- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Circle Back Lending Review

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 24th March 2023, 11:37 pm

Circle Back Lending

- Phone : (855) 592-9767

- URL :

- Global Rating

- Good

User Rating

- 0 No reviews yet!

Review Summary :

Circle Back Lending provides the same basic features and services that most of its larger and more popular rivals do, with the exception that it offers lower origination fees for well-qualified borrowers. Investors are mostly institutional at the platform's encouragement, though it is unclear exactly the steps that they take to pick out loans to fund and how much they receive for these based on the various grades the company assigns the loans.

Pros:

- Depending on the grade your loan receives, it is possible that your origination fee will be lower than with competing platforms.

- The platform provides a greater possible loan amount.

- Faster processing times of as little as 24 hours to 5 days for funds to be disbursed.

Cons:

- APR high end rates are greater than with most any competing platform or company.

Quick Facts about Circle Back Lending

Reviewed By:David Crowder

Have you purchased products from Circle Back Lending? Leave a review!

Some of the P2P and crowdfunding platforms have chosen to go a different route than the mainstream direction, by seeking out institutional investors. This way, they do not have to worry about who is accredited and who is not, or fear running afoul of the old law forbidding non-accredited investors from getting involved in the platform somehow. Circle Back Lending is one such platform that has chosen to go this direction with its investment backers.

Circle Back Lending Intro & Background

The feature that distinguishes Circle Back Lending from its numerous Peer to Peer Lending rivals is that it chooses to work mostly with institutional investors for its funding. This means that the majority of its financiers on the platform are pension funds, banks, and insurance companies who review loan applications and then buy personal loans that are issued to those borrowers who are fortunate enough to boast from good to excellent credit. In this way, those prime borrowers are able to obtain a fixed-rate, low-interest rate, unsecured loan, and professional investors gain access to lower risk and higher returning investments that help them to better diversify their investment holdings.

Circle Back Lending Founder and Management Team

Co-Founder and Chief Executive Officer Michael Solomon possesses more than 25 years experience in the entertainment, financial services, and legal fields. He has served in various roles including sales and marketing, management, compliance, business development, and operations. He founded Loanio.com, an early days contender in the Peer to Peer Lending space in the U.S., then served as the company's CEO from the beginning in 2006 to 2010. Before his Loanio days, he co-founded and served as President of Omnilaw Legal Plans, Inc. This firm delivered economical access to both financial and legal services. Michael similarly founded the Solomon Law Group, which operated as an immigration law practice that served the niche of internet-based legal firm. Prior to this, Michael also co-founded and became President of Breakthru Entertainment.

Co-Founder and Chief Operating Officer Todd Walters worked with Michael Solomon in the early days at Loanio.com, where he served as Director of Finance and Operations as the very first recruit on the new management team. Before his time with Loanio, Todd worked as Portfolio Manager and Senior Analyst for Catalyst Capital Advisors. Here he assisted in managing more than $100 million of assets in various strategies of numerous investment types. Todd also worked in several different capacities at Fidelity Investments, LPL Financial, and the Institute for Foreign Policy Analysis.

Chief Technology Officer Sean Coates boasts more than 20 years of experience in constructing the very best of systems and applications for financial technology. Prior to this, Sean served as VP for Engineering at LendKey, cfX's CTO, and on the senior technology management group with Insight Card Services, PaineWebber, TMCBonds, and various other financial firms. His record shows that he successfully grows the startup technology teams as they transform to the leaders of their industries.

Circle Back Lending Loans

This platform is basically offering a single type of loans, personal loans, then approving them for a variety of uses, including for business needs. Whatever they use the loan for, the terms remain the same. The loan is given a grade of credit that decides how much the interest rates and other costs will be, and this is all based on the borrowers' credit scores primarily.

Circle Back Lending provides loans that vary from $3,000 to $35,000. The repayment terms can extend to 60 months or five years. Interest rates can run the full scope from 6% to 36%. Naturally this interest rate will have a dramatic effect on the amount of the payments.

