- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Commodity Prices Pick Up Again; Inflation Could Follow Suit

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

A look at various commodity prices since beginning of year

Commodities have had a remarkable first quarter in 2016, and the turnaround has been substantial and not limited to just Crude Oil and Gold. Soybeans, Silver & Cocoa, have seen their prices grow sharply over the past week along with strong performances since the start of the year. Other commodities have also been in strong bull markets over the past 2 months. Cocoa, Cotton and to a lesser extent copper have had strong gains.

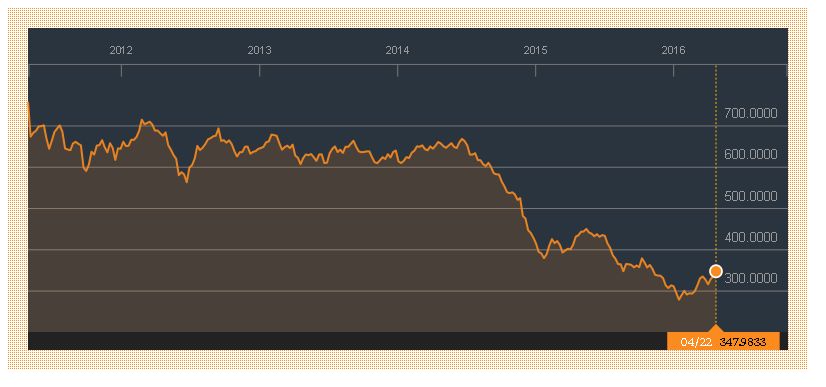

It doesn’t surprise then that the S&P GSCI (Goldman Sachs Commodity Index) all commodity index has been on the rise since it bottomed at 277.89 on January 20th, to close on Friday, April 22nd at 347.98. The S&P GSCI has a YTD of 11.66% as of Friday’s close.

Most of this solid rise has been led by the strong rally in Crude oil prices, which have increased 35.43% since they also bottomed on January 20th.

Soybeans have grown in price by 13.68% since the beginning of the year and by 3.5% during this week alone. Cotton and Cocoa have also had an impressive start to the year, with Cocoa July futures rising by 14.73% since its most recent low on January 28th. Cotton July futures price has increased by 11.13% since its low on February 29th. Looking at Metals as a sector, Gold has risen by 15.98% since the start of the year, after retracing from recent highs. Copper has also managed a positive start with an increase of 6.09%, and Silver has been an outperformer amongst precious metals rising by 22.02% since the onset of the year.

However, there is also another commodity which is not in the news much and often gets overlooked; and that is the least noble of metals, Iron Ore. This commodity has seen a spectacular rise in price since the start of the year, with China leading the buying. July futures for the gray metal have risen by 53.05% since the start of the year.

Implications of increased commodity prices for inflation

Higher commodity prices mean that many production materials and raw materials for many finished products across the board will also become more expensive. It’s easy to see how some commodities will make our shopping basket more expensive. For example Crude Oil, which will cause gasoline prices to go up, and many manufacturing plants will see production costs rise as their main source of energy is crude oil. Crude also affects many other items that are in the inflation basket, which will see increases in price.

Soybeans are used mostly for animal feed products and some non-food industrial products. Continued increases in the price of this commodity will eventually make meat products more expensive, beef and chicken for example. Copper is used in a variety of applications, from electricals in housing construction to electronics of all kinds. Iron Ore is used to make steel, which is used in various products, too many to possibly mention.

But what is more important is to understand how commodity prices can effect inflation in times of sustained economic demand. The chart below shows US inflation over the past 16 years. We can see how inflation decreased rapidly during 2008 and into 2009 as the financial crisis took its toll.

Commodity price shocks may not always translate into high inflation, but there will be pressure on prices when raw material and basic commodities see increases in price. The above chart also shows how inflation slowed down in 2012, and it coincided with a reduction in the broad commodity index a year later, and especially in the price of Crude Oil.

Inflation lag and effect on economy

This time around it looks like there may be more room for higher commodity prices driven by higher demand and other macro factors. The exchange rate of the US dollar also influences commodity prices. As the US dollar strengthens, or appreciates in price, commodity producers from foreign countries can now afford to sell these commodities at lower US dollar prices as in local currency terms they will still receive the same or more cash. Of course, when the US dollar falls foreign producers will receive less cash in local currency and will want to charge more for their commodities in US dollar terms.

The US dollar exchange rate has seen a strong increase over the past 5 years, the US dollar index (DXY) has gone from 72.72 its most recent low in April 2011 to 95.03, an increase of 30.67%. The rally in the US dollar was further multiplied in early 2015 as talk began of fed returning interest rates to more normal levels, in other words, higher levels. Increasing interest rates in stable economic conditions has the effect of increasing a currency’s value. These interest rate hikes are no longer so discounted and my not happen at the same pace as initially thought which has caused the value of the US dollar to retreat, in fact, it had touched 100.51 in December 2015.

Maybe commodity prices have not been rising long enough yet for there to be an effect on inflation, but there would seem to be a greater likelihood of sustained higher prices going forward. Supply and demand pressures will realign themselves as producers will also cut supply to create higher prices, a lower US dollar will push producers of commodities around the to ask for higher US dollar prices, creating further stress on prices.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81