- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Cold War Between U.S. and China Imminent to Upend Global Economy Again

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

This past week China passed a restrictive new law taking away Hong Kong's freedoms under the 20 year lasting One China, Two Systems policy. Protests broke out furiously as the people of Hong Kong resisted the end of their quasi-independent status in the world. The U.S., Great Britain, Canada, Australia, and the European Union all came out and condemned the new law and its implications in the strongest language possible. America announced that it would be rescinding Hong Kong's special “most favored trading nation” status in retaliation. In response to all of these moves and countermoves, a world-leading geopolitical analyst came out and declared that the United States and China are descending into a terrible new cold war.

Skyrocketing Tensions Over New China Law and Hong Kong Propelling U.S. and China to Devastating Cold War

CEO and Founder Ian Bremmer of Eurasia Group is worried that China and the United States are hurtling to a new cold war thanks in large part to recently skyrocketing tensions over Hong Kong's dying independence. He reminded the world of still simmering older tensions between the two superpowers, with:

“We are in a technology cold war. The fact is that the Chinese will not let some dominant U.S. tech companies into China — the Facebooks, the Amazons, the Twitters… [so] why should we allow Chinese companies in the United States… if they're not going to give reciprocity to American firms? We are not yet in a cold war with China writ large. We are heading in that direction.”

This past week, the legislature rubber stamp body of China's government approved the resolution imposing on Hong Kong new national security laws. Observers noted that these will badly reduce the remaining partial autonomy and special status that Hong Kong has enjoyed since the British returned it to the mainland in 1997.

Bremmer reminded everyone that a large and varied assortment of American industries and companies in sectors ranging from banking to sports, to movie studios have begun to seriously rethink their future business ties to China. Bremmer asserted that:

“Those companies don't see the same options for themselves in China they did before. There's no rule of law in China, no independent judiciary. Chinese companies are getting stronger. They're using their competitive advantage with their alignment with the Chinese government, their access to Chinese credit, so that's becoming a problem.”

Bremmer clarified that he does not see Huwei and other Chinese firms as “evil.” Rather they are directly opposed to their American rivals and competitors. “There is a zero sum-ness in that relationship,” Bremmer added.

Global Financial Hub Hong Kong to Lose U.S. Special Trading Status and Face Ruin

China's recent imposition of this severe national security ruling on Hong Kong the global financial center of Asia is already leading to devastating repercussions and consequences. The U.S. administration announced this very week that it will no longer consider the long-time British built colony to be an autonomous region separate from mainland China. This means that it will lose its critical “most favored nation trading” partner status, which is certain to spell the final ruin of the island enclave in the near to medium term future.

Experts now fear that the moves and counter-moves on Hong Kong from the communist Chinese government and the U.S. will sap away critical remaining business confidence in Hong Kong. Already many wealthy citizens of the enclave are making their plans to leave before the new rules go into effect. Bremmer warned the world that they ignore this simmering crisis at their peril:

“The big question going forward is: will the Americans withdraw the special trade status that we afford Hong Kong, completely within our rights to do so. I don't think it will happen because there are a lot of American companies that do business in Hong Kong that will be adversely impacted if we take that decision. They will lobby the Trump administration not to put that in place. We don't want to hurt Hong Kong more than we hurt mainland China. I expect we will put sanctions on a bunch of mid-level Chinese officials that have been involved in the crackdown… [and] we might say that Hong Kong will have export tariffs that are similar to mainland China.”

In any case, it is unlikely that you will see a full return to the business as usual environment in Hong Kong that it has enjoyed uninterrupted for the past 120 years.

Hong Kong Business Confidence to be Irreparably Harmed

Bremmer and other geopolitical experts are well aware of how fragile business sentiment is in global financial hubs like Hong Kong. He wondered:

“Do we trust that Hong Kong can continue to exist in this way, and how will we act as a consequence? As we are moving towards a broader cold war, the ability of Hong Kong to act as an entrepot is really going away and they will suffer mightily as a consequence of that.”

One fact is that many corporations and investors have already begun looking to other cities and nations that do obey the rule of law in the Asian region, like Singapore, Tokyo, or Seoul, per Bremmer.

Hong Kong Instability Could Easily Spread to the Mainland China

The situation continued to deteriorate rapidly this week from Monday and Tuesday. The local Hong Kong SAR wide protests could quickly spiral out of control and ripple across the mainland, per Bremmer and other observers. Director for China Michael Hirson of Eurasia Group said to Yahoo Finance On the Move that:

“Instability in Hong Kong could have ripple effects very easily into China. What we need to watch for is a real further deterioration of the security situation… the kind of moves that would leave Beijing to decide that it needs to step in… as a guarantor of Hong Kong's stability.”

The demonstrations on Monday were severe enough to close down the city's important international airport. Thousands of travelers were stuck on that day and again the next. Today's Hong Kong protests have quickly become the greatest challenge to the control of China over the island since the British withdrew and gave the island back to China back in 1997 at the end of their 100 year long lease during which time they built the backwater fishing village into one of the world's greatest and wealthiest cities.

A report from the Wall Street Journal revealed that the government of China's own Hong Kong and Macau Affairs Office Spokesperson stated during a recent news conference that:

“Radical Hong Kong protestors have repeatedly used extremely dangerous tools to attack police officers.. The first signs of terrorism are starting to appear.”

Hong Kong Protests Already Harming Local Economy Badly

Pain is already showing up across the city's once-impressive local economy too. Chairman Allan Zeman of the Hong Kong-based Lan Kwai Fong Group operating bars and restaurants throughout the city revealed to Bloomberg that:

“It's affected business tremendously — all businesses basically. We have to stop the violence. That's the most important thing. Then we can talk.”

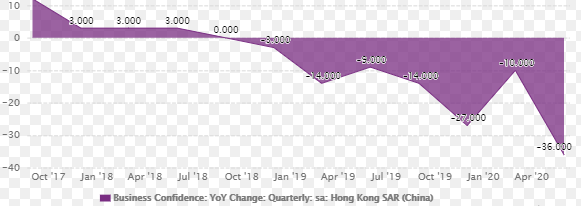

This chart tells the sad tale of the continuing decline in Hong Kong business confidence over recent years as the communist Chinese have tightened their control over the special administrative region:

Legendary regional investor J. Kyle Bass of Hayman Capital Management similarly cautioned that the world has to “pay attention” to the ongoing crisis in this important global financial hub in his interview with Yahoo Finance:

“I think, unfortunately, it takes a million to 1.5 million people to march in the streets of Hong Kong to get the world's attention.

Unfortunately for everyone, the news coming from China this past week has demonstrated that a vainly hoped for global economic recovery after the devastating lockdown and shutdown (effects from coronavirus) is only a pipe dream. Gold makes sense in an IRA ultimately because the geopolitical situation in the world is far from stable. IRA-approved precious metals are one way to hedge your investment and retirement accounts against the chaos unfolding between China and all of its most important trading partners around the globe. It is a good idea to read all about the Top Gold IRA Companies and Gold IRA Rules and Regulations before potentially acquiring the yellow metal as a safe haven via undertaking a Gold IRA rollover.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68