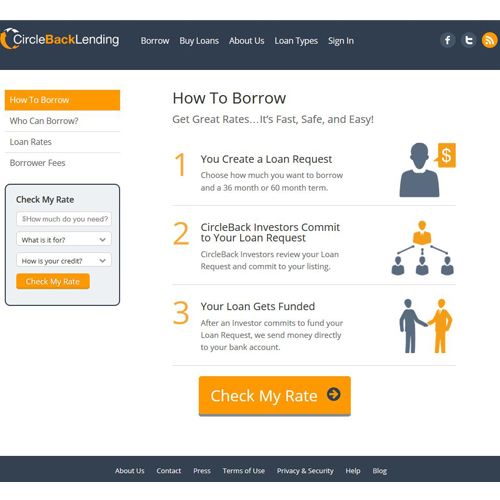

How Circle Back Lending Works

The whole process begins when the borrowers come on the site and set up their loan request by explaining the amount they would like to borrow and if they wish for a 36 months or a 60 months loan repayment term. Once this is turned in, the investors on Circle Back consider the loan request. After it is approved, the company direct deposits the money straight to the borrower's bank account.

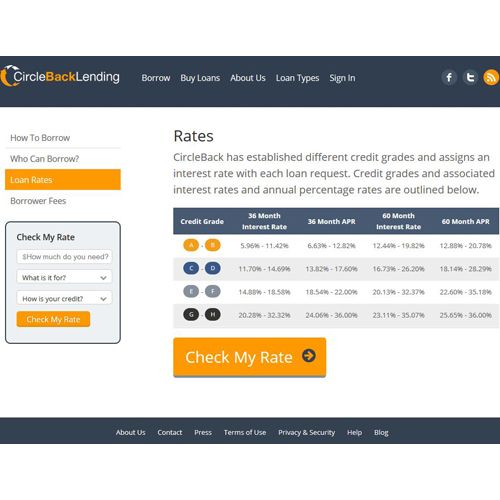

Interest rates are dependent on both the credit grade they assign the loan, the loan term, and the amount that the borrower takes. Rates are lower if the loan term is shorter. Smaller dollar amounts borrowed yield better rates as well. As an example, a super-prime borrower who received a grade of A or B and who applied for a 3 year $20,000 amount would receive rates that vary from 6.6% to 12.8%. That loan given to a G or H credit grade borrower would receive rates that ranged from 24.1% to 36%.

Borrowers must have at least a 660 or higher credit score in order to qualify. The company would rather see debt to income ratios at less than 35%, though they consider other factors as well. As is common with personal loans that are issued for business purposes, the business' performance and history are not factors in the process of obtaining a loan from a peer to peer platform.

Once the application has been turned in and received its credit grade, investors look over the application. The platform does not allow the applications to stay open or wait around for funding. A single investor picks out the loan and finances it. The funds can be received even the next day if the application is turned in by 10am EST. Typically borrowers will receive their funds in between two and five days. The origination fee is then deducted from the loan total before it is disbursed.

Circle Back Lending Services

- Simple and Quick Application Process — the entire application online requires only a few minutes of time to complete.

- Lower Interest Rates — The Circle Back Lending company interest rates are among the lowest on the P2P and traditional lending market.

- Rapid Turnaround — In as little as 24 hours, borrowers can have their funds.

- Convenient Payment — Borrowers' bank accounts will be automatically debited every month for the payment amount without the borrower having to take any action.

- Efficient and Rapid Borrowing – Super-prime customers are able to obtain borrowed funds rapidly and efficiently at compelling interest rates.

- Transparent Investment Platform – Institutional borrowers can utilize the transparent platform with confidence and calm, knowing that it is both safe and cutting-edged.

Circle Back Lending Locations

Circle Back has a single office in South Florida. Their corporate headquarters is found at 777 Yamato Road, Suite 500, Boca Raton, FL 33431.

