order to support the falling stock markets. They will also require lower interest rates to keep consumers able to continue borrowing. This is why the Fed has been unable to completely escape from its former loose monetary policy of the last decade. It also explains why the Powell Pause in the interest rate tightening cycle was conveniently developed when it was.

Unsustainable Debt Levels Mean That Rates Can Not Practically Rise

The Fed has been the architect of its own demise. It has become boxed into a corner because of all this raging consumer debt (that is fueled with its QE policies over the last ten years). Now, they can not increase interest rates to anything approaching historically normal levels so long as American consumers have to make monthly payments on in excess of $4 trillion worth of debt. This does not even take into account the devastating effect normal interest rates (of historically at least five percent) would have on the federal government's over $22 trillion in debt and mounting. In ten years at the rate the government is going, it will take close to all of the federal tax revenue just to service the interest on the rising federal debt.

Clearly the debt train can only go so much farther along down the sustainability tracks. Sooner or later, this debt bubble will burst spectacularly. When it does, you do not want to be holdings just stocks and bonds primarily. What will protect your investment and retirement portfolios at that devastating point? The yellow metal has been fulfilling such a role for over three thousand years. It helps explain why gold makes sense in an IRA.

These unfortunate news are a stark reminder that investing in gold can be a wise decision if you want to diversify and protect your portfolio. You should consider buying gold in monthly installments. Some good news is that it is easier to buy and store gold now than ever before, thanks to the IRS relaxing their once stringent rules and approving top offshore storage locations for your IRA gold. Do not wait until the debt bubble bursts to protect both your financial present and future. And remember to only buy from Top Gold IRA companies and bullion dealers when you do secure your retirement portfolios.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.67

Platinum: $931.67

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68

Is it wise to use a government aproved IRA offshore account considering that

If gold is ever confiscated AGAIN that you are using an organiation that has an agreement to tell the feds who and how much and where the gold is? We have reached the point that paying off the national debt is laughable and printing money or outright default are the only other options. My theory is to split my assets into 3 categories. Gold into non ira vaults, Dividend producing quality stocks, and burying mostly gold and a little cash. Telling my heirs the instruction to where the buryings are at and leaving out the starting point and putting that in my safety deposit box that they get when I die. Please critic this for me.