- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Consumer Confidence Plunges in September

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 9th October 2019, 12:09 pm

This past week the troubling news emerged that the U.S. consumer confidence plunged by its largest amount in nine months for the month of September. The Conference Board industry group stated that the consumer attitudes' index dropped to 125.1 from the prior month of August. This was further down from the August reading that was also downward revised to 134.2. These readings were far worse than had been anticipated by economists. The decline was attributed to the worsening U.S. and China trade war, per the private sector report released last Tuesday.

Economists Had Expected Significantly Better Consumer Confidence Readings

Reuters reported that the 49 economists which they polled had forecast a consumer confidence reading of 133.5 versus the actual reading of 125.1. This shortfall proved to be the worst one (compared to the expectations of Wall Street) dating back to 2010. Senior Director of Economic Indicators Lynn Franco of The Conference Board stated that:

“The escalation in trade and tariff tensions in late August appears to have rattled consumers.”

In a disturbing side note, the prior month's reading was also revised further down. August's reading had come in at 135.1 originally but was then revised down to 134.2 with this current data release. The expectations index (which covers consumer's shorter-term outlook for income, labor market, and business conditions) similarly declined from the level of 106.4 seen in August down to 95.8 for the month of September.

Analysts put the blame squarely on the escalation in trade and tariff tensions that consumers saw during the end of August. This may be part of the reason, but the trade war has been ongoing for many months now. It did not suddenly start impacting consumer confidence just this past month.

Meanwhile Consumer Debt Is At All Time Record High Levels

Consumer confidence is critically important to the American economy because of the fact that consumer spending comprises approximately 70 percent of the entire U.S. GDP. In the event that Americans appreciably stop spending money, the national economy comes to a virtual stand still. Yet other data released shows that even as the consumers appear to be losing confidence in the strength of the economy, they are carrying all time record high levels of debt.

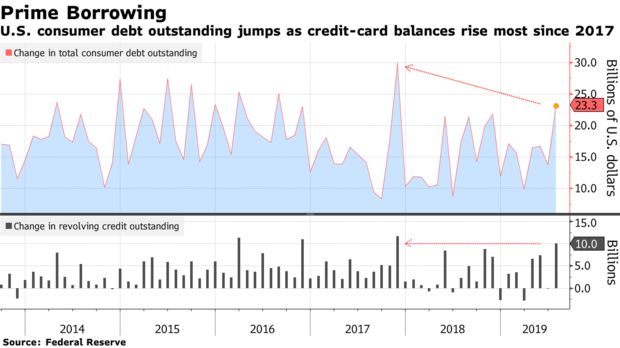

The statistics show that American consumers continue to prop up the U.S. economy using money that they do not have currently. Consumer debt has been soaring over the past months. The total amount of consumer debt in America is now at an all time high of $4.123 trillion (according to the most recent July data released by the Federal Reserve). Consumer debt roared higher by $23.4 billion in July.

As part of these figures, American shoppers piled another $10 billion on to their already existing credit card balances, making this the largest increase in credit card debt going back to November of 2017. It brought the total amount that Americans owe on just credit cards up to a high of $1.08 trillion. The category for non-revolving credit also significantly increased. This category (also including both student loans and car loans) gained by another $13.3 billion. In the month before it was up another $14 billion.

Shocking Rise in Consumer Debt Catches Analysts By Surprise

This enormous jump in consumer debt (driven by the massive increase in credit card balances for both everyday and online purchases) caught the economic analysts completely off guard. According to Bloomberg, this massive increase “exceeded all estimates” in their survey of economists. The total consumer debt category saw a shocking annual rate of increase amounting to 6.8 percent. This compares to the month prior increase that had only risen by four percent higher.

Consider too that this consumer debt figure does not count mortgage debt, but only includes credit cards, car loans, and student loans. The chart below shows how significant the jump in revolving credit debt has actually been:

The economy is especially heavily dependent on this continuing consumer spending (fueled by credit) thanks to weakness showing in critical housing, manufacturing, and capital investment categories. Perhaps most surprising is the spin that the mainstream analysts and commentators have managed to put on this record high indebtedness data. They called it a positive factor for economic growth. Bloomberg reported it as:

“The surge in borrowing indicates Americans, supported by higher wages, were feeling confident enough about their financial situation to continue borrowing and spending. The economy, beset by weakness in manufacturing, housing, and capital investment, remains highly dependent on the U.S. consumer to keep driving the expansion.”

This ongoing spending will be harder for the consumers to manage given that they are feeling significantly less confident about the current and future economy now.

Bankruptcies Are Also Increasing As Consumer Debt Rises Dangerously

One sign that the indebtedness is reaching a dangerous tipping point is the number of bankruptcies that are filed. These are growing significantly. The American Bankruptcy Institute data shows that American bankruptcy filings grew by three percent between July of 2018 and July of 2019. This rate may be considerably less than during the peak of the Great Recession and Global Financial Crisis, but analysts point to the uptrend in the figure as worrisome.

Any Way You Look At It, Credit Card Spending Does Not Equate to Confidence

Many analysts try to make a connection between higher credit card spending being good for economic growth. In light of the declining consumer confidence (even as credit spending is rising), it could also signify that American workers are having to struggle to make their ends meet. This is all the more true as many individuals deploy their credit cards for use as an emergency fund.

One thing that is certain with the credit card-driven spending spree is that it can not continue indefinitely. The vast majority of credit cards have a pre-set limit. They also must be paid down (if not completely paid off) at some point. Americans spending money using credit cards are actually borrowing money against their future. This is not positive news for tomorrow's economic data. Bloomberg admits as much in their assessment of the potential economic downside to accruing so much consumer debt:

“At the same time, bigger credit card statements may indicate households feel they are overextended and may become more tentative about spending.”

Spending using credit cards also does not indicate consumer confidence in their own futures. It could easily signify that they have no spare income left to spend and so are resorting to credit cards for even everyday purchases. This may drive economic numbers for now, but it will have to stop at some point. A lower consumer confidence signals that the end point may be fast approaching. Economist Spencer Schiff wrote about this that:

“It may soon become apparent that consumer spending, currently our primary recession deterrent, has ground to a halt. If so, a serious economic downturn awaits.”

Unfortunately the news from last week on sinking consumer confidence and skyrocketing consumer debt at the same time is not good. It does help to explain why gold makes sense in an IRA. Diversifying your assets across a broad spectrum of asset classes is prudent. One way to achieve this is through acquiring IRA-approved gold for a gold IRA rollover. You can start by learning more about gold IRA allocation strategies and top gold IRA companies and bullion dealers.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81