Circle Back Lending Interface Screenshots

Circle Back Lending Safety

The team at this platform and company is serious about your privacy concerns and stresses the ways that they protect your data. Because they gather your name, mailing address, email address, phone number, Social Security Number, residing state, website password, date of birth, expenses, yearly income, and employment information, this information has to be protected. They utilize it to pull your credit report, double check your identity, and make determinations for the bank if you qualify for the loan, and at what terms you qualify.

The concern regarding safety is that the FAQ section asks the question what is being done to protect your personal and financial data and answers that you should use stronger better passwords that you are not already utilizing on other sites. They also recommend that you change your password every 90 to 120 days, and that you do not tell it to anyone else. This is all good and sound advice, but it hardly constitutes a vigorous defense against potential online hackers of the platform. The company and platform may have, and likely do have, greater online defenses than simple password protocols, but we wish the site would be far more forthcoming about these than they are at this point.

Circle Back Lending Complaints and Ratings

Circle Back owns the very best Better Business Bureau rating of A+. This tells you most everything you need to know about the company's reliability. They earned this for a variety of reasons including:

- Number of years that Circle Back Lending has operated.

- Number of complaints registered with the BBB for a business of this size.

- Circle Back's response to 2 complaints lodged against the company.

- Their resolving the complaints registered against the company.

Two complaints have been settled with the BBB over the past three years, two of them in the prior 12 months.

Circle Back Lending Customer Support

Circle Back provides solid customer service. Their toll free number does not make you wait long, and the representatives are knowledgeable. Emailing the company similarly garnered a rapid response in only a few hours time. The biggest weakness in the customer support seems to be the website itself, which sadly does not provide much useful information about the whole process of making loans and investors buying into them. The Peer to Peer part of the loans is poorly explained, and the help center page tells you that the Help Desk is coming soon while encouraging you to email them at support@circlebacklending.com so that one of their representatives can contact you back soon. This is not exactly the kind of transparency we would hope for in a P2P Lending site and platform, though at least their phone and email support is sound.

Circle Back Lending Costs & Fees

Circle Back does not appear to charge its investors anything for participating in the system and platform. Besides the interest rate, borrowers have to pay an upfront single origination fee that ranges from 1% to 5%, which naturally depends on the credit grade of the borrower in question. This origination fee is among the lowest on the peer to peer and traditional markets. Besides these fees, the other charges associated with late and returned fees are comparable to those across the industry. Failed payments earn a $15 fee. Late payments similarly earn either a $15 or a 5% of the past due amount charge, whichever is higher. Paying by checks costs $15 as a processing and handling fee.

Final Words on Circle Back Lending

For those who boast from good to astonishing credit reports and scores, Circle Back Lending provides a rapid and efficient source of and priced credit. The interest rates prove to be competitive, even when measured against the industry heavyweights. Prepayment does not incur any hidden fees or charges, allowing borrowers to pay off the obligations early.

For any borrower who is interested in obtaining a larger amount of money than what many rivals provide, Circle Back is a great choice. The origination fees may be better than the amount that the major rivals charge, but the interest rates could be higher for less than super-prime borrowers. Investors gain the advantages provided by many of these P2P space platforms, which is the opportunity to build up a portfolio of loans that will produce a consistent stream of monthly revenue.

Circle Back Lending

- Phone : (855) 592-9767

- URL :

- Global Rating

- Good

User Rating

- 0 No reviews yet!

Review Summary :

Circle Back Lending provides the same basic features and services that most of its larger and more popular rivals do, with the exception that it offers lower origination fees for well-qualified borrowers. Investors are mostly institutional at the platform's encouragement, though it is unclear exactly the steps that they take to pick out loans to fund and how much they receive for these based on the various grades the company assigns the loans.

Have you purchased products from Circle Back Lending? Leave a review!

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81